10/21/24

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

The Livestock Markets were mixed again today, with the Cattle Markets sinking a little lower. December’24 Live Cattle were 50 cents lower today and settled at 186.82 ½. Today’s high was 187.47 ½ and the 1-month high is 188.55. Today’s low was 186.52 ½ and the 1-month low is 182.82 ½. Since 9/20 December’24 Live Cattle are 3.62 ½ higher or almost 2%. The Feeders lost more than a dollar today. January’25 Feeder Cattle were 1.25 lower today and settled at 244 ¼. Today’s high was 245.60 and the 1-month high is 248.52. Today’s low was 243.92 ½ and the 1-month low is 235.85. Since 9/20 January’25 Feeder Cattle are 7.27 ½ higher or more than 3%. The Hogs were higher again. December’24 Lean Hogs were 45 cents higher today and settled at 78.27 ½. Today’s high was 78.47 ½ and that is the new 1-month high as well. Today’s low was 76.80 and the 1-month low is 72.40. Since 9/20 December’24 Lean Hogs are 4.02 ½ higher or almost 5 ½%. The Cattle Markets turned around again today and headed lower, on a slow trading day. The December’24 Fats had less than a dollar range and settled just above the lows on the day. I still think the December’24 Fats will head lower toward their 100-Day moving average of 183.43, and then toward the 50-day moving average of 181.53 and the 50% retracement from the 52-week High/Low number of 181.93. The January’25 Feeders I feel can head back toward their 50-Day moving average of 236.19 and then the 1-month low of 235.85. The December’24 Hogs made a new 1-month high today and look strong, but I still think they will follow the Cattle lower. The 50-Day moving average is 73.00, the 1-month low is 72.40, and the 50% retracement number from the 52-week High/Low is 70.71. It appears that Iseral is still in the planning phase of their response. Over the weekend US intelligence was leaked and posted online. So that tells me something is still going to happen, but we don’t have a time frame. The President also said he knew what the response was going to be late last week. I don’t believe anything is off the table, especially after the US used B-2 Stealth Bombers to take out bunkers in Yemen late last week. The Dow Jones continued to break after the Livestock and Grain Markets closed, and I feel that the US Stock Market will break after Iseral retaliates, whenever that might be. We also have an election coming up, and if the Markets get the jitters, I think they will break off their all-time highs, and that will send the Cattle Markets lower. Nobody like instability, and neither do the Stock Markets. There is also the Cattle on Feed Report this Friday the 25th, and things always seem to happen all at once, but that’s just what I think. I wonder what the Placements number will be in the Report Friday.

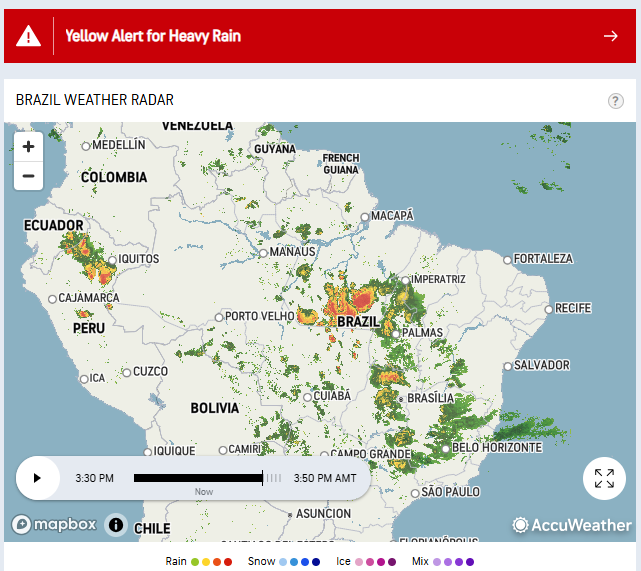

The Soybeans and Corn Markets reversed course again today and headed higher. November’24 Soybeans were 11 cents higher today and settled at 981. Today’s high was 983 ¾ and the 1-month high is 1069 ¾. Today’s low was 969 and the 1-month low 968 ¼. The 52-week low is 955. Since 9/20 November’24 Soybeans are 32 cents lower or more than 3%. The Corn Market continued higher as well today. December’24 Corn was 4 ¾ cents higher today and settled at 409 ½. Today’s high was 411 ¾ and the 1-month high is 434 ¼. Today’s low was 403 and the 1-month low is 399. The 52-week low is 385. Since 9/20 December’24 Corn is 8 ½ cents lower or more than 2%. The Wheat Market was slightly lower today. December’24 Wheat was ½ a cent lower today and settled at 572 ¼. Today’s high was 584 ¼ and the 1-month high is 617 ¼. Today’s low was 570 ¾ and the 1-month low is 569. The 52-week low is 520 ¾. Since 9/20 December’24 Wheat is 3 ¾ cents higher or fractionally higher. Brazil has been getting rain, and the forecast continues to look wet. Soybean planting in Brazil is up about 10% from last week, to 18% complete, but less than the 30% that is usually complete by this time. With the steady rains here now, the planting pace should accelerate. China imported a huge number of Soybeans in September, more than 11mmt, however less than 2mmt were from the US Farmer, and nearly 8.50mmt were from Brazil, and that is more than 80%. Through the first nine months of this year, Soybean imports from Brazil increased 13% over last year, to more than 62mmt, and for the US, Soybean shipments are down 15% to about 15.50mmt over the same time period. Demand looks strong, and the USDA announced 380,000 tonnes purchased by unknow today, and I am guessing China again. It was also rumored that China purchased a huge quantity of Soybeans from Brazil on Friday. China has been stockpiling Soybeans for a while… Datagro stated that Brazil could produce more than 167mt of Soybeans this year, and the USDA’s estimate is 169mt. Soybean Harvest here is going well and is about 15% more complete to about 80% complete. The US Corn Harvest increased by about 18% to about 65% complete. Corn planting in Brazil is about 48% complete. The Demand for Corn has been strong as well, and $4.00 looks to be an attractive price. There was some rain in the Black Sea Region, but it does not sound like it was enough for the Wheat Crops there. the extended forecast looks dry as well. I still think the Beans can make new lows; however, I got out of most of my Customers Short Positions in November’24 Soybeans on Friday. The Price action did not look good on the close Friday, and my Customers agreed to take profit. I have been Bearish Soybeans for over a year, and it was very rewarding. I still think the Beans can head lower, but the risk/reward at this point was not worth it. If you are someone that is on my email list, then you have seen the new trades I sent to you this morning. One of the Trades would capture a rally if there was a problem with the current Soybean planting in Brazil now, or the growing season, and through Harvest. In addition to the Brazil Crop, it would also capture a move higher if there was a planting problem in the US, or a problem during most of the growing season next year as well, and it came with a Credit. If you are interested in seeing the trade or trades, please click on the Sign Up Now link. I would like an opportunity to work with you. If you are Hedging or Trading, I know I can help your bottom line. I know you are still busy but give me a call when you have a chance to talk about it. I look forward to speaking with you.

.

Brazil Weather Radar Map Below.

.

If you would like to receive more information on the commodity markets, please use the link to join our email list Sign Up Now

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.