Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

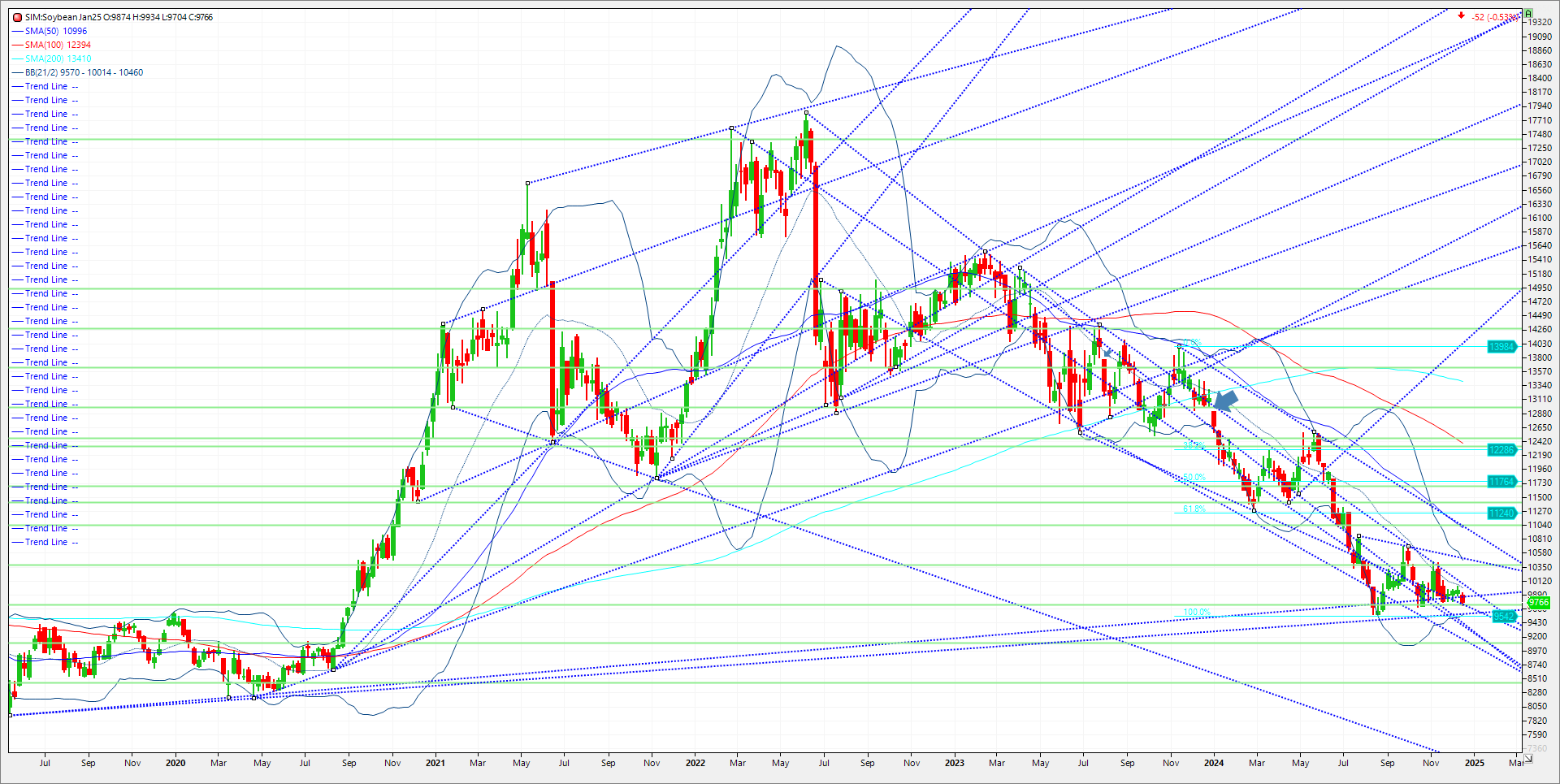

Soybeans were pressured overnight and throughout most of the session on two fronts in my opinion. First, Reuters is reporting that an upcoming U.S. government funding bill will include a provision for year-round E15 sales, according to sources; they are currently effectively blocked from June to September. This in my view is seen as bearish as concerns mount on how or whether soybean oil qualifies for 45Ztax credits. Second issue is the Brazilian Real continues to move to all-time weakest levels vs the US dollar; with concerns of spiraling inflation and economic uncertainty triggering the collapse in my opinion. This is driving up the revenues for the Brazilian grower who continues to sell as crop prospects remain very favorable. Despite the USDA announcing two flash sale announcements, 132K of beans into Uknown for future shipment and 187K to Spain. The trade will view the sale into Spain as front loaded before any potential tariffs that maybe forthcoming. The growing weather in Brazil is optimal currently in the big growing areas, where rains are widespread with big totals. The bean market is hanging onto its fingernails just above support. January 25 beans is still the most actively traded contract until next week. For the remainder of the week focus on January soybeans. Support is just below todays close at 968 to 972. A close under and its 958 and then 951. Resistance is 9.86. A close over and we could trade back to 10.06/08.

Hedge Idea-For those with unpriced bushels of soybeans.

Futures-N/A

Options-Buy the March 25, 1020, puts for 53 cents. Sell the January 2026, 1220/1160, put spread for 53 cents.

Risk/Reward

Futures-N/A

Options-The maximum risk is 60 cents or 3K plus trade costs and fees. It’s a lot of risk per spread unless one has unpriced bushels of beans. The majority of the risk is the value of the March 1020 put that has been purchased for 53 cents. Make or break on this trade is where one exits that option. The short put spread in January 26 beans is a 60 cent wide put spread that one is selling for 53. Risk is 7 cents plus trade costs and fees. We are selling that put spread to simply finance the in the money March bean put. If oe thinks that March beans will test the August lows at 955, then this trade makes sense in my view. If one thinks March beans trade to 9.00 prior to option expiration in late February 2025, l think we should talk. This is just one strategy to be short, not THE strategy.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.