Commentary

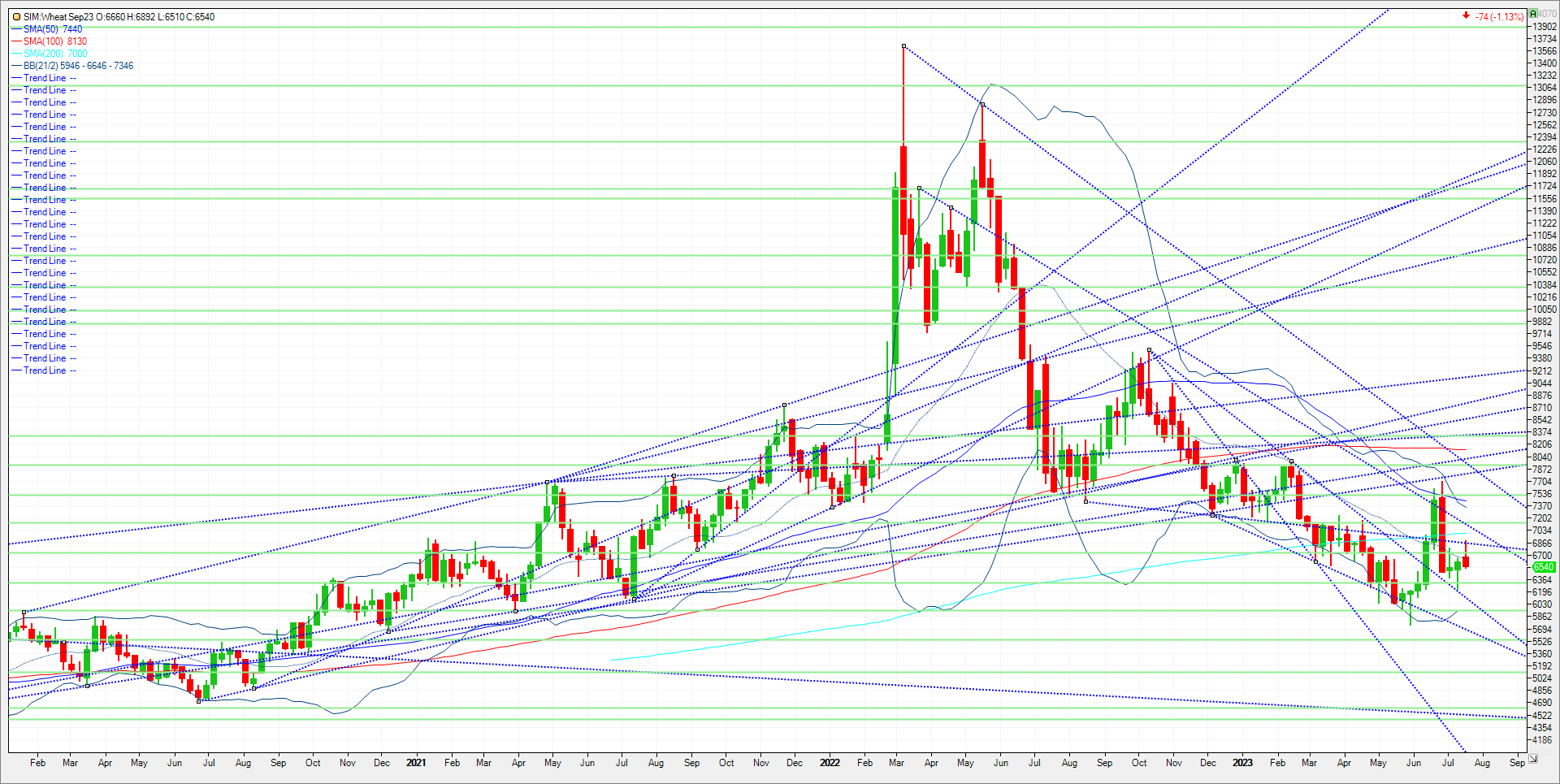

A volatile trading session was seen today in wheat as Russia officially terminated the Black Sea Grain Deal. The initial announcement overnight sent Chicago wheat over 20 cents higher, while KC and Minneapolis posted similar gains. However, markets sold off this morning after coming to the realization there will most likely be plenty of world wheat supplies. Even with the shutdown, analysts say Ukraine can still export 1 million metric tons per month via land, and Russia and the EU both have large supplies that can suffice world demand until the coming harvest. Russian grain exporting union Rusgrain said on Monday its members planned to continue supplying customers with Russian grain at competitive prices, despite Moscow pulling out of the Black Sea grain export deal. “Russia is the largest supplier of wheat to the world market… All contractual obligations of Russian grain exporters will be fulfilled,” it said. The Kremlin also said they would return to the deal if conditions are met for Russian fertilizer exports, so in my view the door is still slightly open. The fact that both corn and wheat sold off on the news and ended the day in red should cause concern for the Bulls. Can prices trade higher? Absolutely they can in my view, but I believe the market is going to need to see declining Spring wheat conditions and a rally in beans and corn to hold support. Chicago wheat technical levels for the rest of the week come in as follows. Support is first at 6.32. A close under and 6.10 is next. Big level there in my opinion, as a close below could push the market down to 5.70 with a brief stop at 5.92. First resistance is at 6.66 and then 6.72. A close over is needed to challenge key resistances at 6.83 and 6.99.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Email me at slusk@walshtrading.com for link

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604