11/18/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

.

The Livestock Markets were all higher again today. February’25 Live Cattle were 72 ½ cents higher today and settled at 185.97 ½. Today’s high was 186.32 ½ and the 1-month high is 190.32 ½. Today’s low was 185.05 and the 1-month low is 184.40. Since 10/18 February’25 Live Cattle are 2.15 lower or more than 1%. The Feeders shot higher again today. January’25 Feeder Cattle were 2.27 ½ higher today and settled at 249.50. Today’s high was 249.85 and that is the new 1-month high as well. Today’s low was 246.65 and the 1-month low is 239.50. Since 10/18 January’25 Feeder Cattle are 4.00 higher or more than 1 ½%. The Hogs were higher as well today. February’25 Lean Hogs were 37 ½ cents higher today and settled at 83.27 ½. Today’s high was 83.85 and the 1-month high is 86.90. Today’s low was 82.87 ½ and the 1-month low is 80.90. Since 10/18 February’25 Lean Hogs are 1.42 ½ higher or almost 2%. The Cattle Markets, and especially the Feeders have been on a tear recently, with the differed months leading the way higher. The February’25 Fats already closed above the 100-Day moving average of 184.62 and the 50% retracement from the 52-week high/low of 184.48 on Friday. Today they settled above the 50-Day moving average of 185.92 as well and then came within 28 ½ cents of the 200-Day moving average of 186.61. I feel the 1-month low of 184.40 will be tested soon. The January’25 Feeders made a new 1-month high today and settled just 35 cents off the day’s highs. They also settled well above all the major moving averages except for the 200-Day moving average of 250.57. The February’25 Lean Hogs also settled well above all the major averages, and I think we can see a reversal in the Hogs. I feel the February’25 Hogs can head lower again through the 200-Day moving average of 78.01 down to the 50% retracement from the 52-week high/low of 76.76 and the 100-Day moving average of 76.56. The recent, and much needed rains throughout the Plains could have helped the Feeders advance, but I am also hearing Cattle are being put on the Wheat Crops as well. The Cattle on Feed Report is on Friday, and expectations are for it to be large. I have heard estimates of 101% Cattle on Feed and 105% marketings and 105% placements as well, with over 12 million Head on feed. That is a big number, but I have also heard that it can be the biggest one for a while. The Funds are long over 12,000 Futures and Options in the Feeder Market and in the Fats, spec trades grew by more than 5000 Futures and Options contracts and now totals more than 100,000 contracts in open interest. Argentina is getting ready to start exporting Beef to China in 2025, and it will be the first time in 15-years after a trade deal was reached earlier this year. Today, Brazil said that a new agricultural trade deal with China is expected to include Packers approved for meat export to China as well. The US Dollar Index slid lower today (-0.414) for the first time in the last 7 trading sessions, and that could have helped all the Commodity Markets today. There was short covering when the Market hit a 7-week low, and I would expect profit taking before the Cattle on Feed Report. I am still Bearish the Livestock Markets. If you would like more information on these Markets or to see my recommendations, please use this link Sign Up Now

.

The Grains were all higher today. January’25 Soybeans were 11 ¼ cents lower today and settled at 1009 ¾. Today’s high was 1011 ½ and the 1-month high is 1044. Today’s low was 989 ½ and the 1-month low is 977 ¼. Since 10/18 January’25 Soybeans are 27 cents higher or almost 3%. The Corn Market looked good again today. December’24 Corn was 5 ¼ cents higher today and settled at 429 ¼. Today’s high was 429 ½ and the 1-month high is 434 ¾. Today’s low was 422 ¼ and the 1-month low is 403. Since 10/18 December’24 Corn is 24 ½ cents higher or more than 6%. The Wheat Market was up again today. March’25 Wheat was 11 ¾ cents higher today and settled at 565 ¾. Today’s high was 569 ¼ and the 1-month high is 604 ¾. Today’s low was 554 ¼ and the 1-month low is 546. Since 10/18 March’25 Wheat is 26 ¾ cents lower or 4 ½%. The Beans were higher again today, probably of some flash sales this morning, but I don’t see a trend higher any time soon. I would continue to sell into strength. The 50-Day moving average is 1022 and the 100-Day is 1033, and I feel beans will be below $10.00 again soon. I am still Bearish the Soybean Meal as well, and still Bullish the Bean Oil, and Canola Oil. I still like the Corn Market as well, and December’24 Corn settled only a ¼ cent off the highs today and is only 5 ½ cents from the 435 level I expect it to test again. The 200-Day moving average is 440 ½ and the 50% retracement from the 52-week high/low is 451 ½. The Wheat climbed higher today, and I think it rallied because of what Biden said. He told Ukraine that they can now send long-range US missiles into Russia. That sounds really really smart… what a moron. So, that sent the not only the Wheat higher, but the Crude Oil Market higher as well. If Crude Oil spikes higher again, it will not help any other commodity market. For the March’25 Wheat the 100-Day moving average is 590 ¾ and the 50-Day is 596 ½. If you would like more information on these markets, please use this link Sign Up Now I am still Bullish the Natural Gas Market as well, and I would be happy to talk to you about it, just give me a call or use one of the links. Have a great night.

.

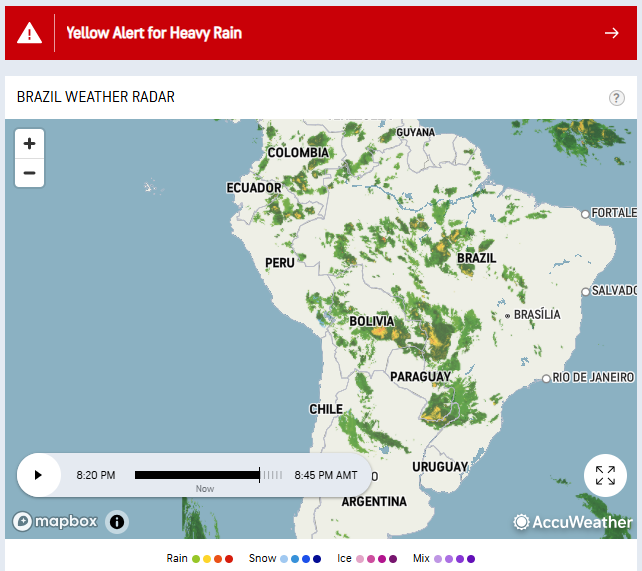

Today’s Brazil Weather Radar Map Below.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

.

.

Walsh Gamma Trader Link Walsh Gamma Trader

.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.