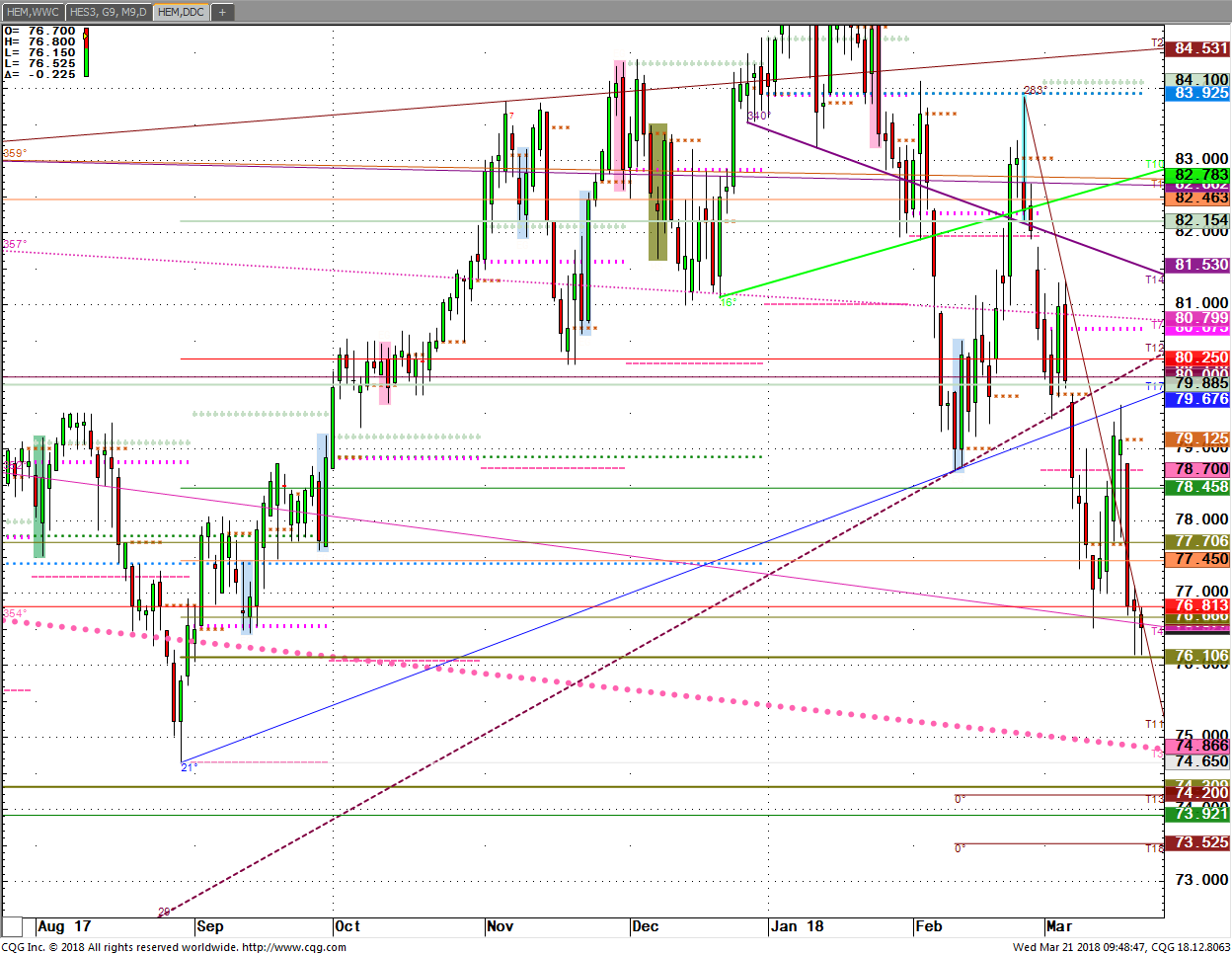

Fast market conditions may have begun. This feels to me like a big meat blow, funds were long.

MEAT ALERTS- live, Hogs has an OLB by lows and holding yest. Tariff talk may put nail in coffin for soybean fund longs? @ day puts may be lotto ticket, 2 days into announcement. Are funds really record long in meal? 110,000 on this break now. I have head and shoulders necklines live, look out below is my opinion if we start to leak. Charts below. Buckle up said Pence.

Can you imagine buying beans right before, well call for some color before it happens if you need an idea. I’m long on ideas if you’re a seasoned trader.

Lots of calls in meats. Characteristics of olive is they give up like me in old days. Can beans break another 70c? Is this everybody out of the pool?

Good Wednesday and FED day,

So the dot plots idiosa’s which guess at how many rate hikes the FRB will do in the future are (managing expectations) that the Fed will now do 4 rate hikes the last time I heard. I prefer and suggest that we only use what the fed DOES and not what these purps, feed to the public. I assume the fed is and will continue to be behind the yield curve. If you don’t know what that is, go back and read my mentor’s (Tudor) public statement about the bond market. He would rather have hot coal in his hand than own bonds because he knew he would only lose his hand. That is from a very large respected futures trader. He seldom speaks in public anymore.

I continue my 1 1/2 year theme that we are entering an inflation cycle that new participants have never witnessed but I won’t bother you with that big stuff now. It’s happening right now. What has not moved almost 40% in a year? A meal squeeze this early already? Maybe those guys should have heeded my cover your grain needs that I have more a less pounded the table bullish.

Now it is a new game and it is game on. KC wheat I have talked about and posted my OLS up at $5.625 which I call the olive line. “The number that hurts the most traders.” When this rare signal of mine pops up the crowd is usually in this case very bullish. We hit it in the O/N trade and never, so far, took it out and we spent two weeks up there and it was hard not to be bullish when you hear or see of drought conditions that are almost hard to believe but the OL works in ways that take people out. This olive line indicator of mine appears in all markets or at least the 100 or so I follow for clients, pro traders, others I don’t want to talk about but we now see when this (semi-ambiguous) (disclaimer) signal says beware.

It was typical pre-qtr-end violent action in that we blasted up 50c in wheat, then down hard but now is where you must in my opinion pay attention if looking to get long your drought wheat today. I thought the mkt under estimated the fact that grain stock USDA # would still have a play and the fact that traders, I come in contact with mysteriously woke up all bulled up on beans. Argentina weather but on their 2nd crop, double cropped when I was on the floor. I still think beans can break while wheat needs to be bought down here if your bullish. What has KC don’t last two days?

Soybeans also hit a 10.82 OLS but not OLS2 like wheat. I think each has to be played with tight stops for those patient enough to just trade the chart patterns.

I do not know if any of these are going to hold, top at, or violate which is what cattle just did at 111.40 small olb. We get one test but thats not a rule of mine. Anyway, cattle is doing consecutive down pattern and clients had a chart of how these bear raids start which was once under org support. We went straight down on a 3min, and another proprietary timeframe. Don’t use 60 minute charts is my opinion. Why 60 min? It give a whole new look to how algo’s slap the market around and trendlines in odd ball timeframes give clues unseen to all but whom I think this olive algorithm is used by. Think- the market races down right to where you want to buy with a nickel stop, less in my book. I suggest you not be G hood ornament.

CATTLE- Ok I hear you cattle people and this is vicious in that CME board is going down hard while cash is over futures to where the credibility of the futures mkt may come into question. I hear your angle and why your ticked off. JUNE- off top of mind due to commuter comment writing now has another pair of OLB s a few cents lower. Call me for the levels but don’t trade on them. Is repatriation type tax-free money flowing in the country now going to buy cash meat producers? Sorry, that may be too macro or big picture. You always want to be an owner is my lesson. When someone comes calling to contract your crop months out, that may be the inflation backdrop Macro situations I see that are, and continue to provide trading opportunities that I have not seen since I was a runner on the CBOT trading floor when I just turned a teen.

Why open a 2nd futures account with you Alan?

Access and my lifetime of trading experience.

Tariff Alert talk out there. Are beans a buck too high now?

I also said there would be a time shortly that it would become too busy to keep posting regularly. That doesn’t mean that there are not dozens of markets with special situations.