Commentary

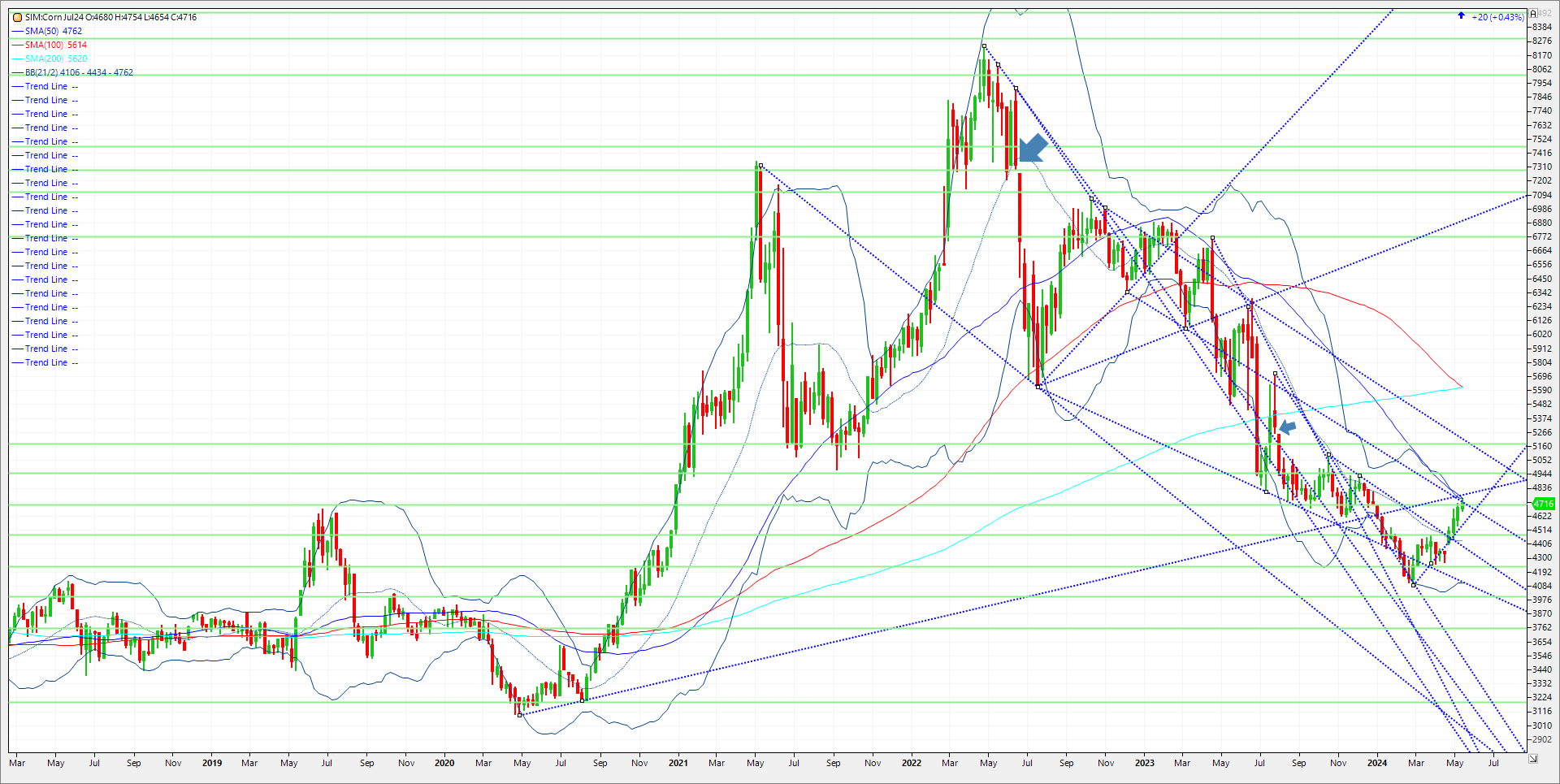

This past February saw funds establish a new record short in corn at 340K contracts of both futures and options. Last week’s commitment of traders reduced the managed money short in corn to a total of 102,513 contracts as of the Tuesday May 7th close. Per CFTC, from Wednesday May 1 to Tuesday May 7th, saw the longs in the market increase 26K while the short decreased 89K contracts. That is a 115K contract swing in one week. Not sure if this some weekly record but definitely historically elevated. Since then, last Wednesday and Thursday’s trade saw corn finish lower, approximately 12 cents from the end of April’s close. Then WASDE report day saw corn take back those prior day losses. The fund short today after further short covering could put the net under 90K. Where to from here? The market in my view will focus on planting progress to see if Midwest rains show up this week that keep planters out of the field deeper into May. Planting progress came in at 49 percent as expected which is just 5 points behind the five-year average. Emergence is at 23 percent, versus the five-year average at 21. Remember the USDA is using a 181 national yield which is almost up 4 bushels per acre versus last year. So late plantings on a bigger percentage delayed could put that number in jeopardy while any downward revisions to yield maybe offset with an increase in plantings. The end of June planting progress report could be wild. Producers need to be looking at deferred new crop corn prices and smiling. There is a good price to protect now that in my view a producer should start to consider a marketing plan as the calendar turns to June. March 25, May 25, and July 25 corn are all above 5.00 on the board. That said July 24 futures is still the most actively traded contract. Despite a big rally in wheat today, July corn rallied just 2^6 cents today. Weekly continuous chart below. Support is bunched just under today’s close at 4.71/4.69 and 4.67. A close under 4.67 and the market breaks to 4.55. A close under 4.55 and its 4.48 and 4.43. Resistance is 4.76/4.78. a close over 4.78 is key in my view and could push the market to 4.95. A close above here could push the market to 5.17.

Trade Ideas

Futures-N/A

Options-N/A

Risk Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604