bustling markets from buy nov beans sell dec wheat ratio, -37c was support, another near miss buy level. Do you think people are waiting in the wings to buy?

(chart order challenged but levels posted last few weeks. Olive’ line is powerful. Illustrative purposes in charts, patterns. The 7’s also appear a lot and have good meaning if you like to

fade the trade looking for risk based payoff’s. Majority opinion’s at turns is common in my charts at specific levels.

I try to detail the meat charts, the point is if you were looking for a chart sell levels on way up, the horizontal lines colored were my only levels for customers to play short. I think I labeled one a flippant comment I think we go limit (or just lower) under level cited. If meat cash buying can top now in summer, then these were sell strategy plays.

Flippant are or can be good comments if you like ahead of time strategy, be prepared, high frequency trading does its work at these levels.

AugFEEDER-RED-OLS16100- red line was only level this commodity if looking for a level. Red lines play, here a top, others an olive.

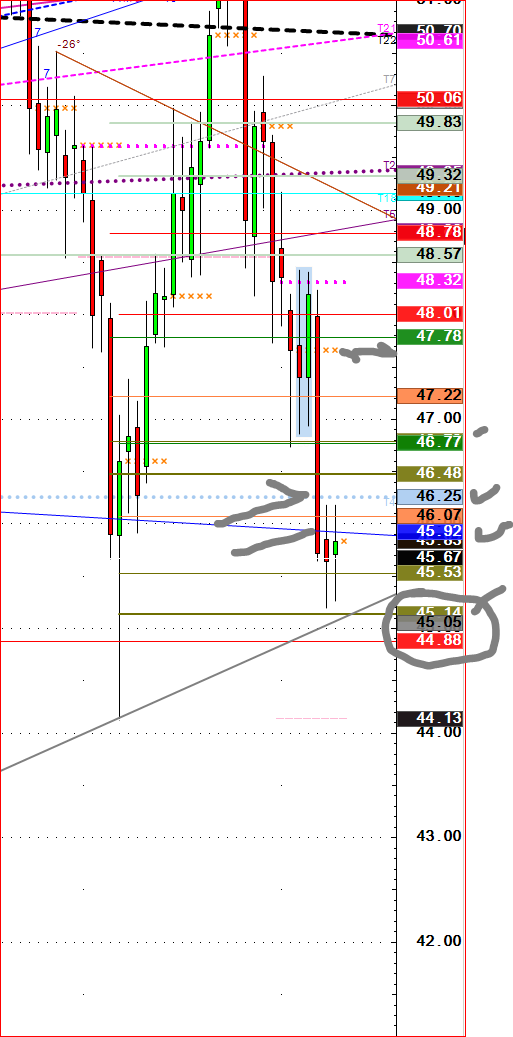

Crude chart- If looking for bottom last week 45.15 another near miss was probably it in my opinion. Everything is my opinion, report.

h

Buy beans sell corn also came into support but nobody here plays so take as macro comment. Corn bottomed last year as cited on my previous website before coming to Walsh to Broker for you. Please email me if you find this interesting. I have to stay short so.

Below here are a few macro charts in grains but opinion is same. These are the breaks to buy. New players entering market that have been out for years is my market color.

Alert- I will be out Friday and Monday.

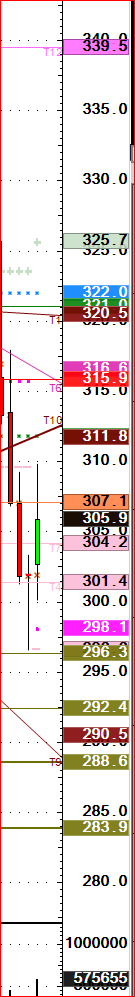

WHEAT- look for the 3 levels in right hand column as these were cited in voice comments before the highs were made. Watch levels if looking to buy, 4.34 is big with funds, under ? you pick a level.

312.957.8248 Alan direct

Corn- I think Farmers should use to get out but I also think/guessing a drought is in order. 40% ish? maybe more so call.

MEAL- LEVELS in

July.

Crude- Is the next move up 14% again? These price swings I think will become larger macro moves. This has been cited that this could be a bottom if 14% move is something you might entertain trading for. 14% up and 14% down has happened in fast order but this is opinion coming from a floor trader turned new broker here at arp@WalshTrading.com

Call me if you like or might have interest in these type trading situations.

I have to stress tight stops is part of my trading idea and strategy but there are many reasons why. I think you can subscribe to this methodology if you can hang onto winners for a while. It is only way I believe is approach. Risk small management, and play for large moves so we can control our down-strokes. We can always come back but respect when lines and levels are taken out.

I think price swings will become bigger going forward macro.

Have a great trading day.