Commentary

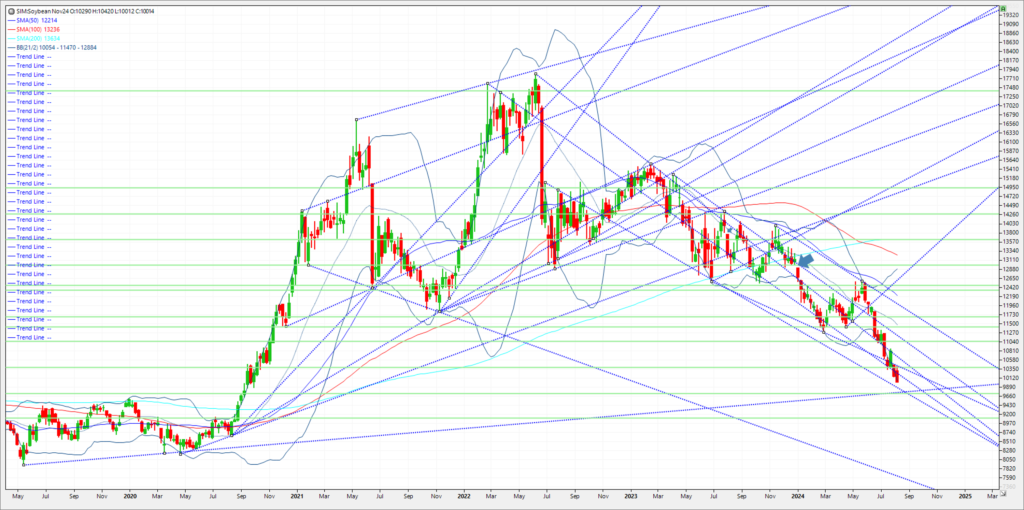

Soybeans slipped into new lows under light volume. Funds light sellers ahead of the WASDE report on Monday. Optimism about US yields remain high with the Nov bean market challenging the 10.00 level. As of now it looks as if most of the grain Belt will benefit from favorable weather through the soybean pod setting and early filling periods through the August 21st, with only southwestern areas facing notable moisture stress. That fact was probably the main driver of this week’s futures dip to fresh multi-year lows. The U.S. dollar rebound from early-week lows added to the pressure, whereas Argentina’s soy worker strike offered limited help to bulls, as it was seen as temporary. As of this past Tuesday, funds are short 169K of beans, but given the price drop I would bet we are near the record short of 185K. The bigger picture here is that there is no story outside of profit taking to send the market higher on a sustainable rally. That may change and weather could flip, but new crop demand is weak despite two Chinese purchases for future shipment today. USDA announced 132,000 metric tons of soybeans for delivery to China during the 2024/2025 marketing year. Second purchase made by unknown destinations totaled 212,000 metric tons of soybeans received in the reporting period for delivery. Of the total, 50,000 metric tons is for delivery during the 2023/2024 marketing year and 162,000 metric tons is for delivery during the 2024/2025 marketing year. The market needs to see a whole lot more of this to make sizable alterations to the export forecast to tighten the balance sheet. Weekly continuous chart attached. Support for next week comes at 9.87 and then 9.74/72. A close under could take the market in my opinion to 9.09 which is 30% lower on year. Key resistance is at 10.38 to 10.41 and then 10.59. A close over that level is needed to turn friendly, should that happen its 10.86 and 11.03.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me every Thursday at 3pm Central for a free grain webinar. We discuss supply, demand, weather and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.