Commentary

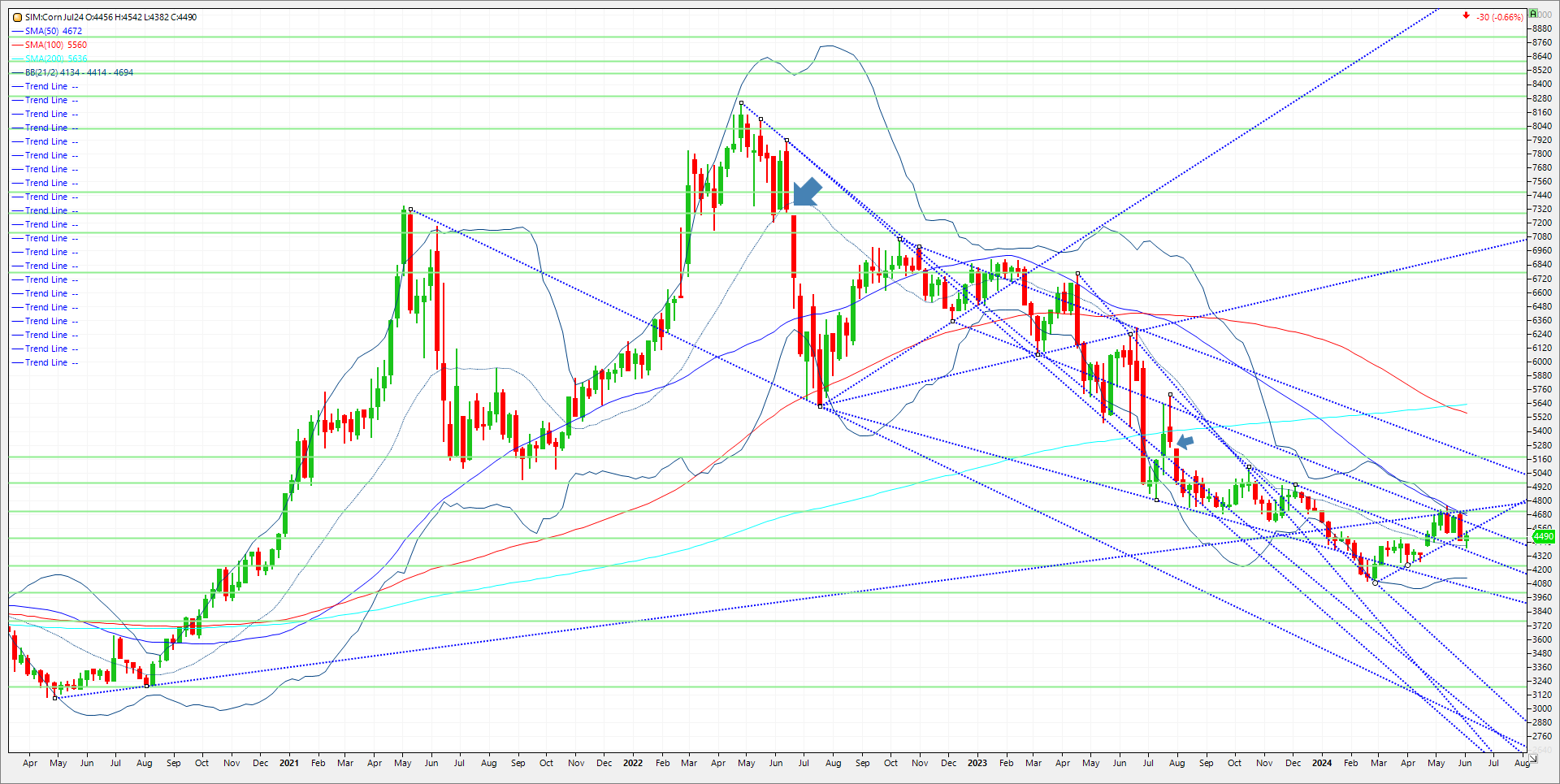

An early week decline in corn was followed by somewhat aggressive short covering to end the week to close out at 448, which represents 5% down for the year. Early week selling likely reflected yield implications of the first corn condition rating at 75% “good” to “excellent”. Nevertheless, futures posted an impressive rebound on Thursday June 6th, which is often the case in my opinion when the majority of the crop goes in the ground. Buyers may also have been encouraged by forecasts for above-normal temperatures across the central U.S. by mid-month. Export demand also perked up, with a daily flash sale to Spain and “unknown,” which is spelled C H I NA, and weekly sales of 1.18 million metric tons. Weather threats overall remain subdued as a current cooler pattern is the feature into next week. Yesterday’s announcement from the Brazilian government that closes tax loopholes for grain exporters gave brief thoughts of better export demand of US origin. That was quickly reeled in today across the grain board today, but the trade bough the close in corn and meal today. Technically July 24 futures are still the most actively traded contract. Support is at 4.41 which needs to hold. A close under and its 4.34 and then 4.24, ten percent down for the year. Resistance is at 4.56 and then 4.59. A close over could push the market to 4.72/73. A close over here and its katy bar the door to 4.95.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604