11/4/24 If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

The Cattle Markets were all lower to start the week. December’24 Live Cattle were 85 cents lower today and settled at 185.07 ½. Today’s high was 186.05 and the 1-month high is 189.80. Today’s low was 184.57 ½ and the 1-month low is 184.45. Since 10/4 December’24 Live Cattle are 1.92 ½ lower or just over 1%. The Feeders traded lower again today. January’25 Feeder Cattle were 77 ½ cent lower today and settled at 242.42 ½. Today’s high was 243.42 ½ and the 1-month high is 248.52 ½. Today’s low was 241.32 ½ and the 1-month low is 239.50. Since 10/4 January’25 Feeder Cattle are 1.95 lower or almost 1%. The Hogs started their journey lower today. December’24 Lean Hogs were 85 cents lower today and settled at 83.22 ½. Today’s high was 84.82 ½ and the 1-month and 52-week high is 85.07 ½. Today’s low was 82.85 and the 1-month low is 75.07 ½. Since 10/4 December’24 Lean Hogs are 7.07 ½ higher or more than 9%. I run the Pure Hedge Division of Walsh Trading, and under Pure Hedge I write the Walsh Gamma Trader as well. I also structure Hedge Programs for Producers in each commodity across the Livestock and Grain Complex’s. In addition to that, I structure Spec Trades in the Option Markets, on each Livestock and Grain commodity as well. If you have any questions for me about hedging, trading, or market direction, please use this link Sign Up Now On Sunday, according to the WSJ, Iran says Israel to Face “Strong” Attack. They went on to say Iran is planning the attack against Israel after the election here, but before the inauguration of the next President. The US Military must take the threat somewhat serious, because they “deployed additional ballistic missile defense destroyers, fighter squadron and tanker aircraft, and several US Air Force B-52 long-range strike bombers to the region.” So, it looks like the possibility of more conflict exists, and the Markets will be watching. I am still Bearish the Livestock Markets and think they will all head much lower. The December’24 Fats I feel will head toward their 50% retracement from the 52-week high/low of 181.93. The December’24 Fats almost traded down to their 200-Day moving average today of 184.55, just 2 ½ cents from the lows today. The next stop could be the 100-Day moving average of 183.72 and the 50-Day moving average of 183.48. I still think we can see the December’24 contract move into the 170’s. The Feeders almost imploded last Friday, and I think those levels will be traded through again. The January’24 Feeders settled below the 100-Day moving average of 243.94 today, and I feel the January’25 Feeders can trade down through the 50-Day moving average of 238.80, down to about 233-234, and then decide what to do next. The Hogs were lower again, and I think they will head much lower from here. The 50-Day moving average is 75.75, the 1-month low is 75.07 ½, the 200-Day moving average is 74.19 ¾, and the 50% retracement from the 52-week high/low is 73.45. I feel we will see everything lower, sooner than later.

.

The Grain Markets were a little higher today. January’25 Soybeans were 3 ½ cents higher today and settled at 997 ¼. Today’s high was 1008 and the 1-month high is 1058. Today’s low was 994 and the 1-month low is 977 ¼. The 52-week low is 973 ½. Since 10/4 January’25 Soybeans are 59 cents lower or more than 5 ½%. The Corn Market continued to look stable today. December’24 Corn was 2 cents higher today and settled at 416 ½. Today’s high was 420 and the 1-month high is 428. Today’s low was 413 and the 1-month low is 399. The 52-week low is 385. Since 10/4 December’24 Corn is 8 ¼ cents lower or just almost 2%. The Wheat Market was fractionally higher today. December’24 Wheat was ¾ of a cent higher today and settled at 568 ¾. Today’s high was 575 ¾ and the 1-month high is 611 ¼. Today’s low was 565 and the 1-month low is 557 ¾. The 52-week low is 520 ¾. Since 10/4 December’24 Wheat is 21 cents lower or more than 3 ½ %. They tried to push everything higher in the overnight trade. I don’t understand the need to rally the Beans, but it would have been another good time to sell them at 1008 this morning and 1008 ¾ Friday morning. Be careful if they trade up there again, it looks like a trap before the WASDE Report on Friday. The Corn continues to impress and gained another two cents today. I still think we will see the corn test the 435 and 450 levels. The 50% retracement from the 52-week high/low is 452 ¼, and I think we can go there. If that were to happen, I think we will see the Wheat trading around the 640 level. The 50% retracement from the 52-week high/low for December’24 Wheat is 640. I did write a new Walsh Gamma Trader this morning, and I structured a Hedge Program for Corn and Soybean Meal as well. If you are interested in learning more about it, please use this link Sign Up Now There is plenty happening this week, with our Election tomorrow, Fed Rate Cut decision, Iran, and the WASDE on Friday. I am still Bearish the Soybeans, and Soybean Meal. I am Bullish the Corn, Wheat, Soybean Oil, and Canola Oil. I am also Bearish the Livestock Market in case you forgot. I would like to work with you, and the first easy step is a simple phone call. I look forward to speaking with you.

.

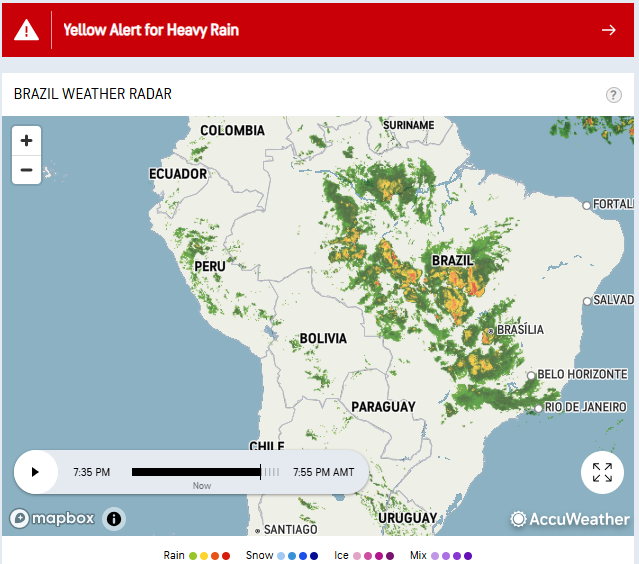

Today’s Brazil Weather Radar Map Below

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.