The information and opinions expressed below are based on my analysis of price behavior and chart activity

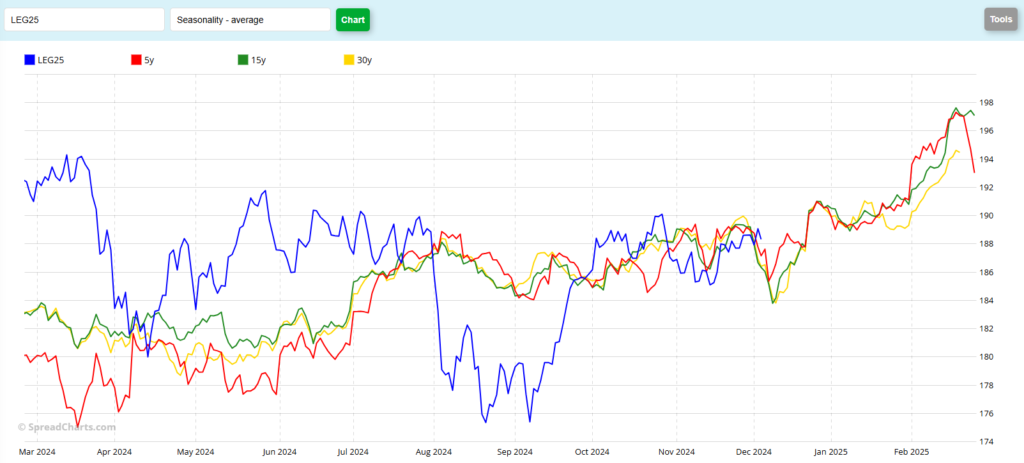

February Live Cattle

On Thursday, the February Live Cattle closed down 2.000 at 186.325. That the lowest close since November 18th. As you can see on the chart above, the red trendline resistance, drawn off of the March and October highs, has been tested a few times over the past couple of weeks. The market has been unable to break through that resistance level (roughly 189.50, today) and today the selling pressure accelerated. The 2.00 drop in value is the largest decline since September 5th and put prices below the 200-day moving average (purple) again. Seasonally (chart below) this market tends to drop quite aggressively the first couple of weeks in December, before resuming a rally that typically last until expiration. But as I Iook at that chart, I don’t see much correlation between the way Live Cattle have traded this year and the “usual” patterns. This year, it seems to me, the periods of correlation have been a lucky coincidence, as opposed to a market that is closely tracking its normal seasonal patterns. Cash trade has stayed strong (prices are toward the high end) but the chart above indicates to my eye that this market has been trending lower all year. With that in mind, producers of Live Cattle may do well to consider adding some price protection or hedges at these levels. February Put options expire in 64 days, so there’s not that much time value in the premium now. I would consider using a put spread, Buying the 185 and selling the 180. At today’s close, those options closed at a difference of 1.575, or $630 plus commissions and fees. If you choose to do that, I would suggest setting a GTC profit target at 2x what you paid for the spread. More aggressive and well-margined hedgers or traders could also add a 3rd option, Selling a Call, to that position, making it a 3-way spread. The 190 Call closed at 2.00 today. If you chose to do that, you’ll receive $800, less commissions and fees, generating some positive income for your trading account. There is a margin requirement and you’re adding some risk to the equation, so be sure this strategy is right for you, your operation and your risk tolerance. Call me directly if you have questions about this or anything else you might read here. Very aggressive and well-margined traders may do well to consider a short position at this time. There should be some resistance near the 200-day moving average (186.42) the 50-day (187.46) and the 5- and 10-day average will likely flip to the bearish side, unless we open sharply higher tomorrow morning. I would also recommend using either a protective stop to protect your account equity or using a call option to defend your futures position, should you choose to go short. Support may be found near the 100-day average, near 184.59 today or against the mid-August highs of 182.75.

Feb Live Cattle Seasonal Tendency

Jefferson Fosse Walsh Trading

Direct 312 957 8248 Toll Free 800 556 9411

[email protected] www.walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.