10/9/24

The Livestock Markets were all lower today, as the Feeders led the way down. The Fats made a new high before breaking back down. December’24 Live Cattle was 65 cents lower today and settled at 187.22 ½. Today’s high was 188.10 and that is the new 1-month high. Today’s low was 186.60 and the 1-month low is 175.72 ½. Since 9/9 December’24 Live Cattle are 10.52 ½ higher or almost 6%. The Feeders made a new monthly high today as well, before they turned around. November’24 Feeder Cattle were 1.62 ½ cents lower today and settled at 248.67 ½. Today’s high was 250.80 and that is the new 1-month high as well. Today’s low was 247.80 and the 1-month low is 230.77 ½. Since 9/9 November’24 Feeder Cattle are 17.07 ½ higher or almost 7 ½%. The Hogs were also lower today. December’24 Lean Hogs were 1.60 lower today and settled at 75.57 ½. Today’s high was 77.22 ½ and the 1-month high is 77.47 ½. Today’s low was 75.07 ½ and the 1-month low is 70.82 ½. Since 9/9 December’24 Lean Hogs are 4.47 ½ higher or more than 6%. The Fats and the Feeders Made new monthly highs today, before running out of steam and heading lower. I still feel that we will see the December’24 Fats head lower back towards the 100-Day moving average of 183.44 and the 50% retracement from the 52-week High/Low of 183.12 ½. The November’24 Feeders traded just through the 50% retracement from the 52-week High/Low number of 250.50, then set the new high for the month 30 cents higher. The Cattle Markets have been strong during this rally. The Funds have been injected with new capitol and the have pushed the Cattle Markets higher. The Funds have a nice profit right now and they could decide to start selling soon, before anything happens that could send the Stock Market lower. Tomorrow the CPI numbers (Consumer Price Index) will be released, and that can have market moving results. There is also the likelihood that Iseral will respond at some point. The Crude Oil and the Gold Markets have been flying all over the place, anticipating the Israelle strikes would have occurred already. If, or when Israel does respond it could cause instability, depending on how big the response will be. The Stock Markets don’t usually react well to global instability. The Funds ran the Grains up as well, but they broke back down after the buying stopped. If the Funds are done buying in the Cattle Markets, we could see the same thing happen to the Cattle that happened to the Beans. If the Funds do start selling, it could get ugly fast. Seeing the November’24 Feeders trade through the 50% retracement number, set a new monthly high and then break, and close almost two dollars below that level does not look good to me.

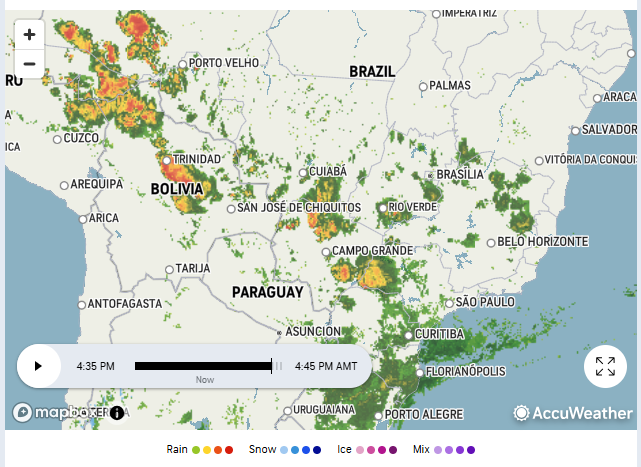

The Grains were all a little higher today. The Beans were trading lower in the overnight trade. November’24 Soybeans were 4 cents higher today and settled at 1020 ¼. Today’s high was 1027 ¼ and the 1-month high is 1069 ¾. Today’s low was 1011 ½ and the 1-month low is 995 ½. Since 9/9 November’24 Soybeans are 2 ¼ cents higher or fractionally higher. The Corn Market was a little higher today. December’24 Corn was ¼ cent higher today and settled at 421. Today’s high was 423 ½ and the 1-month high is 434 ¼. Today’s low was 420 and the 1-month low is 397. Since 9/9 December’24 Corn is 13 ¾ cents higher or more than 3%. The Wheat Market closed higher today as well. December’24 Wheat was 4 ¼ cents higher today and settled at 599. Today’s high was 604 ¾ and the 1-month high is 617 ¼. Today’s low was 594 ¼ and the 1-month low is 564. Since 9/9 December’24 Wheat is 30 1/2 cents higher or almost 5½%. There was not that much action in the Grains today. The beans were lower overnight and 11 cents higher on the highs today, before quietly settling four cents higher. November’24 Soybeans closed just short of 50 cents (49 ½) lower from the 1-month high today. The Funds ran it up, and when they stopped, the Beans broke. I hope you took advantage of the 50 cents gift and continued to sell calls and buy puts. The Grain Market is now waiting for the WASDE Report to be released on Friday. I have been hearing large yield numbers across the country. Yes, there are spots that did not fare as well as others, but I am optimistic we will see a large Soybean crop. The weather has been cooperating, and the Harvest is going well and fast. It appears that the rains in Brazil have arrived as forecast. This will add pressure to the Soybean Market. November’24 Soybeans traded down to 1011 ½, just above the 50-Day moving average of 1010 ¼. I think the Soybeans could be back down to this level before the Report on Friday. December’24 Corn settled just four cents below the 100-Day moving average of 425. December’24 Wheat settled just below the 100-Day moving average of 600 ¼. I still feel that the Soybeans are heading lower, but the Corn and Wheat could rally together. They are both trading around the 100-day moving average, and if they both rally, they could potentially head to their 50% retracement levels. The 50% retracement from the 52-week High/Low for December’24 Corn is 456 ¼. The 50% retracement from the 52-week High/Low for December’24 Wheat is 640. Take a look at the November’24 Soybean Options, there is still some great pricing on some of the Put strikes. If you would like to know what I would do, just ask. If you are interested in Hedging or Trading, and would like to open an account, give me a call or send me an email. I would be happy to answer any questions you might have. Call 312-957-8079 or Email BALLEN@WALSHTRADING.COM

.

Today’s Brazil Weather Map.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.