10/14/24

The Livestock Markets were mixed today, as the Hogs lost almost 2-Dollars. The Fats were able to stay positive today. December’24 Live Cattle was 35 cents higher today and settled at 187.92 ½. Today’s high was 188.25 and the 1-month high is 189.67 ½. Today’s low was 187.15 and the 1-month low is 180.55. Since 9/13 December’24 Live Cattle are 8.05 higher or almost 4 ½%. The Feeders ended the day lower. November’24 Feeder Cattle were 22 ½ cents lower today and settled at 249.57 ½. Today’s high was 251.25 and that is the new 1-month high as well. Today’s low was 249.05 and the 1-month low is 234.75. Since 9/13 November’24 Feeder Cattle are 14.27 ½ higher or just over 6%. The Hogs slipped lower. December’24 Lean Hogs were 1.85 lower today and settled at 75.80. Today’s high was 77.50 and the 1-month high is 77.90. Today’s low was 75.20 and the 1-month low is 71.30. Since 9/13 December’24 Lean Hogs are 4.52 ½ higher or almost 6½%. The December’24 Fats had a narrow trading range today on a quiet day but were able to make a small gain. The Feeders had a slightly wider trading range, and set a new 1-month high, but traded lower on the day. November’24 Feeders once again traded through the 50% retracement number of 250.50, and once again settled below that level, and near the lows of the day. The November’24 Feeders have traded through the 50% retracement number 4 of the last 5 trading days, setting new 1-month highs, 3 of those 5-days, and each day closed below that number 250.50. This looks to be a barrier, and if the market can’t settle above that level soon very soon, I feel the market will start to break again. Last week the estimated dressed Cattle weight was 862 pounds, the same as the week before, and still 29 pounds above last year’s weight of 833 pounds. The 5-year average for last week is 833 pounds. I continue to hear that the feed lots are full, but the numbers are tight. We know the weights are up, but there is also a drought, and I have heard from some that it could increase the number of placements. The Funds continued to purchase Cattle futures last week and added over 13,500 contracts to their long position and are now long over 77,000 contracts. The Funds still have a nice profit after running the November’24 Feeders up over 15-dollars and they could decide to start selling at any time. Today was the 10th trading day of the month, and the market has settled lower 6 of the 10 days. The main reason the Feeders are at this level is from last Tuesday’s rally of $3.87 ½ on October 2nd. The October’24 Feeders for the month of October are up $4.67 ½, and most of the gain was on the 2nd. The October’24 Feeders are only up $1.02 ½ from the close on October 2nd. It looks weak to me, and if the market is unable to close above 250.50 shortly, then I feel the market will move lower quickly.

The Grain Markets were all lower today, with the Beans settling below $10.00. November’24 Soybeans were 9 ½ cents lower today and settled at 996. Today’s high was 1008 ½ and the 1-month high is 1069 ¾. Today’s low was 995 ½ and that is also the new 1-month low. Since 9/13 November’24 Soybeans are 10 ¼ cents lower or just over 1%. The Corn Market sank lower today. December’24 Corn was 7 ½ cents lower today and settled at 408 ¼. Today’s high was 415 ¼ and the 1-month high is 434 ¼. Today’s low was 407 ½ and the 1-month low is 401 ¼. Since 9/13 December’24 Corn is 5 cents lower or more than 1%. The Wheat Market fell apart today. December’24 Wheat was 13 ¾ cents lower today and settled at 585 ¼. Today’s high was 601 and the 1-month high is 617 ¼. Today’s low was 584 ¼ and the 1-month low is 564. Since 9/13 December’24 Wheat is 9 ½ cents lower or more than 1 ½%. November’24 Soybeans settled below 10 bucks today for the first time since September 10th. November’24 Soybeans traded up to 1069 ¾ on that ridiculous rally. That is why I use the Option Markets, it gives you the ability to take the heat, if the market goes against you. If you received my trades in March’25 Soybeans over the last few weeks, take another look at them. They are all winners, each and every one. It is raining in Brazil, as expected, and the monsoons are likely to arrive at any time. Brazil’s planting is more than 9% complete, compared to more than 17% last year, but that can be made up quickly with the rains already there. CONAB will release their new production numbers for Brazil Soybeans tomorrow. CONAB’s estimates for Brazilian Soybean production before the last WASDE Report was 166.24mt, we will see how the new numbers compare tomorrow. It seems that the Funds have started been buying Soybean Oil recently, and net longs are now at a 1-year high. The vegetable oil supplies could get tight, especially if something happens to the flow of used cooking oil from China. I like getting long Soybean Oil at these levels as well. December’24 Corn was pulled lower by the Wheat today, and closed ¾ of a cent off the lows. December’24 Wheat dropped 13 ¾ cents and settled just one cent above the lows. November’24 Soybeans settled just ½ a cent from the lows today, and I hope you continued to sell Calls and buy Puts. The 52-week low for November’24 Soybeans is 955, and I feel the Market will test that level again. I still recommend getting short in the March’25 contract. March’25 Soybeans closed at 1025 ¼ today.

.

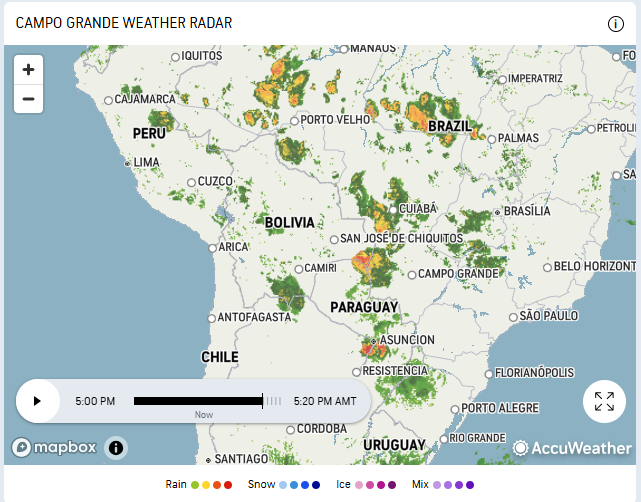

Today’s Weather Radar Map For Brazil.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.