10/11/24

The Livestock Markets were mixed today, as the Cattle Markets were kept in check. December’24 Live Cattle was 70 cents lower today and settled at 187.57 ½. Today’s high was 188.55 and the 1-month high is 189.67 ½. Today’s low was 187.40 and the 1-month low is 180.05. Since 9/11 December’24 Live Cattle are 8.92 ½ higher or almost 5%. November’24 Feeder Cattle were 15 cents lower today and settled at 249.80. Today’s high was 250.70 and the 1-month high is 250.80. Today’s low was 249.37 ½ and the 1-month low is 234.15. Since 9/11 November’24 Feeder Cattle are 15.72 ½ higher or almost 7%. The Hogs had a small gain. December’24 Lean Hogs were 70 cents higher today and settled at 77.65. Today’s high was 77.90 and that is the new 1-month high as well. Today’s low was 76.70 and the 1-month low is 71.12 ½. Since 9/11 December’24 Lean Hogs are 5.35 higher or almost 7%. US Beef Exports were lower last week and were just 13,700 tonnes. The 4-week average is 15,100 tonnes. The USDA said the slaughter for this week was 474,000 head on yesterday. That is 17,000 Head below the week before and more than 24,500 fewer than last year. The IRS has extended the time period to defer gains on Livestock sales until the end of 2025, for Ranchers in the counties affected by drought, by purchasing replacements. I still feel the Cattle Markets are heading lower. November’24 Feeders have been unable to settle above the 250.50 level on this rally. They have traded through the 250.50 number, which is the 50% retracement from the 52-week High/Low, but have closed below each time. Today the November’24 Feeders traded to within 10 cents of the 1-month high, but once again were unable to extend the rally, and for the 3rd time this week prices were sent lower. I believe this could be the top of the Cattle Market for a while. The Funds still have a nice profit after running the November’24 Feeders up over 15-dollars. The Funds could decide to start selling at any time as well. The US Stock Markets are still strong and made new all-time highs today, but I don’t believe it will last much longer. I think the Stocks could break and Crude could shoot higher next week. One reason I feel this way is because Israel has not responded yet. Yom Kippur begins in Israel in about an hour. They are eight hours ahead of Central Standard time, and it will be over tomorrow at 4:00pm CST. I believe there could be a response after that time frame. In addition to that, Monday is Columbus Day, and US Banks and the US Stock Markets will be closed, however the Livestock and Grain Markets will be open as usual on Monday. Maybe I am wrong, but the timeframe makes sense to me, and that could send the Stocks lower, putting pressure on the Cattle Markets. For December’24 Fats the 50-Day moving average is 182.63. The 50-Day moving average for the November’24 Feeders is 239.12 ½.

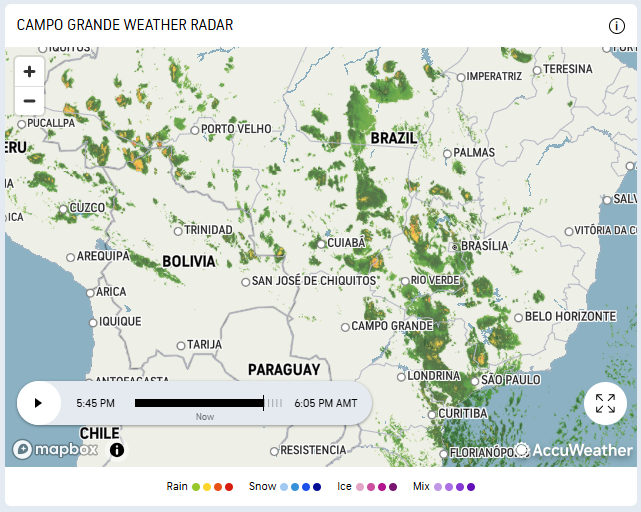

The Grains were all lower after the WASDE Report was released. November’24 Soybeans were 9 ¼ cents lower today and settled at 1005 ½. Today’s high was 1023 ¾ and the 1-month high is 1069 ¾. Today’s low was 1004 and the 1-month low is 997 ¼. Since 9/11 November’24 Soybeans are 5 cents higher or ½%. The Corn Market was a little lower today. December’24 Corn was 2 ¾ cent lower today and settled at 415 ¾. Today’s high was 422 ¾ and the 1-month high is 434 ¼. Today’s low was 415 ¼ and the 1-month low is 397. Since 9/11 December’24 Corn is 11 cents higher or almost 3%. The Wheat Market closed lower today as well. December’24 Wheat was 4 ¾ cents lower today and settled at 599. Today’s high was 611 ¼ and the 1-month high is 617 ¼. Today’s low was 592 ½ and the 1-month low is 564. Since 9/11 December’24 Wheat is 19 ¾ cents higher or more than 3%. The Beans broke today, but not as much as I thought they would, at least not yet. November’24 Soybeans traded down to 1004 today and settled just 1 ½ cents above the low. The Grain Markets were slow to react after the WASDE Report was released, but eventually everything headed lower. The November’24 Soybeans settled 4 ½ cents below the 50-Day moving average of 1010, and I still Feel the Market will continue to break. The Soybean Yield was 53.1 Bushels per acre, down from the estimated 53.2BPA, but the production was 4.582BB, more than the expected 4.581BB. Ending Stocks are still huge at 550MB, above the estimated 546MB for the Report. World ending Stocks were higher as well, at 134.65MB vs an estimate of 134.60. Brazil’s production estimate for 2024/2025 is a whopping 169MT, higher than the estimated 168.6MT, and would be a record. The production numbers for Argentina were as expected at 51MT. There will be plenty of Beans for the foreseeable future. Corn production and US ending stocks were higher was well, with 183.8BPA vs 183.5BPA. Ending stocks were higher at 1.999BB vs an estimated 1.988BB. World ending stocks were a little lower at 306.5 vs 307.3. Ukraine’s Corn production was cut to 26.2MT. Brazil’s Corn production was higher at 127MT vs an estimated 126.6MT. Argentina’s Corn production estimate was higher as well at 51MT vs 50.8MT. Russia continues to attack Ukraine Grain Ports, and this last attack was in Odesa, and the 4th attack this week. The rains have returned in Brazil, and the monsoons are forecast on the way. Brazil should not have any trouble getting their crops planted this year. I am still Bearish these Soybeans and feel we will see lower prices next week. If you have any questions for me, or would like information on opening an account, please send me an email or give me a call. BALLEN@WALSHTRADING.COM

Brazil Weather Radar Map Below.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.