Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Commentary

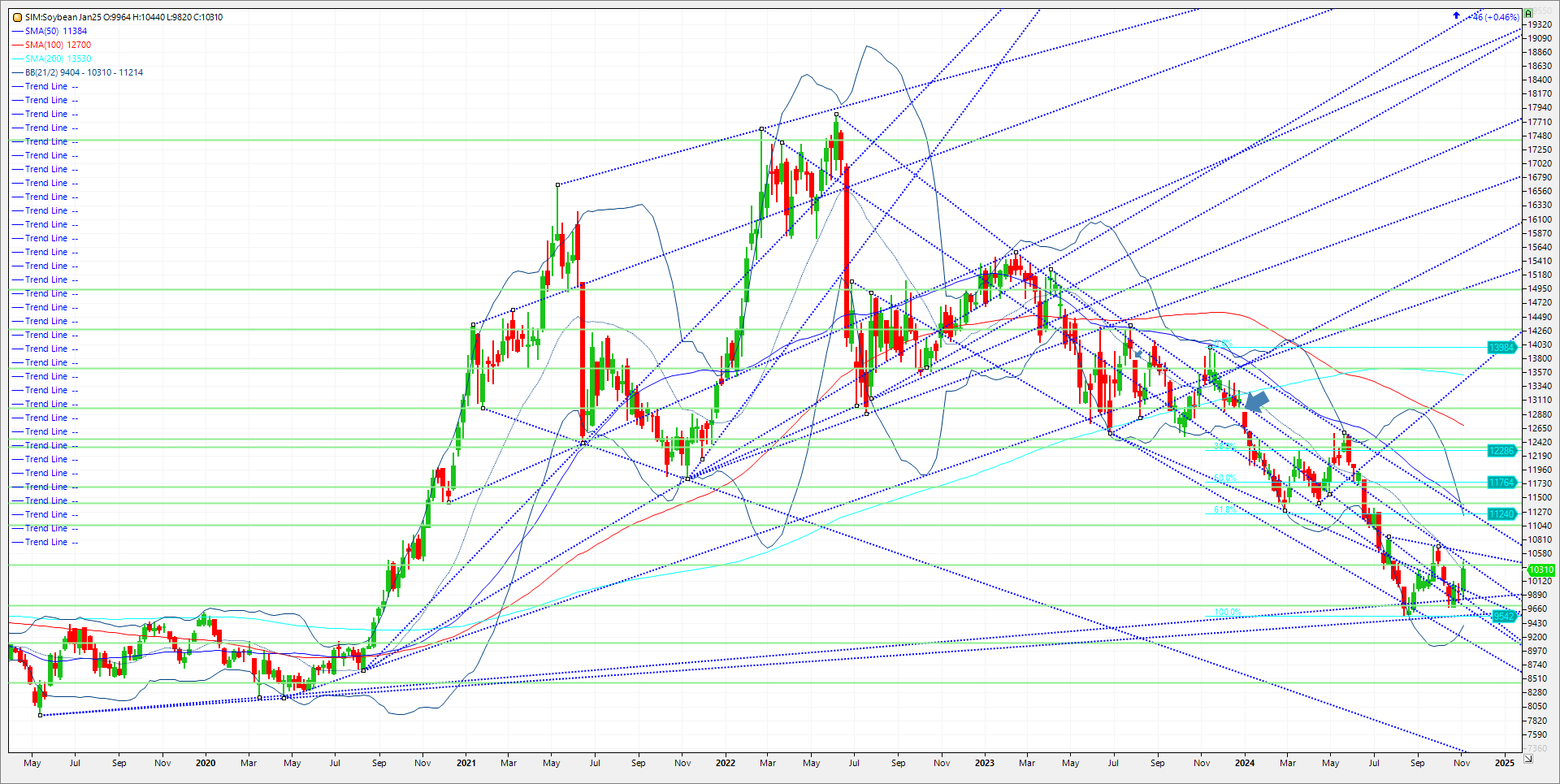

The soybean session turned into a wild ride today but at the end of the day, January 25 soybeans, the most actively traded contract, settled right at resistance just a few cents higher on the day. Surprises by USDA that delivered a US yield number that were much less than expected. The average trade guess was for a 52.8 yield. USDA came in with a bullish surprise at 51.7. This punched ending stocks from a pre report guess at 532 down to 470 as production was revised lower by 121 million bushels. With the 51.7 yield, the decline cut US production by 121 million bushels. This was offset by the USDA softening the production loss with a cut to exports and crush. A 470-million-bushel carryout is still putting a 10.8% carryout/use ratio on paper. Historically, prices associated with a ratio over 10 percent puts the path of least resistance lower if you cite prices in past crop years. This may be why most of the day’s rally evaporated by the close. It is my opinion that soybean and soy oil futures are likely receiving spillover support from the palm oil market, which has surged about 35% since mid-August. Palm oil prices are expected to remain elevated into early 2025 amid a shortage of supplies in Asia. Todays close settled just below the 21-week moving average. At 1031, which is first resistance next week. Next levels up are 10.38 and 10.44. A close over 10.44 pushed the market to 10.59. A close over 10.59, and I wouldn’t be short, as the technical levels tell me that we could rally to 11.03. There isn’t much meaningful support until 9.92/91. A close under and its 980 and then 972/69. A close under 969 puts the August lows in play at 9.55. Make no mistake this report was a bullish surprise in my view and yet the market could only a muster a 4-cent rally. Looking for follow thru if any early next week.

Trade Ideas

Futures-N/A

Options-N/A

Risk Reward

Futures-N/A

Options- N/A

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

311 S Wacker Drive Suite 540

Chicago, Il 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.