Commentary

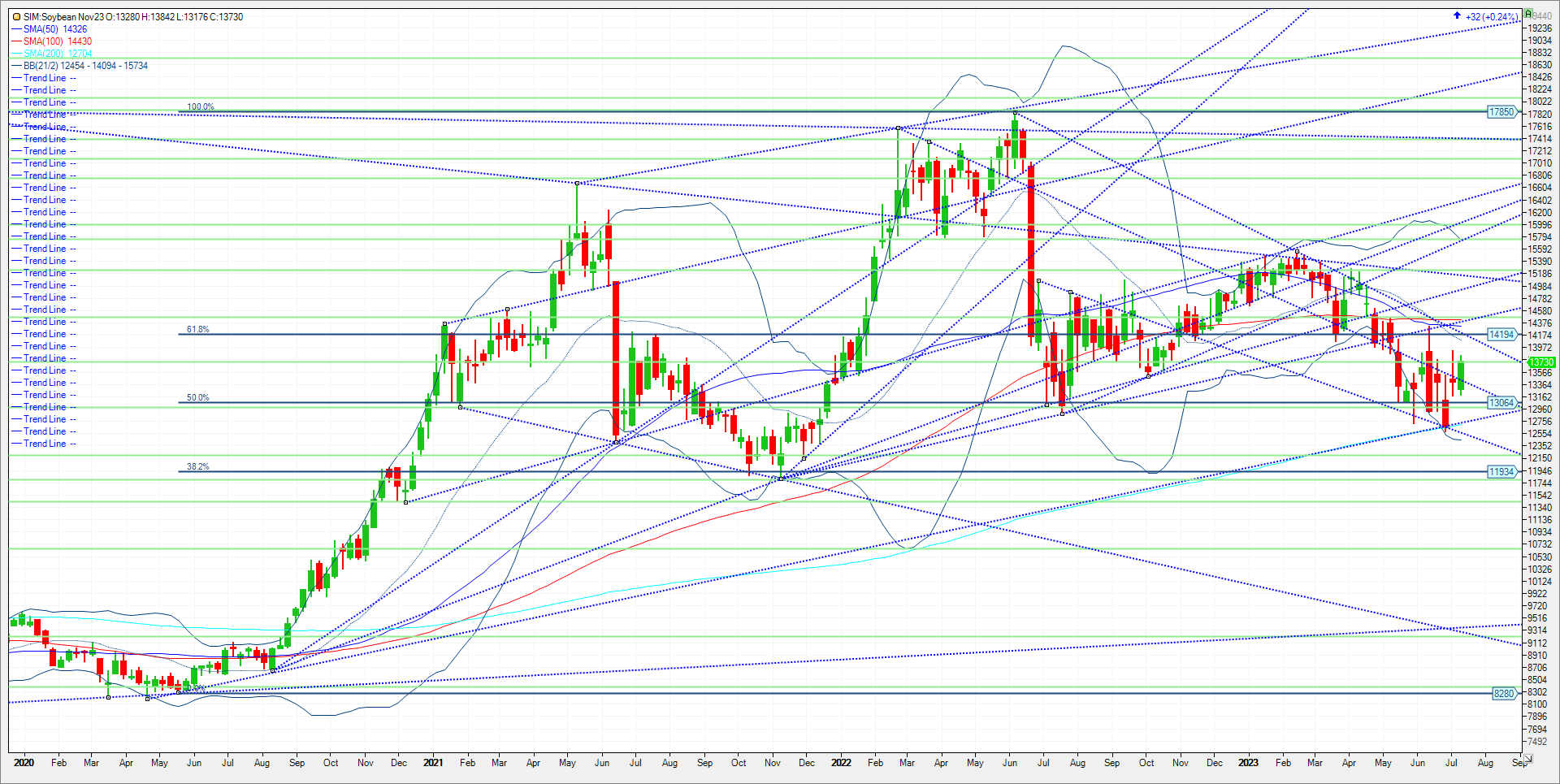

The balance sheet numbers for beans were the second straight surprise by the USDA in the last few weeks in my opinion. For 2023-24, USDA cut ending stocks 50 million bu. to 300 million bushels. The average pre report guesstimate was 199 million bushels. Total supply was lowered 185 million bu. to reflect smaller acreage. USDA cut total use 135 million bu., with crush down 10 million bu. and exports down 125 million bushels. The export number was the big surprise in my opinion. Did they cut exports due to Brazil increasing its market share of exports amid a record crop? Or was it due to China’s declining hog herd that decreases its crush needs for meal? Maybe both reasons in my opinion. Weather forecasts continue to show good rain chances despite a warmup in the Midwest. Condition ratings appear to have bottomed for now. The demand numbers for US beans maybe understated by USDA with likely revisions coming. The lack of demand can be adjusted in a hurry as China’s demand for beans is insatiable. That said there is no substitute for lost or failed production as 83 million acres planted leaves not much margin for error should yield come in under 50 BPA. The USDA yield is currently at 52. Trend and Index following funds are going to be hypersensitive to any heat domes and or persistent dryness in growing areas through August. That said new crop November beans struggled a few times this week at breaking through the 1380 level. Both bean oil and bean meal faded to end the week as new crop beans received no help from the “products” and against projected beneficial rains. More light rains forecast for the 5-day forecast in the Midwest, yet the models have lightened and withdrew some chances over the next 15 days in the latest two updates. Watch for any news over the weekend regarding Russia agreeing to a Black Sea corridor extension, as that could have ripple effects in corn and wheat while seeing any changes to the 1 to 5 and 6-to-10-day forecasts.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Please contact me at slusk@walshtrading.com if interested.

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.