Rich Moran 6/20/2025

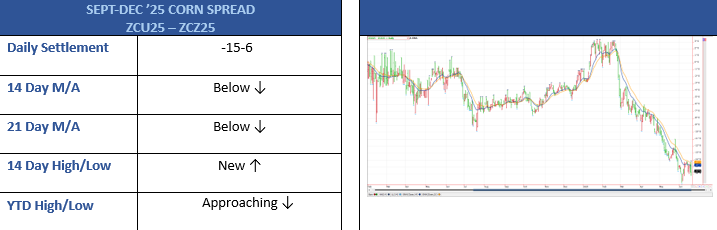

SEP-DEC CORN SPREAD (ZCU25-ZCZ25)

The short-term forecast has us expecting some hot temperatures through-out the Midwest this weekend and up into the middle of next week. With this, the over-all mindset remains very optimistic for a good corn harvest this summer. Even with the strong expected demand, the corn market has obviously been trending down. Today, September corn (ZCU25) settled 425-4, only 7-2 cents off its 52-week low of 418-2, from this past Monday (6/16).

September corn has clearly been winning the race down verses December corn. This spread of SEPT-CORN minus DEC-CORN (ZCU25-ZCZ25) has gone from its 52-week high of +3-2 on 1/24/25 and on 1/29/25 to its 52-week low of -17.2 this past Monday (6/16/25). Since then, the spread has been trading in a pretty tight range between -17 and -14-2.

Today, the spread is at a place where it can’t seem to make up its mind. It is trading at or near the 14-day and 21-day moving averages and settled just below them at 15-6. My thought is to wait and see. If we can remain below the 14-day and 21-day moving averages while making a new 52-week low below -17-2 (which would also be a new 14-day low), it might be a good time to short the spread. We are only about half-way to “Full-Carry”. Last year, the 2024 SEPT-DEC CORN SPREAD exceeded 80% of “Fully-Carry”.

If you have any thoughts/questions on this article or any questions in regard to the commodities futures markets, please feel free to contact me at ;

Rich Moran

Senior Commodities Broker

Direct: (312)985-0298

Cell: (773)502-5321

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.