Last weeks macro comment below, still applies. This was pre USDA bottom.

Maybe. Coffee is game on 123.20. Hit&filled.

Sugar over 14.20-ish possibly to upside if looking to buy sugar, 1376 sell stop.

13.80 and above were olb s.

open order stop and forget it.

only focus on risk stops.

Wheat- buy break.

Corn- its close, price wise.

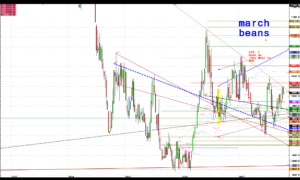

Beans- you catch last break. No thanks.

2yr-10yr- Its at a trendline on this break.

Nobody can predict winners and reason for open order risk- stops. Then relax and with some luck they move 20% in four months like crude $42.01 OLB. Crude now you are in sell areas. $53 on up. Buy coffee sell crude?

Those are the ultra high-frequency front-runner’s price pushers. This is why steep speed-lines over the stock index then becomes support once we gap open over. FIA Chicgo ends today.

These are momentum futures trading desks max. Squared.

Like in pit trading we all did so well. GAP UP SHARPLY! Buy it long over the opening range type trading strategy if you go home flat daily. If thats you.

Stocks- Dow down 500? Down 5,000 like in 1987 crash anniversary? I remember eating lunch that day of the crash and coming back up to the trading floor, right before the halt. Lesson.

Is Fed trading desk in NY selling option premium till infinity? Thats a good discussion on how the broken budget is being balanced.

It is an accident waiting to happen with so much trading opportunities it will make your head spin. If you need an idea and where we must put a risk stop.

Trader profile must not look at winner when precise and not stopped out. I specialize in that with floor trading strategy to catch big vertical moves.

Throw fundamentals out window.

We trade the now.