10/7/24

The Livestock Markets were mixed today. December’24 Live Cattle was 2 ½ cents higher today and settled at 187.02 ½. Today’s high was 187.55 and the 1-month high is 187.90. Today’s low was 186.55 and the 1-month low is 173.50. Since 9/6 December’24 Live Cattle are 12.32 ½ higher or about 7%. The Feeders made a new monthly high today. November’24 Feeder Cattle were 12 ½ cents lower today and settled at 249.15. Today’s high was 249.97 ½ and that is the new 1-month high as well. Today’s low was 248.47 ½ and the 1-month low is 226.27 ½. Since 9/6 November’24 Feeder Cattle are 21.12 ½ higher or about 9%. The Hogs were a little higher today. December’24 Lean Hogs were 67 ½ cents higher today and settled at 76.82 ½. Today’s high was 77.35 and that is the new 1-month high as well. Today’s low was 75.77 ½ and the 1-month low is 70.55. Since 9/6 December’24 Lean Hogs are 5.60 higher or almost 8%. There have now been more than 250 Dairy Herds in the US that have tested positive for H5N1 this year. The infected Herds are spread across 14 different states, with 56 cases in California alone according to the USDA. The Funds have been buying Cattle the last two weeks and it looks like they are slowing down. The Funds purchased over 25,000 contracts over that two-week time period. Last week the estimated dressed Cattle weight was 862 Pounds, that is up another 4 pounds from the week before, and 31 pounds more than this time last year. Last week’s weights are also 31 pounds over the 5-year average of 831. When the Fed cut the rates by ½ a point, it sent new money into the Commodity Markets, and that has caused the run up in the Cattle and Hog Markets. Today the November’24 Feeders were 12 ½ cents lower and the January’25 Feeders were 1.80 higher. I believe that was due to the “new money” that has entered the market, and the Funds have purchased enough of the front month already and are spreading their risk. If the capital has to be deployed, then you have to buy something. During the past three trading sessions Nobember’24 Feeders traded on average about 2700 more contracts than the January’25. Today, only about 1700 more contracts traded in November’24 Feeders than January’25. The November’24 Feeders traded through the 100-Day moving average of 249.42 again today, but settled below that level again, just like they did on Friday, after making a new 1-month high today. I feel the Feeders will begin to break again after the 250-level held, and they settled below the 100-Day, as we still wait to see Israel’s response. December’24 Dow Jones Index broke more after the Livestock and Grain Markets closed, settling 401 points lower on the day.

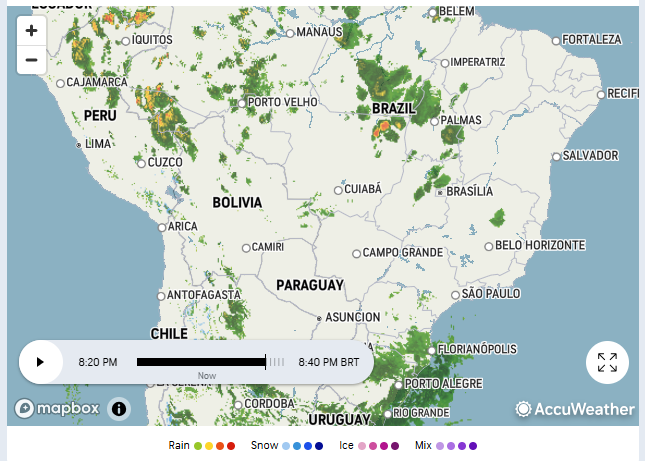

The Soybeans continued lower today. November’24 Soybeans were 3 ¾ cents lower today and settled at 1034. Today’s high was 1039 and the 1-month high is 1069 ¾. Today’s low was 1026 ½ and the 1-month low is 995 ½. Since 9/6 November’24 Soybeans are 29 cents higher or almost 3%. The Corn Market was a little higher today. December’24 Corn was 1 ¼ cents higher today and settled at 426. Today’s high was 427 and the 1-month high is 434 ¼. Today’s low was 421 ¼ and the 1-month low is 397. Since 9/6 December’24 Corn is 19 ¾ cents higher or almost 5%. The Wheat Market closed higher today. December’24 Wheat was 2 ¾ cents higher today and settled at 592 ½. Today’s high was 595 ¼ and the 1-month high is 617 ¼. Today’s low was 584 and the 1-month low is 560 ½. Since 9/6 December’24 Wheat is 25 1/2 cents higher or more than 4 ½%. Brazil has started to get rain in the Western and Southern Center of the county. The monsoons are expected to arrive at the end of the week. According to Safras, Soybean plantings in Brazil are about 4.1% complete. At the same time last year, total Soybean plantings were 7.8% and the 5-year average is 5.5%. So, there is no real delay in getting the Beans planted yet. They have been planting in Southern Brazil for a while now. With the expected rains to be here shortly, I am sure they will waste no time planting a crop that is estimated to be at least 3% bigger than last year. Another Russian missile hit a civilian Grain ship in Ukraine. The ship was loaded with Corn. This was the 3rd time a Russian missile hit a civilian Grain ship in the Black Sea Region in a month. The Western parts of Russia and the Eastern sections of Ukraine are still abnormally dry and looks like it might remain dry for a while. The weather in the Midwest looks perfect for the next 10-Days, and Harvest should get done quickly. Just 4-Days away from the WASDE Report, and I continue to hear from Farmers how truly large their crops are going to be.

Tonight’s Weather Radar Map for Brazil.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540

Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.