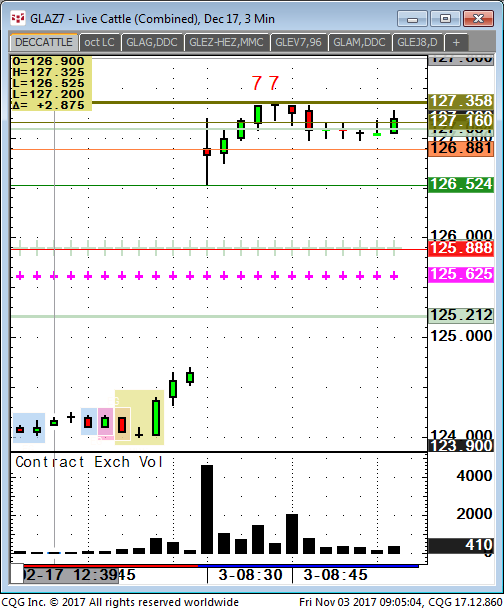

Dec Cattle- this am we had an OLS play right up at limit. If you were a pit trader and came in flat this would have been a sell at limit early and put in a buy stop back at limit up. This is a spec algo trade and we could break hard today like yesterday. Someone blew out big if looking at my volume indicator. Is this a top? Don’t know but this is a trade where you sell 127.15 with a limit up stop. That is risky but so far the high and can we break 500? I think this is a setup. I surely think we can trade settlement or break 300 but under that, sure we could go limit down, 15% change is guess.

HOGS- I HAVE IDEAS.

BeanWheat hit $1.47 over and nov beans again at 989.25 was good sell pivot that has been talked about for months on www.WalshTrading.com. This feels good to me, exciting right at high and day later falling hard, beans losing to wheat, get it?

DEC DEC CORN SPREAD IS FLASHING.

IF YOU DON’T SEE THE PATTERN IT IS ON THIS PAGE MORE THAN ONCE. You only want to shoot at these levels and when other things reinforce on whether you want to trade aggressive, bottom in.

LESSON- Here I have a small and nimble .25c risk selling this. High is limit up but the birds are chirping to be feed. I think this is a day trade short with a possibly big trade if we break late today. Huge volume to me shows someone is blowing out.

Lumber is live so watch very closely. I would not lift short hedges at my level, 435-445 range today. Lumber had same formation the live cattle did yesterday. Weird but lets see how this plays. Plenty of lumber in this country is what I hear but you know what we do with fundamentals? Throw em right out the window but Cattle may have had something have happened. Most probably a big short covered at this tiny OLS 127.35-ish.

DECDEC corn if playing condition present, -44c-ish and I call this live.

Host of other mkts, ethanol, same pattern at an olive now 1.42 up 2% fast. I like to shop value plays in leverage commodities for clients that want to shoot decent with tight stops accurately placed.