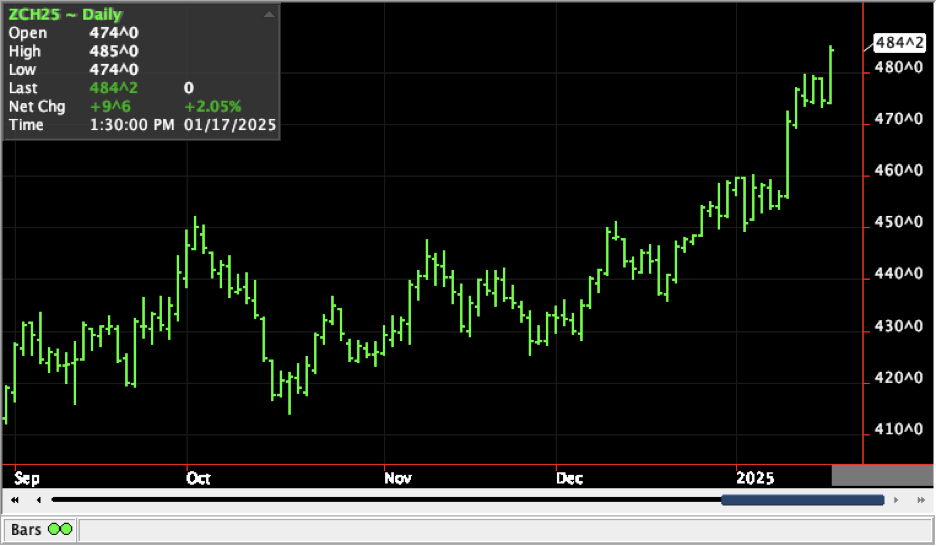

On Friday, January 17, days before the inauguration of a new United States president, U.S. March 2025 corn closed higher at $484.25 per bushel and U.S. March 2025 soybeans closed higher at $1,034.00 per bushel. In my opinion, these higher prices reflect changes that could be coming with the new administration.

Charts courtesy of CQG, January 17, 2025

According to an article published January 16 on the Progressive Farmer website, Scott Bessent, who is president-elect Donald Trump’s nominee for Treasury secretary, said he would demand China fulfill its obligations for agricultural commodity purchases. These obligations were part of the Phase One economic and trade agreement signed by the United States and China on January 15, 2020, to further open China’s food and agriculture market to American products.

Under the agreement, China was expected to buy $40 billion a year in agricultural commodities. The article states that Chinese purchases initially increased, peaking at $38.1 billion in 2022, but have since fallen to $28.8 billion in 2023, and $22 billion for the first 11 months of 2024, a drop of 16% from the same stretch a year earlier.

“China has not made good on their ag purchases for four years,” Bessent said. “If confirmed, next week I would start pushing for them to resume the purchases and then I would conference with President Trump on whether he believes there should be a makeup provision.”

The other side of the coin is the threat of trade tariffs. According to the AgricultureDive website, “farmers are bracing for the prospect of increased tariffs and another painful trade war at a time when U.S. exports already remain uncompetitive.”

The National Corn Growers Association and American Soybean Association recently asked World Agricultural Economic and Environmental Services (WAEES) to evaluate the impact a trade war would have on soybeans and corn today. If it were to occur, the evaluation says a trade war would not only reduce the value of production for U.S. farmers but also have a ripple effect throughout the U.S. economy. The bottom line, according to the evaluation: A repeated tariff-based approach accelerates conversion of cropland in South America, which has permanent ramifications on soybean and corn exports worldwide. And U.S. soybean and corn growers bear the burden.

The information and opinions expressed above are based on my analysis of price behavior and chart activity. A risk assessment must be undertaken before making decisions. Call me for additional information.

Use this link to join my email list: SIGN UP NOW

Saturday, January 18, 2025

Stephen Davis

Senior Market Strategist

Walsh Trading

311 S. Wacker Dr., Suite 540, Chicago, IL 60606

Direct phone: 312.878.2391 Toll Free: 800.556.9411

sdavis@walshtrading.com

www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.