Perfect growing weather from someone in the pit that was labeled a perma bull in beans. Midwest is unreal really, with cool August temps. except for all the ‘lollapalooza’ kids heading to Lake Michigan.

I try to produce conditional indicators that funds use explicitly, especially when violated. This enables me to help you identify low risk high reward trades. Macro traders frequently use these levels and my floor trader rules help maintain discipline.

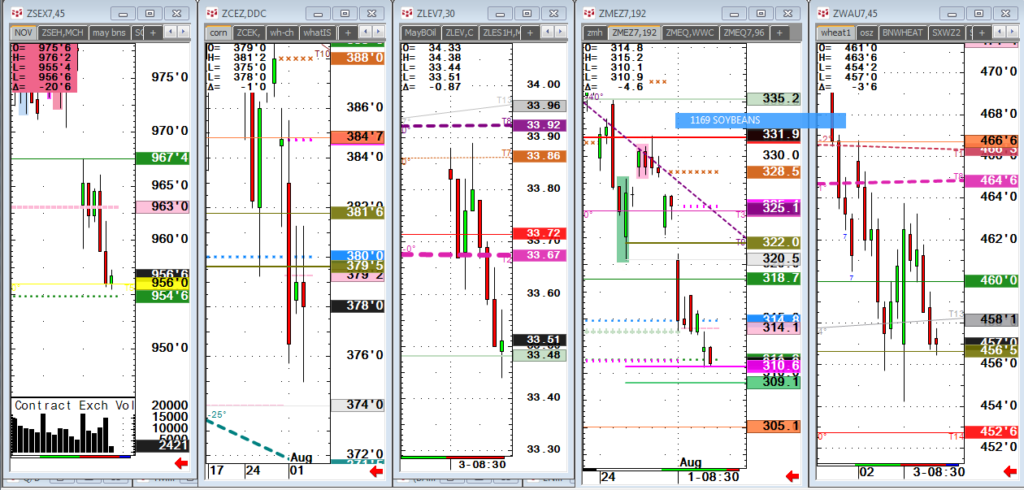

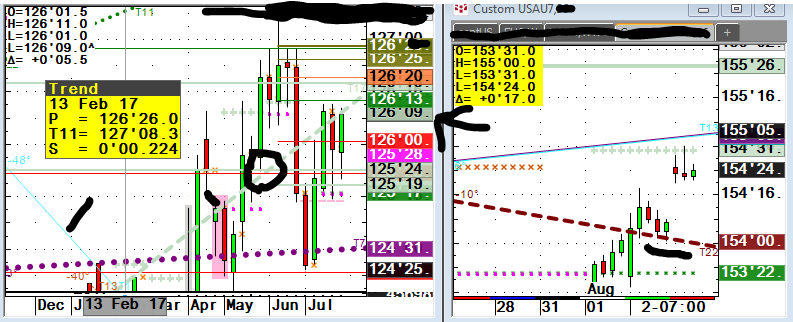

WHEAT is interesting if naked long here OLB1 $5.56.1/2 live- or against beans which grain players that must spread are selling. Bean/wheat I noticed was at even money this morning and something to be used as a pivot.

THIS IS IN BUY TERRITORY. Are longs beat up enough? This is

WATER-BOARD-OF-TRADING TO LONGS pattern in Wheat. This is a buy level, one of two.

corn crop feels like its made fundamentally, but we know those don’t matter and only confuse.

SOYBEAN MEAL- FUSIA AND TEAL GREEN indicators. dotted levels also. Targets. NOTICE when 322 fails, it gaps lower and it goes to target. This keeps you out of the way if bullish in this timeframe.

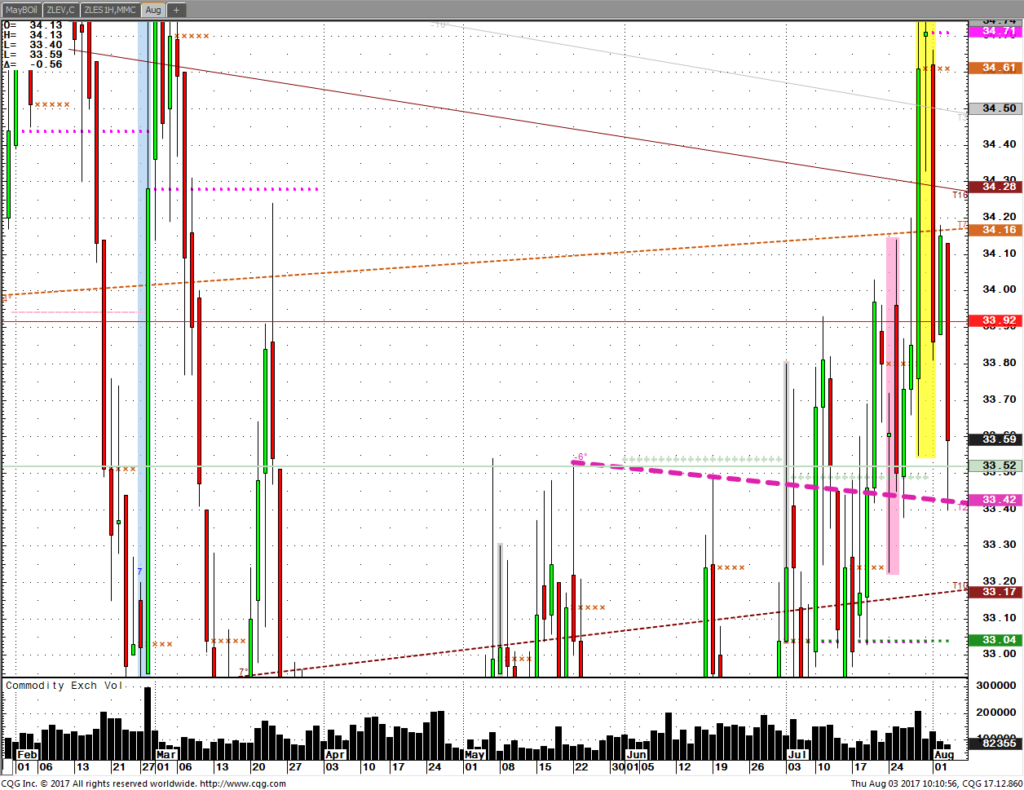

oilshare- do you get levels like this at turns? This almost needs a team to trade unless you have stones of steel to withstand the heat but if it is going to turn, it turns a my levels. Worst case they are levels to trade daily off of. NO?

LONG OIL SHORT MEAL. UP MEANS OIL GAINS. Content in oil share is the price.

Not a lot of noise levels. Risk stops under lines ahead of time keeps emotion hopefully minimum.Aug coming off.

Bond bulls- I speak as a long term bearish Macro view also addressed in voice files for last year. Hey, when did bonds top last?

Have a profitable day and if you need insight let’s talk.

ARP 312.957.8248