11/27/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

The Livestock Markets were mixed, with the Cattle higher and the Hogs lower. February’25 Live Cattle were 90 cents higher today and settled at 188.60. Today’s high was 189.27 1/2 and the 1-month high is 190.60. Today’s low was 187.47 ½ and the 1-month low is 184.40. Since 10/25 February’25 Live Cattle are 1.32 ½ lower or almost 1%. The Feeders were higher again today. January’25 Feeder Cattle were 67 ½ higher today and settled at 258.77 ½. Today’s high was 260.00 and that is the new 1-month high as well. Today’s low was 257.52 1/2 and the 1-month low is 239.50. Since 10/25 January’25 Feeder Cattle are 13.15 higher or more than 5%. The Hogs were lower today. February’25 Lean Hogs were 35 cents higher today and settled at 87.92 ½. Today’s high was 89.60 and that is the new 1-month high as well. Today’s low was 87.75 and the 1-month low is 82.10. Since 10/25 February’25 Lean Hogs are 4.50 higher or more than 5%. The February’25 Fats traded to within $1.05 of the 1-month high today and settled above all the major moving averages. The January’25 Feeders Made a new 1-month high at 260 even today and is well above all the major moving averages. The 200-Day is 250.07 and the rest are well below that level. Friday is the day after Thanksgiving and the last trading day of the month. The January’25 Feeders have closed higher 9 trading sessions in a row. 9 times, every day since 11/15, and is $15.57 ½ since the 15th. I think it is possible to see some profit taking on Friday, or it will be 10 trading days in a row with higher prices. The February’25 Hogs made a new 1-month high, and also settled well above all the major moving averages. If the music stops on Friday, the Livestock Markets cold break substantially. Thank you again to the Texas Gentleman with the Feedyard, that told me they were passing on 188’s and let me know after 190’s were traded today. I have new March’25 Feeder Cattle trades, and if you would like more information, use this link Sign Up Now

.

The Grains were mixed as well today. January’25 Soybeans were 5 ¼ cents higher and settled at 988 ¾. Today’s high was 994 ¼ and the 1-month high is 1044. Today’s low was 983 ¼ and the 1-month low is 975 ½. Since 10/25 January’25 Soybeans are 8 ¾ cents lower or almost 1%. The Corn Market was unchanged today. March’25 Corn was unchanged today and settled at 428. Today’s high was 431 and the 1-month high is 447 ¾. Today’s low was 427 ½ and the 1-month low is 423 ¼. Since 10/25 March’25 Corn is 1 ½ cents lower or almost ½ %. The Wheat Market was lower again today. March’25 Wheat was 9 ½ cents lower today and settled at 548 ½. Today’s high was 558 and the 1-month high is 599 ½. Today’s low was 547 ½ and the 1-month low is 546 ¼. Since 10/25 March’25 Wheat is 40 ¾ cents lower or almost 7%. The Wheat Market has been hit hard this month and today March’25 Wheat traded to within 1 ¼ cents of the 1-month low of 546 ¼. With all the problems in the world and the recent break in the market it looks like a good buy again and is almost 40 cents below the 100-day moving average of 586 ½. The rest of the averages are much higher. The Corn did not do much today, and there is not much new news either. The Beans continue to float between 970 and 1000, and I don’t think we will see much of anything for a while. I they trade above $10.00, sell them. I like the Soybean Oil Market again right now. Today the May’25 Bean Oil traded to within 1 cent of the 1-month low of 41.39. The 200-Day moving average is 44.60. Today I made new trades in the March’25 Wheat and the May’25 Bean Oil. If you would like more information on these markets or my new trades, use this link Sign Up Now Happy Thanksgiving everyone, and be safe.

.

.

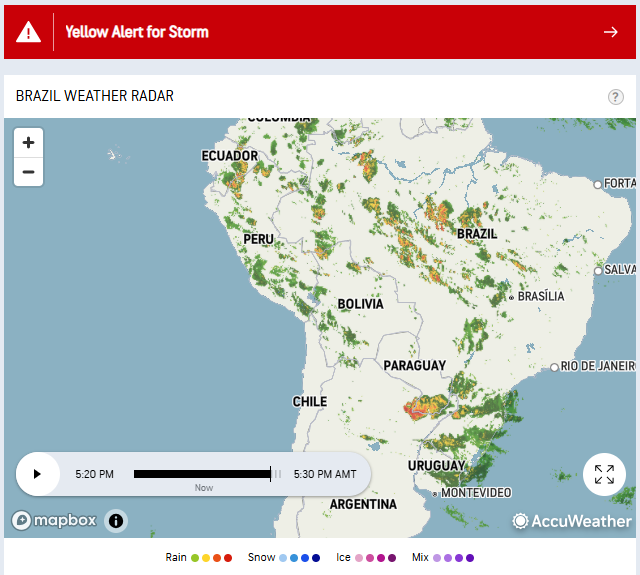

Today’s Brazil Weather Radar Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.