Cattle- 120.65 is very big level to me. This is where I find players out of step (short covering). FEB APRIL are different and violating but Feb has short term targets here at time of print. FEB today- 125.87 and 126.35 are targets and live now.

HOGS- We are not staying here 65.16, and the now old 64.40 are levels to watch. This is also an OLS also which is uncommon. Back months are different so no short opinion in the backs. Olive’s work in spreads at extreme’s. Can we break hard? I think this is as good a spot as any which means this is my level to play. If flat and looking to short? Sold! If this is violated this says to me we go possibly much higher so always use a stop and get good placement areas or call. 312.957.8248 arp@walshtrading.com

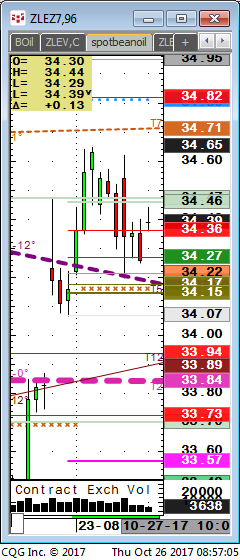

Wheat- $4.30 is a level. Today baffles people as corn is stronger today to wheat and corn has the monster harvest. I believe players are buying in big size and money managers are buying from the Farmers in my opinion. Corn has apex 350-ish round up and round down but I prefer if speculating to sit this out. Corn is cheap under $3.40 and low was made on a USDA again.

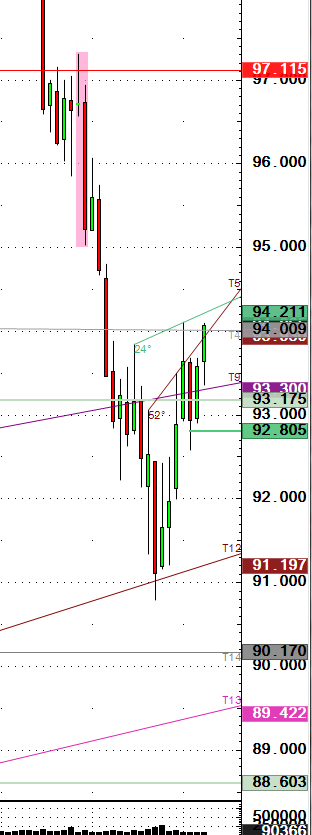

US Dollar- 94.20 is the only level I have that I have said for weeks that over this might be were shorts run for cover.

Safest time to trade seems to be right before or on reports. Some charts are posted on Walsh.

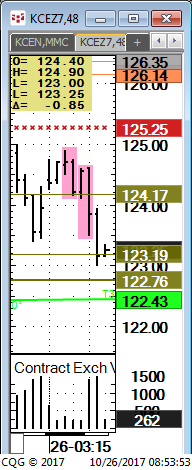

Coffee- How many times can we hold my 123.00 level which has 3 indicators and funds are really selling coffee short. I like this type of trade. I like tight stops and have been open about that level. If you like to risk 100 and can leave a stop in then feel free to give me a call before the chaos breaks out from a dysfunctional Washington that has no idea of the real World. This feels like it could explode higher in price at any time. Inflation play? Let’s chat for 5. Need courage? Keep tight stops and don’t look at the trading screen. This is how this behavioral science works as big volume (stop loss) occurs on the way to the olive line. This was my nemesis that used to take me out right before major turns for decades on the trading floor. I had to find something that caught emotion in the markets, big volume, fast vertical price moves but that was a touch more long term.

American dream of homeownership is at a record low along with workforce (don’t split hairs) falling off the cliff because mom and pops cannot compete with AMZN that pays no income tax. It is written off in R&D tax credit corporate welfare. Have you ever asked why cities are offering this company that is a monopoly that sell 45% of all eCommerce.

Is this the reason the US is in budget default sequester? I concur.

arp@walshtrading.com

312.957 8248