Commentary

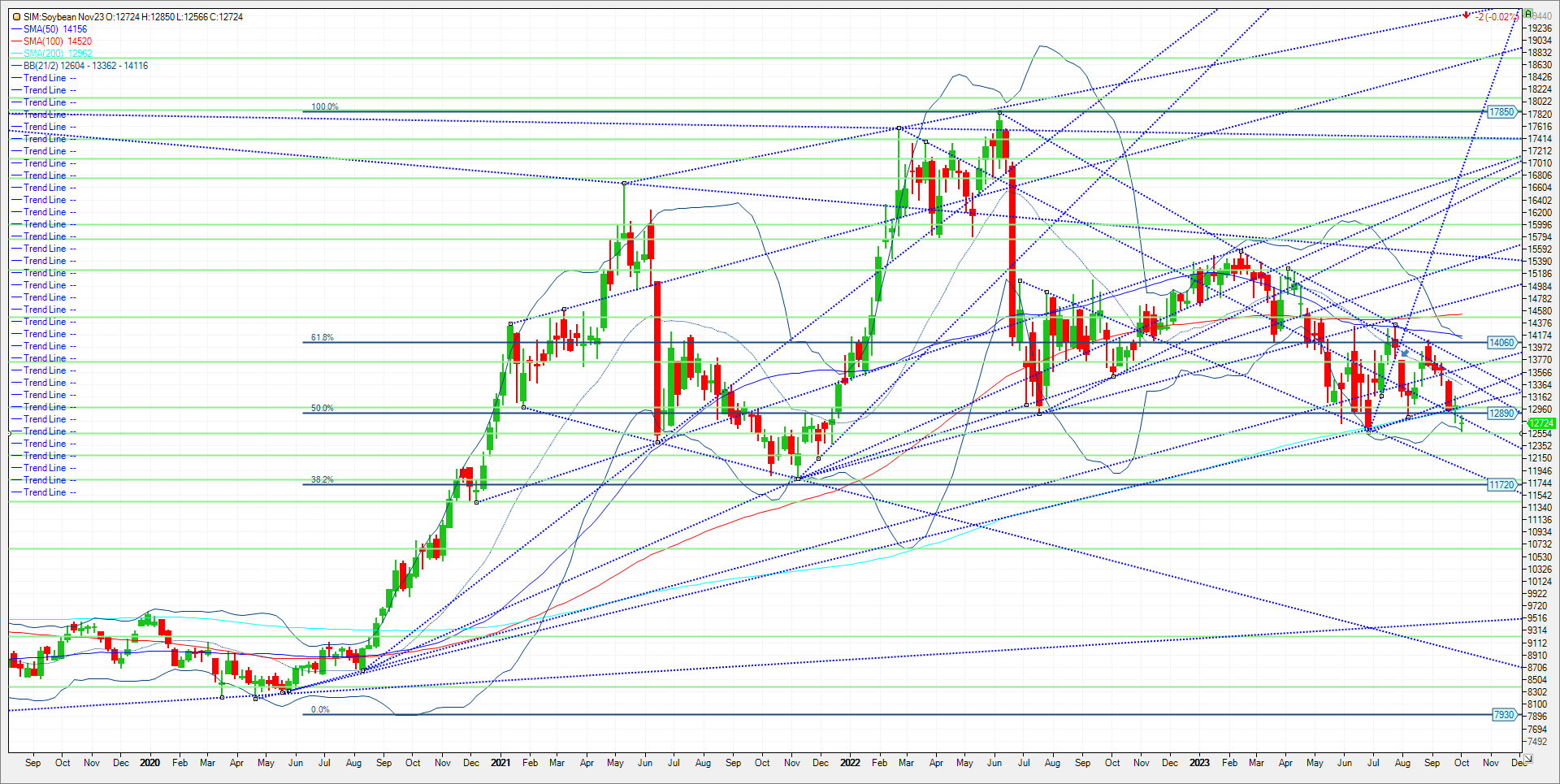

Soybean ratings rose for the first time since mid-August, back to 52% good/excellent, led by a six-point increase in number one producer Illinois and gains for most of the other main states as well—early harvest results are presumably coming in better than expected (usually the case). It remains the second-worst rated crop (besides the obvious 2012) this late in the season in the last three decades. All finishing at 53% g/ex, the 2011, 2013, and 2019 crops averaged yield 5% below trend. Big crop report next week. Will USDA lower yield and if they do will they offset with less demand or crush? Funds are net long less than 20K contracts in my view their lowest net long in years. The rule of thumb is that when harvest progress reaches 35 to 40 percent harvested, your seasonal low is in and the market reverses from sell the rallies to buy the dips. However, the current economic and political environment is anything but usual or normal. A hawkish Fed has curtailed any meaningful grain exports, so lost production out in the field has been offset by lack of demand. Something has to give in my opinion. Trade idea below. Outside of something else entering into the market, I look for short covering into next week’s WASDE report. Look at the potential double bottom at 1256.6 that was hit this week matching the June low. That is a major level of support on the weekly continuous chart in my view. Should the market close underneath it, I would exit the suggested trade below.

Trade Idea

Futures-N/A

Options-Buy the January 24 soybean 13.00 call while selling the May 1420 call for 4 cents OB.

Risk/Reward

Futures-N/A

Options-Unlimited risk here as one is short a call option with a later expiration (6 months) versus the long option on this spread that expires in 10 weeks approximately. Volatility trade here as we are looking for January 24 beans to trade back up to 1340/50 area. Then we look to exit with the long option maybe 40 cents in the money versus the out of money deferred call. However, should beans break through the double bottom at 1256.6, exit this position. Again, there is significant risk here.

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604