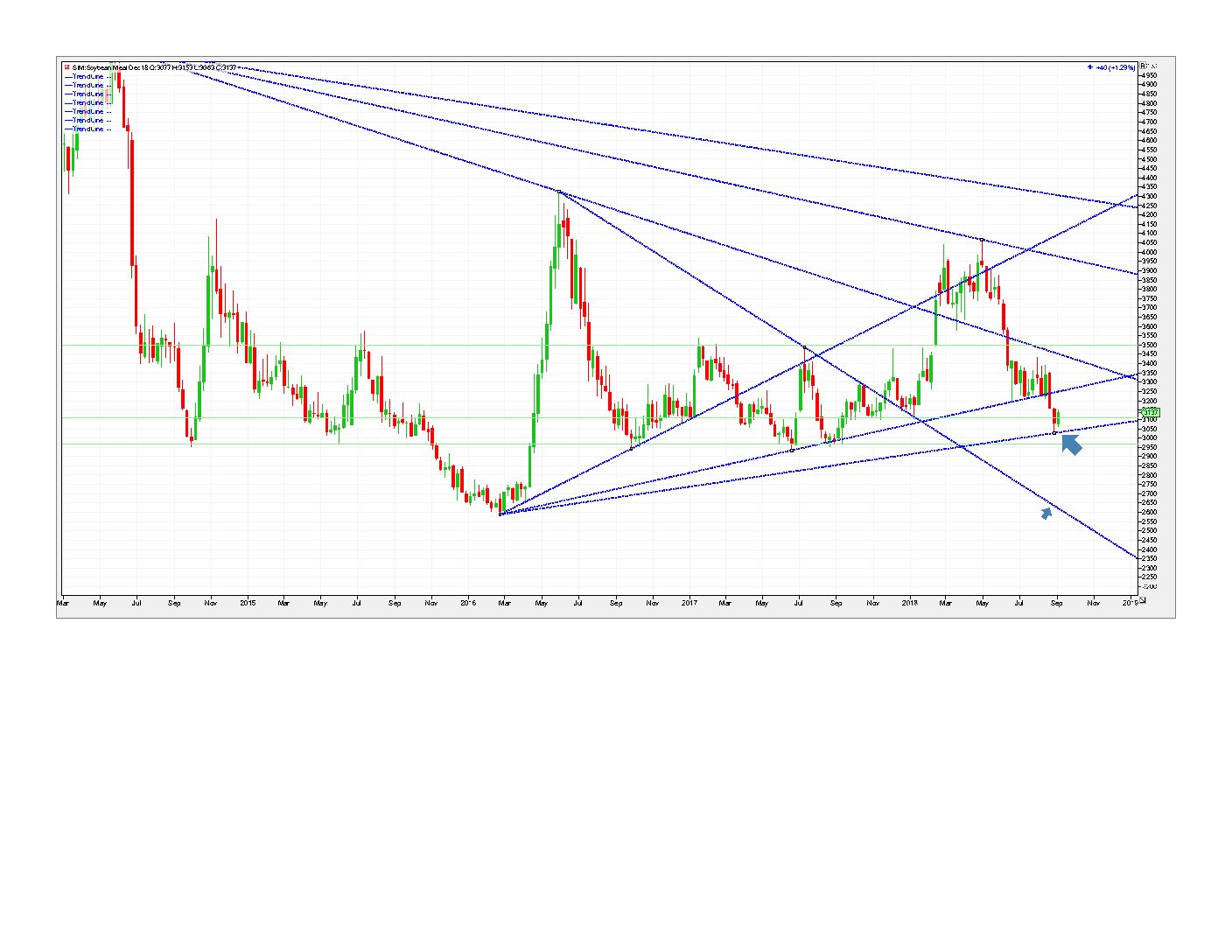

Lots of noise in the meal market lately with talk of potential demand being withdrawn out of the meal market. The talk stems from African Swine Flu in China that is spreading across parts of the country affecting their massive hog populations. There have been 10 reported cases so far since August 1st and the fear is that the swine flu could grow affecting more animals. As a result the soy complex could be the big loser from a demand standpoint if China has fewer animals to feed. This is fundamental news entering into the market. US hog futures have benefitted in my view as US hogs could be in demand, at least that’s the anticipation. Due to tariffs and the impending trade war, we could see third-party switches into China through Canada and the EU of US hogs. We’ll see. China has the biggest hog population in the world to feed their 2.3 billion populace. They strictly import and are not active on the export market. Should they have to cull their hog herds at a greater percentage due to this swine flu outbreak, demand for beans and meal which is a primary source of what they feed the hogs with, maybe reduced in the months to come. Its early here to suggest that this may happen but its noise I’m hearing in the market. See attached meal chart below. The proof ultimately will be in their soy imports in the months to follow but news of increased outbreaks and if they are widespread could add some bearish fuel to the fire. Aside from that, US beans look to be close to a bumper crop here and the market will get a gauge next Wednesday at 11 am with the next supply/demand report from the USDA. Talk of a 800-900 million bushel carry and a yield of 53 BPA (both records), could send beans lower until we get to one-third harvested in October. Funds have stayed long meal through all of the tariff noise from early July on. They had been long a record 110 K contracts from early summer, staying long following the low soy crop out of Argentina this spring. They have since pared long positions to the tune of 70 K contracts in over 2 months, but still remain long at 40-45 K contracts, per the last COT data. Should a complete liquidation occur, I would look for meal prices to drop to 275-280 a short ton. However should China not curtail purchases in future months and US yields not show up as robust as some are reporting, soy could rally in the 4th quarter amid stronger soy demand. I’m not sure how it plays out and therefore think the best play to make maybe a options strangle. What I would say is that deferred month meal contracts are not going to trade between 3.05 and 3.15 a short ton for much longer.

With this in mind consider the following trade:

Buy the Jan meal 280 put for 1.50. Cost is 150.00 plus commissions and fees.

Buy the March Meal 3.50-4.00 call spread at 3.0 points or $300.00 plus commissions and fees.

Cost is $450.00 for the strangle. Off the charts, Dec meal major support at 303. A close under and its 2.96. A close under 2.96 and its katy bar the door to 2.62 Resistance is 425.3. A close over h and the next upside target is 344.8.