1/6/25 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Cattle Markets were higher today, with the Hogs down more than another dollar. The Fats gained more than a dollar today. February’25 Live Cattle were 1.15 higher today and settled at 195.20. Today’s high was 196.32 ½ and that is the new 1-month high as well. Today’s low was 194.60 and the 1-month low is 185.90. Since 12/6 February’25 Live Cattle are 9.02 ½ higher or almost 5%. The Feeders gained more than a buck as well today. March’25 Feeder Cattle were 1.37 ½ higher today and settled at 265.55. Today’s high was 266.80 and the 1- month high is 267.75. Today’s low was 264.37 ½ and the 1-month low is 254.00. Since 12/6 January’25 Feeder Cattle are 10.87 ½ higher or more than 4%. The Hogs continued to break today. February’25 Lean Hogs were 1.12 ½ lower today and settled at 79.65. Today’s high was 81.12 ½ and the 1-month high is 87.87 ½. Today’s low was 79.32 ½ and that is also the new 1-month low. Since 12/6 February’25 Lean Hogs are 7.67 ½ lower or almost 9%. There were record high cash prices last week, and I feel the highs could be in. February’25 Fats settled 1.12 ½ off the highs today, after making a new contract high at 196.32 ½. The February’25 Fats have gained $4.55 over the last five trading sessions, and I think that could be enough. The Dressed Cattle weight gained a pound last week and is 16 pounds heavier than this time last year, and 30 pounds above the 5-year average. Last week’s cold snap and storms are moving East, and it might still be cold, but its winter. The Winter Storm Premium should be out of the Cattle Markets now, especially with the extra 30 pounds. The US Dollar Index was down more than a full point early this morning, and that had most commodities higher. The US Stock Markets were much higher this morning as well. The US Dollar index was down more than 1.20 this morning based on a Washington Post article that stated President Trumps tariff policy will be pared back. President Trump then stated publicly that the article was fake news, and the Dollar Index gained more than 0.500 points back (½ a point). The Dow Jones Index was almost 400 points higher this morning as well and is currently negative on the day. If both of these Markets continue to reverse course tomorrow morning, then I feel the Cattle Markets can as well. The March’25 Feeders settled 1.25 below today’s highs and 2.20 below the contract high of 267.75 made on Friday. Don’t forget March’25 Feeders on Friday closed $3.57 ½ off the high. The March’25 Feeders have gained 5 bucks over the last 5 trading days, and a feel a correction is due. The Funds are still long and will need to take profit at some point. The Cattle stuck in Mexico will be able to cross the border sooner than later I would think. The protocols have been established but not put into practice yet. When the Cattle in Mexico are allowed back in, it will be market mover and could trigger the Funds to sell as well.

.

.

If you realize it is time to open an account, please use this link Sign Up Now account forms are many pages, but only 5 need to be signed.

.

.

The Grain Markets were all higher today. The Beans could not hold a double digit gain today. March’25 Soybeans were 6 cents higher today and settled at 997 ¾. Today’s high was 1009 ¾ and the 1-month high is 1015 ¾. Today’s low was 993 ¼ and the 1-month and 52-week low is 947. Since 12/6 March’25 Soybeans are 1 ½ cents lower or fractionally lower. The Corn Market looked good again today. March’25 Corn was 7 cents higher today and settled at 457 ¾. Today’s high was 460 ¼ and that is the 1-month high as well. Today’s low was 451 ½ and the 1-month low is 435 ¾. Since 12/6 March’25 Corn is 17 ¾ cents higher or more than 4 %. The Wheat Market gained again today. March’25 Wheat was 11 ¼ cents higher today and settled at 540 ½. Today’s high was 543 ¾ and the 1-month high is 569 ¼. Today’s low was 530 ¼ and the 1-month and 52-week low is 527 ½. Since 12/6 March’25 Wheat is 16 ¾ cents lower or almost 3%. The March’25 Soybeans tried to suck people into buying it today, but it broke back down the second half of the day. I would be careful buying or selling March’25 Soybeans right now. One of these days there could be a trap around 1015 ¾, the 1-month high. The Beans keep breaking off the highs, but if it trades through the 1015 ¾ level, it could shoot another dime higher, and force the new shorts out, and then break back down again. I still feel the Soybean Market is heading lower, but there will be spikes up along the way. When we get the numbers from South America, then we will see the lows put in this market. The March’25 Corn looked strong again today and made a new 1-month high. I still don’t think the market is ready for $5.00 Corn, but if it trades through 463, it could push higher. If it breaks down to the 435-440 level it would be a good buy. The Wheat Market had a good day and gained 11 ¼ cents. I still feel the March’25 Wheat can trade up to the 580 level or higher. If it does reach the 580 level, the Corn will be following it up. The Dow Jones Index closed down 39 points for the day, 427 points below today’s high. The US Dollar Index closed down 0.697 points, but that is a gain of 0.526 points off the low.

.

.

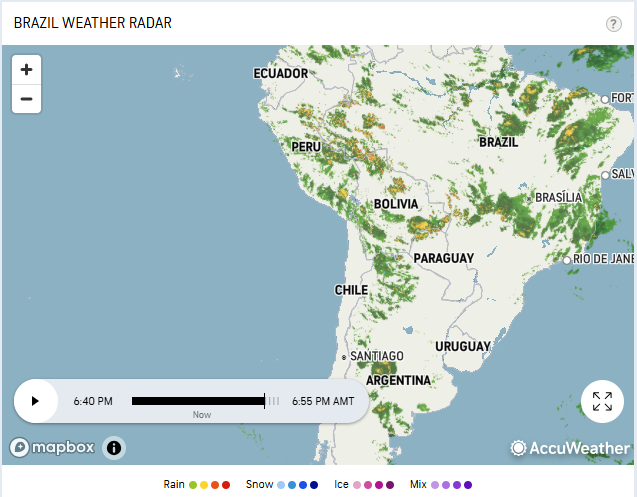

Today’s Brazil Weather Radar Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Newest Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.