4/26/24

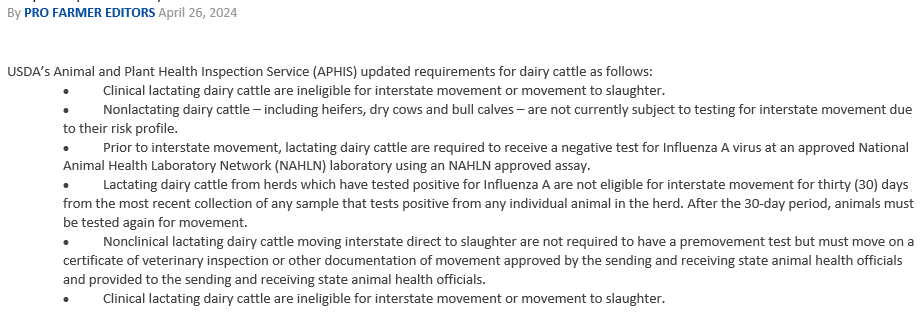

Next week will be interesting. If there is a scare over the weekend, the Cattle could collapse, and May’24 Grain Options have now expired. The Cattle Markets were higher today and June’24 Live Cattle were 77 ½ cents higher today and settled at 178.57 ½. Today’s high was 179.65 and the 1-month high is 181.12 ½. Today’s low was 177.05 and the 1-month low is 170.25. Since 3/26 June’24 Live Cattle are 25 cents higher or fractionally higher. The Feeders looked even better today. May’24 Feeder Cattle were 2.45 higher today and settled at 248.70. Today’s high was 249.25 and the 1-month high is 251.30. Today’s low was 246.40 and the 1-month low is 232.62 ½. Since 3/26 May’24 Feeder Cattle are 1 dollar higher or almost ½%. The Hogs were not as strong today. June’24 Lean Hogs were 2.52 ½ lower today and settled at 102.47 ½. Today’s high was 104.55 and the 1-month and 52-week high is 109.65. Today’s low was 102.22 ½ and the 1-month low is 100.17 ½. Since 3/26 June’24 Lean Hogs are 1.12 ½ or more than 1%. The Cattle Markets have continued to rally this week, and I feel the upside could be over for a while, and a correction is on the way. The average dressed weight was 847 pounds on April 20th. That is an increase of 32 pounds from 1-year ago, when the average weight was 815 pounds, and the 5-year average of 819 pounds. Beef production was 3% higher than last year and the slaughter was 1% lower. Yesterday, the 5-area weighted average price was up two dollars to 185.04. After yesterday’s close, news of Colombia restricting beef imports from the US States that have dairy cows, that have tested positive for bird flu. Colombia is a small importer of US beef, but if others follow their lead, it will not be positive for the Cattle Market. Starting on Monday, April 29th, the USDA will require bird flu testing for dairy cattle moving between states, whether they showed signs of bird flu or not. Bird flu virus particles have been found in milk, available for purchase in stores, and the USDA says that the pasteurization process inactivates the virus, based on their current knowledge of the disease. We will see how the Markets react next week. Below is an update from Pro Farmer.

FROM PRO FARMER: USDA updates dairy cattle H5N1 restrictions

The Soybeans are overpriced, and I believe that will change. Today, July’24 Soybeans were 2 ¾ cents lower and settled at 1177. Today’s high was 1181 and the 1-month high is 1215 ¾. Today’s low was 1172 ½ and the 1-month low is 1145 ¾. Since 3/26 July’24 Soybeans are 37 ¼ cents lower or over 3%. The Corn followed the Beans a little lower today. July’24 Corn was 1 ¾ cents lower and settled at 450 ¼. Today’s high was 454 and the 1-month high is 460. Today’s low was 449 ¼ and the 1-month low is 435 ¾. Since 3/26 July’24 Corn is 5 cents higher or more than 1%. The Wheat Market posted another gain. July’24 Wheat was 1 ¾ cents higher today and settled at 622 ¼. Today’s high was 633 ¼ and that is also the new 1-month high. Today’s low was 616 ¼ and the 1-month low is 550. Since 3/26 July’24 Wheat is 63 cents higher or more than 11%. The Soybeans started their push lower yesterday, and there are plenty of reasons for the Beans to break. Soybean exports have continued to be awful. Weekly sales yesterday was expecting 300,000-600,000mt and the number was just over 210,000mt. That is 57 percent lower than the previous week, and 29% lower than the 4-week average. Planting is going well here, and the South American crops will be large. Brazil is about 90% harvested and I am expecting to hear bearish numbers when their harvest is complete. I believe more acres of soybeans will have been planted in Brazil than were reported or expected, and the yields will be large. Farmers in Argentina have been planting Soybeans, because of the lingering Corn stunting disease. There will also be an increase of Soybeans planted in the US this year, and I don’t know where all the Soybeans will go after harvest. The ending stocks were already huge, and there are still no buyers. China continues to purchase Brazilian Soybeans and are trying to unload their old crop Beans at the same time. With all of the information out there, July’24 Soybeans are still priced over $11.50, but I feel that is about to change. May’24 Soybean Options expired today at 1159 ½, and next week I feel they will push the Soybeans much lower. I believe the 52-week low in July’24 Soybeans of 1140 ½ will be taken out, and a $10 handle is a real possibility. Keep an eye on the open interest in the July’24 Soybean Puts. The Corn Market could pick up some momentum and start to move higher. Corn weekly exports were huge. Expectations were between 400,000-900,000mt and exports totaled almost 1,300,000mt. That was an increase of 74% from the past 4-week average. Farmers are planting fewer acres of Corn here this year, and the Corn in Argentina could be in trouble. The warm weather there is helping to make the leafhopper problem worse. LSEG just lowered their Argentina Corn crop estimate by 4%, down to 52.3mt, below the USDA number of 55mt, and they stated more cuts were possible. If there are any weather problems here this summer, we will quickly see $5.00 Corn. The Wheat Market has continued to rally on a combination of short covering, weather concerns and demand. The Wheat in Kansas needs some rain, and the dryest part of the State in the Southwest might not get any relief. The Ukraine Wheat crop is estimated to be 11% smaller than last year, and they need rain, and so does Russia. The 10-day forecast there still looks dry. Egypt is expected to purchase 2% more Wheat this year, and there is a possibility India will have to import Wheat this year. Have a great weekend.

-Bill

I have market commentary and option charts in

Pure Hedge – Livestock

Pure Hedge – Grain

Listen Live at 7:25am on

Tuesday-Friday

Call for specific trade recommendations.

Email me for free research.

Bill Allen

Senior Account Executive

Direct: 1 312 957 8079

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.