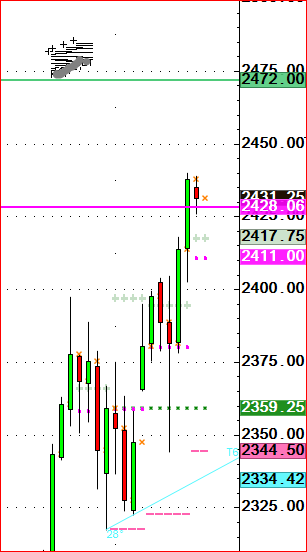

Game on volatility picks up everything. What is your game plan? Need one?

Disclaimer- While I have traded meats I am no expert and do not pay attention to fundamentals because they carry those people out now for years (inquire) but if cattle and feeders can top here they probably did yesterday

I posted the 1150-am-ish voice comment citing olive sells

previous limit up comment once one of the markets took out my macro conditional selling trend-line. Once over my levels new bullish strategies would, or do emerge.

I have only started covering meats last few weeks as this bull market hit fever pitch to me. My signals, levels happen when markets start to hit the news. It can provide fade’s when levels trigger. Consecutive patterns run before is also a condition. (diamonds). Proprietary timeframes are part of my analysis as they reveal more.

So where are we if we need a trading idea? This very well is at a level to top for the longer term. Now if, there is a reason to continue to rally then over this level we can explode.

Feeders-

Aug Feeders sell level 161.05 and buy area 145.898. Yes it always looks scary. Use this trader rule methodology. When levels this close I have rules for this approach if clients interested.

Conversely we can break straight down fast which is my lean, calling this s top with a simple new high stop, if risk appropriate

Prepare for more unexpected conditions like this from which I think we participate.

Coffee is on alert, see prev posts or call me.

312.957.8248

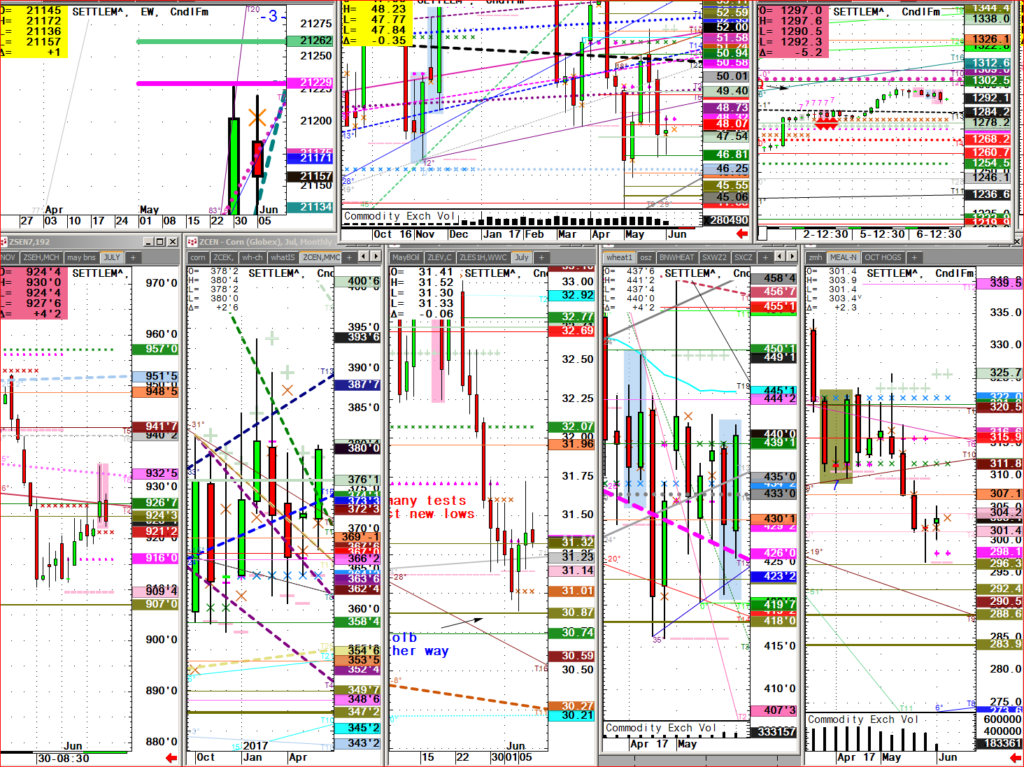

Grains- I stand by the comment a few weeks ago when beans and meal came a smidge from my buy levels that grains bottomed. Yes it was gutsy but the bears were out in force of which I have seen the last two or three years, since beans bottomed at $9.43 or 948, but can’t recall off memory. It was on my old, now mothballed site but now I am here.

Grains- I stand by the comment a few weeks ago when beans and meal came a smidge from my buy levels that grains bottomed. Yes it was gutsy but the bears were out in force of which I have seen the last two or three years, since beans bottomed at $9.43 or 948, but can’t recall off memory. It was on my old, now mothballed site but now I am here.

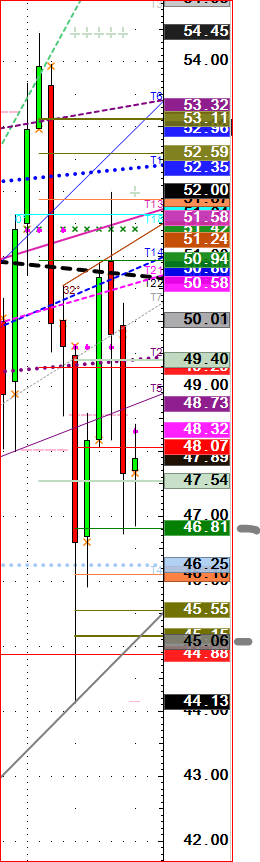

Crude levels to clients, option traders or futures traders ahead of time and a trading idea for clients.