11/6/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

What a night, and we saw some crazy price action today. The Livestock Markets were all higher today. December’24 Live Cattle were 62 ½ cents higher today and settled at 185.40. Today’s high was 186.60 and the 1-month high is 189.80. Today’s low was 184.82 ½ and the 1-month low is 184.45. Since 10/4 December’24 Live Cattle are 1.65 lower or just almost 1%. The Feeders shot higher early but gave most of it back before the close. January’25 Feeder Cattle were 1.67 ½ cent higher today and settled at 244.02 ½. Today’s high was 245.55 and the 1-month high is 248.52 ½. Today’s low was 242.82 ½ and the 1-month low is 239.50. Since 10/4 January’25 Feeder Cattle are 42 ½ cents lower or fractionally lower. The Hogs gained late today. December’24 Lean Hogs were 1.00 higher today and settled at 82.12 ½. Today’s high was 82.35 and the 1-month and 52-week high is 85.07 ½. Today’s low was 80.82 ½ and the 1-month low is 75.07 ½. Since 10/4 December’24 Lean Hogs are 6.07 ½ higher or almost 8%. Today’s is exactly why I use the Option Markets. If you had on a Futures position this morning, you could have been right, but still been run over. It is hard to take the heat in the Futures Markets but using the Option Markets, allows you to take the heat, and then take advantage. I would always rather take advantage of market movement in the Options. There is great opportunity right now, and I want to help you take advantage of it. This is what I do, and if you would like to work together, just let me know. It is easy to fill out account paperwork. I just send you a link in an email, and you submit it from there. I can also walk you through the application. Give me a call if you are interested in receiving the Account Link at 312-957-8079, you can also sign up for more information using this link Sign Up Now I still like the entire trading “basket” I sent out yesterday, and those five trades as a group, lost $375.00 dollars today. I am expecting tomorrow to be a much better day for the Livestock Trades. The US stock Markets exploded higher today, after Donald J. Trump was elected President again. The US dollar Index was up Yuge as well this morning, up over two full points. The Fed is expected to cut interest rates ¼ of a point tomorrow, but what if they don’t? What if the political climate we are in changes everything? The Fats and the Feeders settled basically in the middle of today’s trading range, and well off the highs of the day. The December’24 Fats settled $1.20 off the highs, and the January’25 Feeders settled $1.52 ½ off the highs today. If and or when the Stock market breaks it could get ugly fast. There is a WASDE Report this Friday and the next Cattle on Feed Report is a week from Friday on the 25th. I heard some pre-report estimates for the Cattle on Feed Report and if correct, will be Market moving information. I heard estimates of 101% Cattle on Feed, 105% Marketings, and 105% Placements, as I have anticipated for a while based on the widespread drought. If these numbers are even close to accurate it can push the Cattle Markets lower all by itself.

.

The Grain Markets traded lower early, but all closed positive today. January’25 Soybeans were 2 cents higher today and settled at 1003 3/4. Today’s high was 1007 ¾ and the 1-month high is 1058. Today’s low was 982 and the 1-month low is 977 ¼. The 52-week low is 973 ½. Since 10/4 January’25 Soybeans are 51 cents lower or almost 5%. The Corn Market continued to look strong today. December’24 Corn was 7 ¾ cents higher today and settled at 426 ¼. Today’s high was 426 ¾ and the 1-month high is 428. Today’s low was 414 ¼ and the 1-month low is 399. The 52-week low is 385. Since 10/4 December’24 Corn is 1 ¾ cents higher or just almost ½ %. The Wheat Market was fractionally higher today. December’24 Wheat was ¾ of a cent higher today and settled at 573 ¼. Today’s high was 577 ¾ and the 1-month high is 611 ¼. Today’s low was 562 and the 1-month low is 557 ¾. The 52-week low is 520 ¾. Since 10/4 December’24 Wheat is 15 ½ cents lower or more than 2 ½ %. The January’25 Soybeans dove lower this morning, after President Trumps big win last night. I think they traded lower this morning based on potential tariff and trade war anticipation. The January’25 Beans traded down to 982 before turning around and heading higher and closing 2 cents higher for the day. I still think the Beans and Bean Oil can head lower from here. The Corn Market looked strong again today and settled just ½ a cent off the highs. I feel the December’24 Corn can still trade up to 435 and then 450. For the December’24 Corn, the 50% retracement from the 52-week high/low is 452 ¼. December’24 Wheat traded higher during the second half of the day. but it did not close well, 4 ½ cents off the highs. I still feel the Wheat Market can trade up to the 640 level. The WASDE Report is this Friday, and it sounds like they could take some of the yield out of the Corn and Soybeans. If that were to happen, it could help the Corn to continue to rally, but there are simply too many Soybeans, without any weather problems in South America. I think the Beans can head lower for a little longer, until me know more about South Americas growing season and any potential drought here next year, but it is still too early to tell. We will see what the WASDE has to say on Friday. There is still great opportunity in the Livestock and Grain Markets. if you would like to learn more about it, use this link Sign Up Now I am still Bearish the Fats, Feeders, Hogs, and Soybean Meal. Be careful with the Soybeans right now. I am still Bullish Corn, Wheat, Soybean Oil, Canola Oil, and Natural Gas.

.

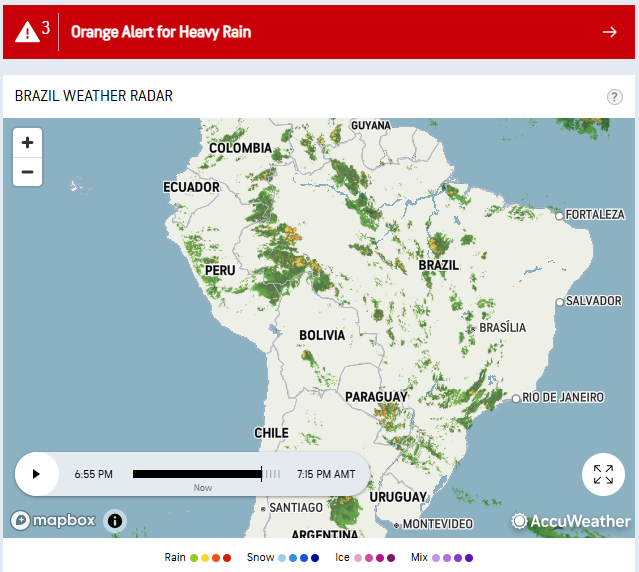

Today’s Brazil Weather Radar Map.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.