While growth expectations are moving forward in 2019 and 2020, in my opinion it looks at best to be steady at the current levels of 2.7 percent. Economists are saying the US economy minus a few bumps should stay strong even if it pulls back to 2.5 percent, during the Obama era GDP was an 8 year average of 1.9 percent, 2.5 percent should be viewed as a good number and expectations of 2020 GDP of 1.8 percent, a two year average 2.35 percent .

Inflation numbers should still be persistent at 2.0 percent, not hurting the consumer. This should also help the US growth targets stay steady as consumers support Durable Goods and US manufacturing.

Growth has been subdued slightly because of uneven global GDP, the tariff debacle and trade issues. The Fed has lowered GDP from 2.5 percent to 2.1 percent now in 2019, this is concerning but job growth hasn’t stopped with 7 million unfilled job openings as of the last unemployment report and an unemployment rate of 3.7 percent.

While the US is experiencing this growth in areas like manufacturing or in the service sector, it also helps that the Fed Funds rate even with the recent rate hike, is low at 2.5 percent. There was an issue because the 10 year note yield currently 2.66 percent which was being effected by Quantitative Tightening, the 10 year yield was as high as 3.24 percent late last year.

The high 10 year yield towards the end of last year hurt home sales and mortgage applications, the Fed then decided to stop rate hikes and Quantitative Tightening. Since the announcement of backing off of both Fed Fund rate hikes and Quantitative Tightening, the 10 year shifted lower to the 2.66 percent currently but the Fed Funds rate while still 2.5 percent, the effect from Decembers Fed Funds rate change will not fully hit the market until May at the earliest, expectations are usually 6 months for the US economy to feel the effect by Fed Fund changes. Also note the 5 year yield was as high as 3.08 percent, now at 2.47 percent. The 5 year yield directly effecting Auto loans and big ticket items like appliances for the home, directly effecting consumers as well.

Right now the US and to a certain extent the Global Economy is mostly on hold as Washington and China plus the European Union hash out trade imbalances, as well as violations on intellectual property and what to do to stop it. It doesn’t seem that an agreement will potentially come to fruition and the March 1st deadline is in two weeks. Only time will tell!

With that said there are a few potential strategies that gives you time to absorb data and various bits of information as things move forward.

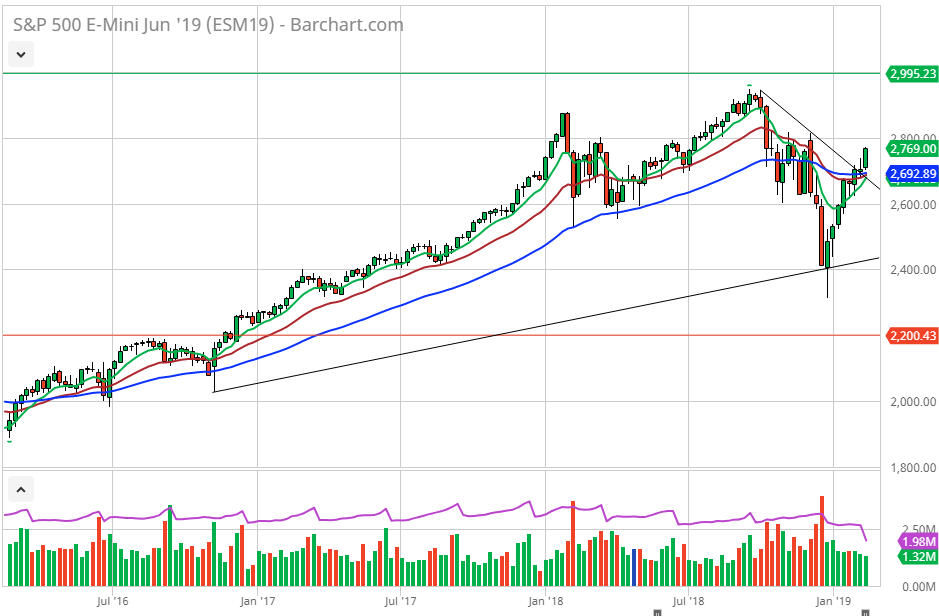

Equities, the S+P June futures contract last at 2770.00 a potential in my opinion in the options space, is the 2200 Put and the 3000 Call – buy the strangle costing 22.5 = $1075.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

The Equity option strategies are on the June Futures contract in both the Dow and S+P BOTH EXPIRE IN 125 DAYS 6/21/19

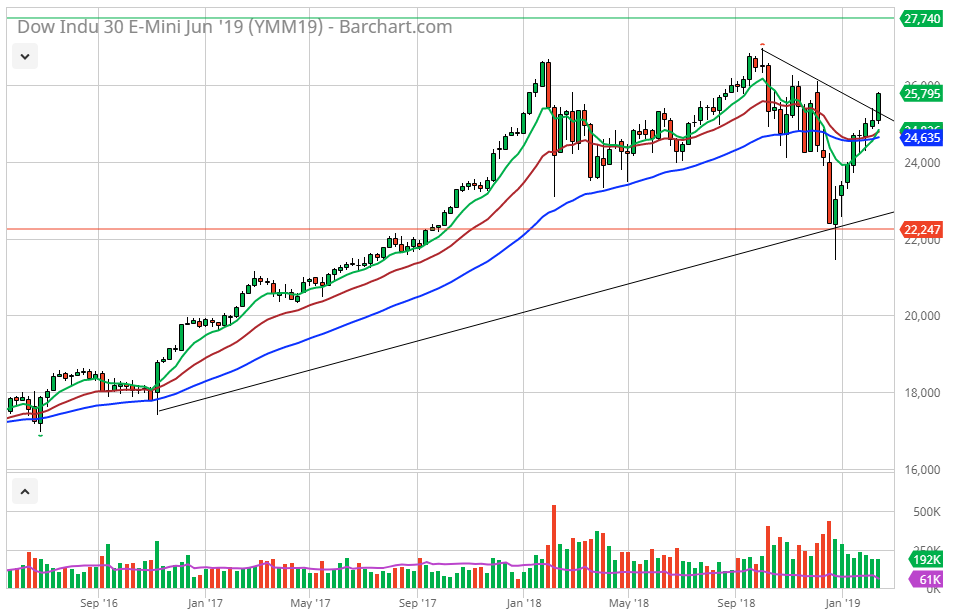

The Dow futures last at 25780.00 as of this writing, the 22250 Put and the 27750 Call buy the strangle cost 296.0 = $1480.00 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

The Equity option strategies are on the June Futures contract in both the Dow and S+P BOTH EXPIRE IN 125 DAYS 6/21/19

Also consider the June 30y Bond future last at 14530 as of this writing. The June 142 Put with the June 149 Call cost 83 = $1296.88 of quantifiable risk plus fees and associated costs per transaction to enter the trade.

The June Bond option is on the June futures contract expiring in 97 days 5/24/19

To discuss any strategies feel free to call 888-391-7894 or email me peterori@walshtrading.com

Walsh Trading, Inc. is registered as an Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (WTI) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

The information contained on this site is the opinion of the writer and obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in current market prices.