11/25/24 If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

The Cattle Markets were wild today, with the Feeders charging higher and then falling apart, and the Fats closing lower on the day. February’25 Live Cattle were 50 cents lower today and settled at 187.70. Today’s high was 190.05 and that is the new 1-month high as well. Today’s low was 187.57 ½ and the 1-month low is 184.40. Since 10/25 February’25 Live Cattle are 2.22 ½ lower or more than 1%. The Feeders shot straight up this morning but turned around the rest of the day. January’25 Feeder Cattle were 1.17 ½ higher today and settled at 255.47 ½. Today’s high was 259.52 ½ and that is the new 1-month high as well. Today’s low was 254.90 and the 1-month low is 239.50. Since 10/25 January’25 Feeder Cattle are 9.85 higher or more than 4%. The Hogs were higher as well today. February’25 Lean Hogs were 25 cents higher today and settled at 85.92 ½. Today’s high was 86.77 ½ and the 1-month and 52-week high is 86.90. Today’s low was 85.10 and the 1-month low is 82.10. Since 10/25 February’25 Lean Hogs are 2.50 higher or 3%. What the heck was that cow paddy today? A worm found in Southern Mexico, on the Guatemalan border, changed the outcome of a Cattle on Feed Report. Really? This Market will correct I believe. The New World Screwworm is the perfect name for this paddy eater. Cattle get worms, they are treated, and we move on. As the morning progressed, the USDA’s update on the screwworm alert sounded less drastic, from “temporarily suspending imports of live animals” to “restrictions are estimated to be in force for at least a month” and followed that by saying Mexico imports around 100,000 head a month. Good thing Placements were 105.3% with an estimate of 103.8% and was the largest October Placement number since 2019. So, the Feedlots here are full, and weights are off the charts. I think the Market can handle 100,000 fewer Feeders from Mexico for a month. In addition to that, the Cold Storage Report was released this afternoon, and it stated the total Pounds of Beef in freezers was up 5% from last month, but down 3% from last year. If the Beef in freezers is increasing, then demand is slowing, or production was ahead of pace. That sounds Bearish to me. Frozen Pork was down 7% from last month and 3% less than last year. Pork bellies were down 8% from the month before and down 42% from this time last year. That sounds Bullish for the Hogs. If you would like more information, please use this link Sign Up Now The Cattle did not close well either, with the February’25 Fats closing $2.35 off the highs today and settling 50 cents lower, and the January’25 Feeders settling $4.05 lower than today’s highs and closing just 57 ½ cents above the low of the day.

.

.

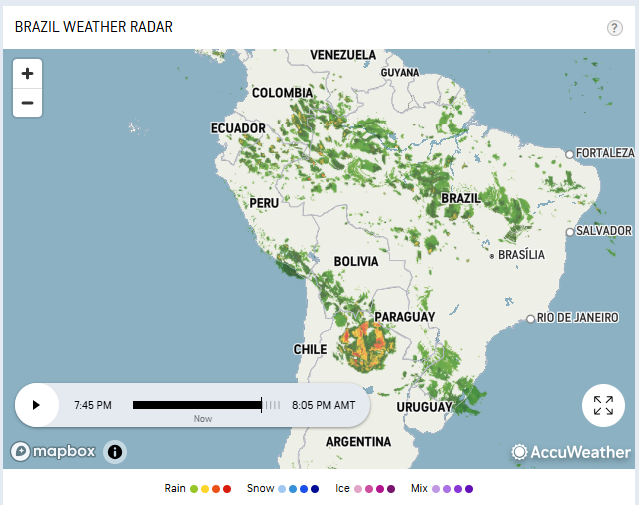

The Grains were not as active as the Livestock Markets, but the Wheat did lead the way lower today. The Beans closed 2 ¼ cents higher today and settled at 985 ¾. Today’s high was 993 ¼ and the 1-month high is 1044. Today’s low was 983 and the 1-month low is 975 ½. Since 10/25 January’25 Soybeans are 11 ¾ cents lower or more than 1%. The Corn Market a little lower today. March’25 Corn was 2 ¼ cents lower today and settled at 433. Today’s high was 435 ¾ and the 1-month high is 447 ¾. Today’s low was 431 ¾ and the 1-month low is 423 ¼. Since 10/25 March’25 Corn is 6 cents higher or almost 1 ½ %. The Wheat Market was lower today. March’25 Wheat was 9 cents lower today and settled at 555 ¾. Today’s high was 568 ½ and the 1-month high is 604 ¾. Today’s low was 550 ¾ and the 1-month low is 546 ¼. Since 10/25 March’25 Wheat is 33 ½ cents lower or more than 5 ½ %. The Grains had a much slower pace today. The January’25 Soybeans had a 10 ¼ cent range and settled 2 ¾ cents above the day’s low of 983. The March’25 Corn had a four-cent range today and settled ¼ of a cent below the 50-Day moving average of 433 ¼. The March’25 Wheat had a 17 ¾ cent range today and settled a nickel above the day’s low of 550 ¾, and just 9 ½ cents above the 1-month low of 546 ¼. If you would like to know more about these markets, please use this link Sign Up Now The crops in Brazil are growing well, and the Beans have no reason to be over $10.00, at least not yet. The Natural Gas Market still looks strong, and I feel it is still a buy at these levels. If you have any questions for me, give me a call. Have a great night.

.

Today’s Brazil Weather Radar Map Below.

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.