The information and opinions expressed below are based on my analysis of price behavior and chart activity

March Wheat

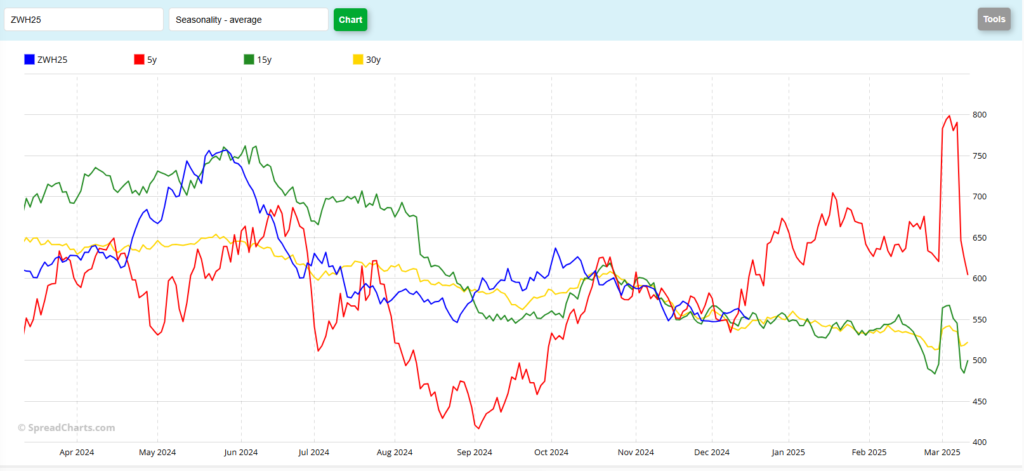

March Wheat closed down 5 cents at 5.45, a new contract low close, today. It did not set a new intraday low however, that was on Dec 4th at 5.40 ¼. By looking at the chart above, you’ll notice that this is the 4th time we’ve seen the market dip below 5.50. The first time was in late August, hitting a low of 5.42 before rallying to 6.39 on Oct 2nd. The second time was Nov 14th, when Chicago Wheat hit 5.46 1/4. The subsequent rally to 5.60 ½ lasted only 5 days that time. A much shorter duration in both time and breadth. The 3rd time came the day before Thanksgiving when we saw prices stay just under 5.50, on a closing basis, for 5 sessions. The following peak at 5.69 ¼ came just 5 sessions (again!?) after posting the low at 5.40 ¼. You can see that the 50- and 100-day moving averages crossed to the bearish side last Wednesday (green and grey, respectively) and are offering some resistance near the 5.77 ½ and 5.82 levels. It would take a close above the 5.82 mark, in my opinion, to significantly change the trend. You may notice that the 100-day average had “held” as resistance when it was tested in early October. The 200-day average is all the way up at 6.16 and that also held resistance in October. Support levels may be found near today’s low of 5.42 ½ and the contract low at 5.40 ¼. Beyond that, you’ll notice the horizontal blue trendlines on the chart. The lower one is drawn off of the lows from May 22, 2023 (last year!) and February 22nd, 2024. Today, that trendline is at 4.94 and off the chart. That’s where I would ultimately expect this market to go. 5.00 is a nice fat, round number and if we don’t see Wheat prices recover soon, that’s the next target. The fundamental news does not seem to be bullish, to my mind, at the moment. Regardless of how things look in your neighborhood, world Wheat production is expected to climb again next year, with gains expected in the US, Canadian, Argentinian and Australian harvests. Increased production in those 4 countries should more than offset the declines from the EU, Russia and Ukraine. But there’s a lot of time (and weather) before our crops are mature next year and bad weather can severely damage crops and yields. Russia is still undercutting the world prices, as their exports have been heavily sanctioned and they seem to be selling grain under the table, so to speak. Except for the past 5 years, when we had wild rallies in prices due to COVID and Russia/Ukraine war, the seasonal charts suggest weakness until contract expiration. (Seasonal Chart below) Wheat producers may do well to consider strategies protecting downside using options. March options expire in 66 days. 550 Puts settled today at 26 ¾, or $1,337.50 plus commissions and fees. If that’s too expensive for your taste, perhaps the 5.30 puts (16 cents, $800 before commissions and fees) are more in your wheelhouse. Normally, I’m usually a fan of option spreads, but option premium is high and the simple vertical spreads don’t catch my eye, today. The spread I would prefer would be a 3-way spread. Using the examples above, if you buy the 5.50 put and sell the 5.30 (10 ¾ at settlement, plus commission and fees) you’ll get 20 cents of protection. If you also sell a Call option, perhaps a 5.70 call (15 3/8 close, or $768.75 plus commission and fees) you can do that for credit (income) to your account of about 4 5/8 or $231.50. This position does have risk and is a marginable position. More aggressive and well-margined traders may do well to consider short positions in the futures. The 5- and 10-day moving averages crossed to the bearish side at 5 53 ¾ today, with the 10 day slightly higher at 5.55 ¼. I think your protective stop on the futures should be about 15 cents from where your entry is, with a downside targets near 5.25 and 5.00.

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

[email protected] www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.