The information and opinions expressed below are based on my analysis of price behavior and chart activity

April Live Cattle (Daily)

April Live Cattle settled up 3.450 today, closing at 207.275, setting another record-high of 207.725 and also a record-high close. That’s 5 days in a row, for those keeping track at home. You might see on the chart that Fat Cattle prices haven’t strung together this many consecutive days up since October 28th. That day ended a 5-day winning streak, and a 12-session winning streak ended on October 2nd. The gains in the Futures have been spurred by a very strong cash trade, with Feeder Cattle leading the way recently, but the Live market has started to accelerate higher. Support may show up near the 5- and 10-day moving averages, at 202.925 and 200.460, respectively. Monday’s high of 205.55, is a bit closer to the market, if you’re looking for nearer support. The market broke out above the trend channel today, as denoted by the parallel blue lines on the chart. Overall, this market looks very strong. Stochastics (lowest sub-graph) are at an overbought level, but they’ve been that way since the day after Christmas, with the exception of 4 days. The MACD, just above the Stochastic, is at the highest level over the life of the contract, indicating strong momentum, in my opinion. Resistance levels above the market are tough to gauge. Today’s high of 207.725 may offer some minor resistance, but I would expect the market prices to gravitate toward the 210.000 or 215.000 levels. A Fibonacci extension (not pictured) pegs the next level up at 215.025. I am of the opinion that the slaughterhouses and packers are hedged. In other words, they are long the market, as that’s where the largest risk is for them. And as long as they are in those long positions, they really don’t care how much they have to pay for cattle. After all, they’re hedged against that. I also believe that this strength will continue until the US consumer balks at the butcher counter. Cattle Producers also need to be hedged, I think, but in an uptrending market like this, it’s a bit frustrating. You’d like to lock in these high prices, but as soon as you do that, prices go even further up. My suggestion for producers is to have a trailing Sell-Stop below the market, in order to establish short futures positions if prices fall. Aggressive and well-margined hedgers may do well to try and select Put options that are appropriate for your time frame and risk. Those can be used to establish a “floor” if you will, as long as the expiration dates correspond with your intended delivery period. Be aware that you may need to do this more than once, as you may find the need to move that floor up as prices rally. Aggressive and well-margined traders may do well to consider long future positions. By glancing at the chart, it appears that the 5-day moving average had held up well in the past, when trying to buy dips or sell rallies.

April Live Cattle (Weekly Front-Month Continuous)

This chart goes back a little over 5 years, and you might notice that the trend has been up since the “COVID” low, set in the first week of April 2020 at 76.600. There was a bit of a pause starting in September 2023 when that high of 191.675 was pegged. Subsequent trade can be best described as consolidation, as the market was constrained by lower highs and higher lows. That continued through the last week of 2024 when prices were able to test that red trendline, which I’ve drawn off of the Nov ’14 – Sept ’23 highs. As we are clearly in uncharted territory here, how much higher we go is anybody’s guess. A Fibonacci Extension (not pictured, reach out and ask if you would like me to send you that chart) suggests that the next resistance level might be up at 222.950. That seems excessive to my eye, but the math checks out. That same Fibonacci extension suggests that support is near 204.150. All of the moving averages are below the market, with the closest being the 5-week and 10-week moving averages, at 200.125 and 194.650, respectively. If the market were to pull back to the 10-week, that also corresponds with that trend line and that might be a good level for buyers to step in. However, that’s also 12.625 lower from here and a drop of that much may have traders changing their tune, especially if it happens rapidly.

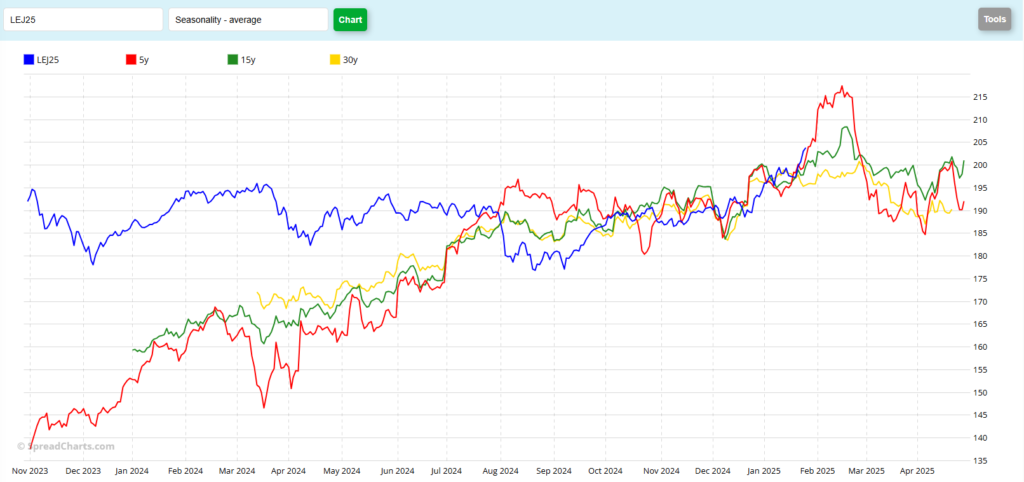

April Live Cattle (Seasonal)

Seasonally, I would expect Live Cattle to stay strong until roughly Valentine’s Day, or perhaps shortly after that. You can see that chart below. To my eye, Live Cattle have been following to their seasonal patterns better than most markets over the past several months, and I would expect that to continue for now.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

jfosse@walshtrading.com www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.