10/23/24

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

The Livestock Markets were mixed again today, with the Cattle Markets sinking a little lower. December’24 Live Cattle were 25 cents lower today and settled at 187.87 ½. Today’s high was 188.97 ½ and that is the new 1-month high as well. Today’s low was 187.12 ½ and the 1-month low is 183.00. Since 9/23 December’24 Live Cattle are 4.05 higher or more than 2%. The Feeders were down almost three dollars on the lows today. January’25 Feeder Cattle were 2.22 1/2 lower today and settled at 243 82 1/2. Today’s high was 246.75 and the 1-month high is 248.52. Today’s low was 243.35 and the 1-month low is 235.85. Since 9/23 January’25 Feeder Cattle are 6.05 higher or more than 2 1/2%. The Hogs were higher again. December’24 Lean Hogs were 1.05 higher today and settled at 80.17 ½. Today’s high was 80.22 ½ and that is the new 1-month high as well. Today’s low was 78.87 ½ and the 1-month low is 72.40. Since 9/23 December’24 Lean Hogs are 5.30 higher or more than 7%. The December’24 Fats made a new 1-month high this morning, but the buying dried up, and the market broke over a dollar off the highs. The January’25 Feeders broke almost 3 ½ dollars off the highs as well. The Cattle Markest broke when the Dow Jones broke for the second time this morning. There is definitely still a connection between the Dow and the Cattle Markets, especially for the Feeders. The Cattle Markets did not close well again today, with the January’25 Feeders settling less than 50 cents off the lows. I still feel the Stock Market will continue to break, and that will pull the Cattle Markets lower. I still think the December’24 Fats can head toward the 50-Day moving average of 181.87 and the 50% retracement level of 181.93. I think the January’25 Feeders can head down to their 50-Day moving average of 236.88. The Cattle on Feed Report is this Friday, and I will have trades available in the Fats and Feeders before and after the Report. If you are interested in seeing any of my trade Ideas, please use this link Sign Up Now Just heard that 186.50 traded in Iowa and it was more than 80% Choice.

The Grain Markets were mostly higher today. November’24 Soybeans were 5 3/4 cents higher today and settled at 997 ½. Today’s high was 999 ¾ and the 1-month high is 1069 ¾. Today’s low was 985 and the 1-month low 968. The 52-week low is 955. Since 9/23 November’24 Soybeans are 41 3/4 cents lower or more than 4%. The Corn Market continued higher as well today. December’24 Corn was 2 1/2 cents higher today and settled at 419. Today’s high was 420 and the 1-month high is 434 ¼. Today’s low was 414 and the 1-month low is 399. The 52-week low is 385. Since 9/23 December’24 Corn is 5 ½ cents lower or more than 1%. The Wheat Market was higher as well today. December’24 Wheat was 2 ½ a cent higher today and settled at 587 1/2. Today’s high was 582 3/4 and the 1-month high is 617 ¼. Today’s low was 566 ¼ and the 1-month low is 565 3/4. The 52-week low is 520 ¾. Since 9/23 December’24 Wheat is 4 cents lower or about ½%. The November’24 Soybeans traded to within a tick of $10.00 dollars today but could not push through. It was a good thing that I covered the shorts in November’24 Soybeans last Friday. I still think there is a chance the November’24 Beans can make new lows, but it won’t happen until November’24 Options expire on Friday. I still recommend selling March’25 Soybeans now and buying August’25 Soybeans. I structured August’25 Option trades on 10/21 and sent them to Customers and people on my email list. The August Beans at that time were 1027 ¼, and they settled at 1041 ¼ today. That trade came with a $250.00 Credit as well. The Corn Market was higher again today and I think we will continue to see that. The December’24 Corn closed just a penny off the highs and I think we can see the December’24 Corn head to the 50% retracement level of 452. The Wheat was higher as well, and I think that can trade higher as well. If the Corn heads up to 452, then I think the Wheat will do the same, and heads to its 50% retracement level of 640. I am also Bullish the Soybean Oil and Canola Markets as well. I structured trades today in December’24 Wheat, December’24 Corn, and March’25 Soybean Meal. If you would like to see them, just use the Sign Up Now link. I sent them to my Customers and people on my email list. There will be plenty of opportunity over the next three-, six- and 12-month timeframes. I would like to work with you in the Livestock and Grain Markets. Thank you for continuing to read this, but give me call, and let’s talk about a plan that works best for you moving forward. I can’t help if you don’t call. Have a great night.

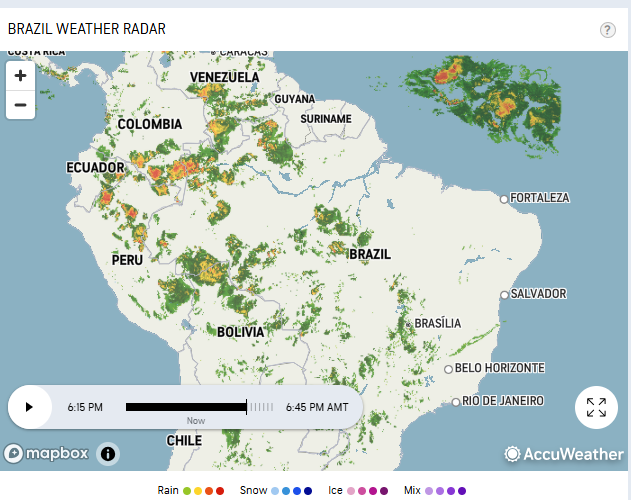

Today’s Brazil Weather Radar Map Below.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.