Commentary

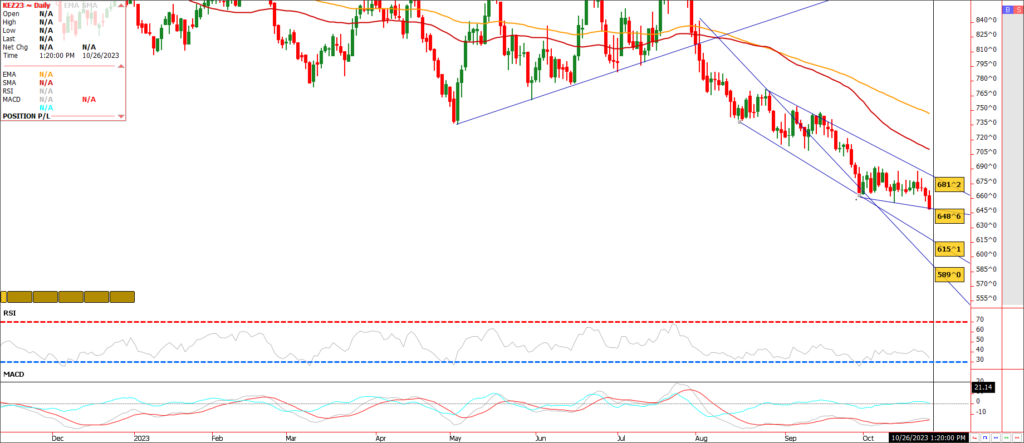

More funds selling seen today with December Kansas City wheat putting a new low for the move and trading down to the lowest level seen since July of 2021. Ouch. Chicago and Minneapolis following that price action but lagging, as those contracts still trade above their late September lows.

It is my belief that managed money shorts have defended their position by adding to their position on rallies. Dec Kc wheat has lost approximately 40 cents (see chart) since last Friday morning’s short covering push higher. Funds continue to be rewarded for the short positions that they have on across the wheat complex. This market needs to see a round of demand to show up or a bullish headline to prod the funds to covering my opinion. Export sales are out tomorrow morning with trade estimates at 300 to 600k metric tons. Funds will be watching to see if any new China business shows up or is switched from unknown destinations. The ongoing Mideast conflict has not resulted in rising global prices amid a strong US dollar that continues to provide fundamental resistance on rallies in my opinion. If the down trend continues , I look for KC wheat to drift to 6.34 basis December, which represents 25% lower on year.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain webinar every Thursday at 3pm. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.