5/10/24

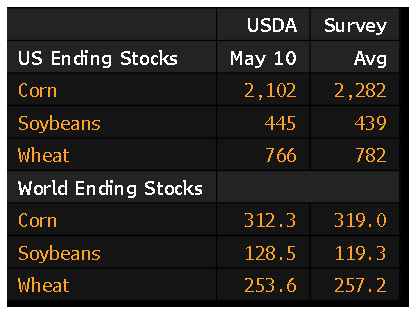

Today’s WASDE Report was released this morning, and it looked Bullish for Corn and Wheat, but Bearish for Soybeans. However, the market reaction in the Soybeans, did not fit with the data, but it will soon. Today July’24 Soybeans were 10 ½ cents higher and settled at 1219. July’24 Corn was 13 ¼ cents higher and settled at 469 ¾. July’24 Wheat was 26 cents higher and settled at 663 ½. This morning, before the Report, China was kind enough to forecast imports for 2024/2025 will be slashed by 50% for Corn and will be lower for Soybeans and Cotton as well. Domestic Corn production and reduced feed needs were the reason for cuts in Corn and Soybean imports. The US is also about to put new trade tariffs on China, starting next week, in the E.V. and solar sectors. Senator Chuck Grassley anticipates China will react to the new tariffs, saying “We know how China reacted when Trump put tariffs on,” “They hit agriculture with it. I can’t be sure that China would hit agriculture the same way as they did in the Trump ones, but they’re going to hit back.” The recent rains in the Midwest slightly delayed some planting, but the weather looks good for the next week. The rain also dropped the area under drought conditions for Soybeans to just 11%, down from 21% last year. Next week CONAB, will release their updated production numbers on Tuesday. CONAB’s last production estimate for Brazilian Soybeans was 146.8. The USDA’s original production number for Brazilian Soybeans was right on target at 155mt, with today’s report number at 154, and with a smaller than anticipated cut, of only 1 million tons due to flooding. Today’s USDA Report showed US ending stocks for Corn at 2,102, below the average estimate of 2,282, and Wheat stocks at 766, below the average estimates of 782. The US ending stocks for Soybeans were 445, above the average estimate of 439. The world ending stocks followed the same pattern and are shown in the chart below. I feel that the surge in both the Corn and Wheat helped to keep the Soybeans higher today, but I would not want to be long the Bean market over the weekend. I feel that the Beans will start to slide lower again next week, after all the info is digested. What would the Soybean Market do, if CONAB raises their estimates substantially on Tuesday?

The Cattle Markets were down 1-2 dollars at one point today, before rally back and following the Grains higher. June’24 Live Cattle were 20 cents higher today and settled at 176.15. August’24 Feeder Cattle were 15 cents lower today and settled at 250.90, and June’24 Lean Hogs were 65 cents higher today and settled at 98.37 ½. China’s meat imports have declined, and in April China imported about 6% less meat than the month before, and almost 9% less than the same time last year. Yesterday the USDA reported US Beef exports were down 45% from the week before and down 29% from the 4-week average. Grocery stores and restaurants are still worried about demand, the feedlots are still full, the Cattle are still heavy, and production is high, and the USDA is not helping. Yesterday, the USDA requested information on developing a vaccine for H5N1 to use in Cattle. Today, the USDA reported four more dairy herds infected with H5N1. Three in Michigan and one in Colorado. That makes a total of nine States that have had infected dairy herds. The funds are still short the Hogs, and if selling pressure resumes, it could get ugly fast. Next week will be interesting in all the Livestock and Grain Markets.

FULL WASDE REPORT LINK BELOW

–Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Listen Live at 7:25am on

Tuesday-Friday

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.