Commentary

May corn fell 2 3/4 cents to $6.57 3/4, near the session low after posting the highest intraday level since Feb. 23. Corn lost overnight price momentum as the session progressed, despite surging crude oil futures following an unexpected production cut made by the OPEC Plus group on Sunday. USDA inspected 43.2 million bushels of corn for export shipment in the week ending March 30 along with 18.3 million bushels of soybeans, 6.2 million bushels of wheat and 0.4 million bushels of grain sorghum. Of those totals, the portion that was destined for China included 10.9 million bushels of soybeans, and virtually no corn, wheat or grain sorghum. There was another flash sale announcement for corn as exporters announced daily corn sales totaling 150,000 MT to Mexico for 2023-24.

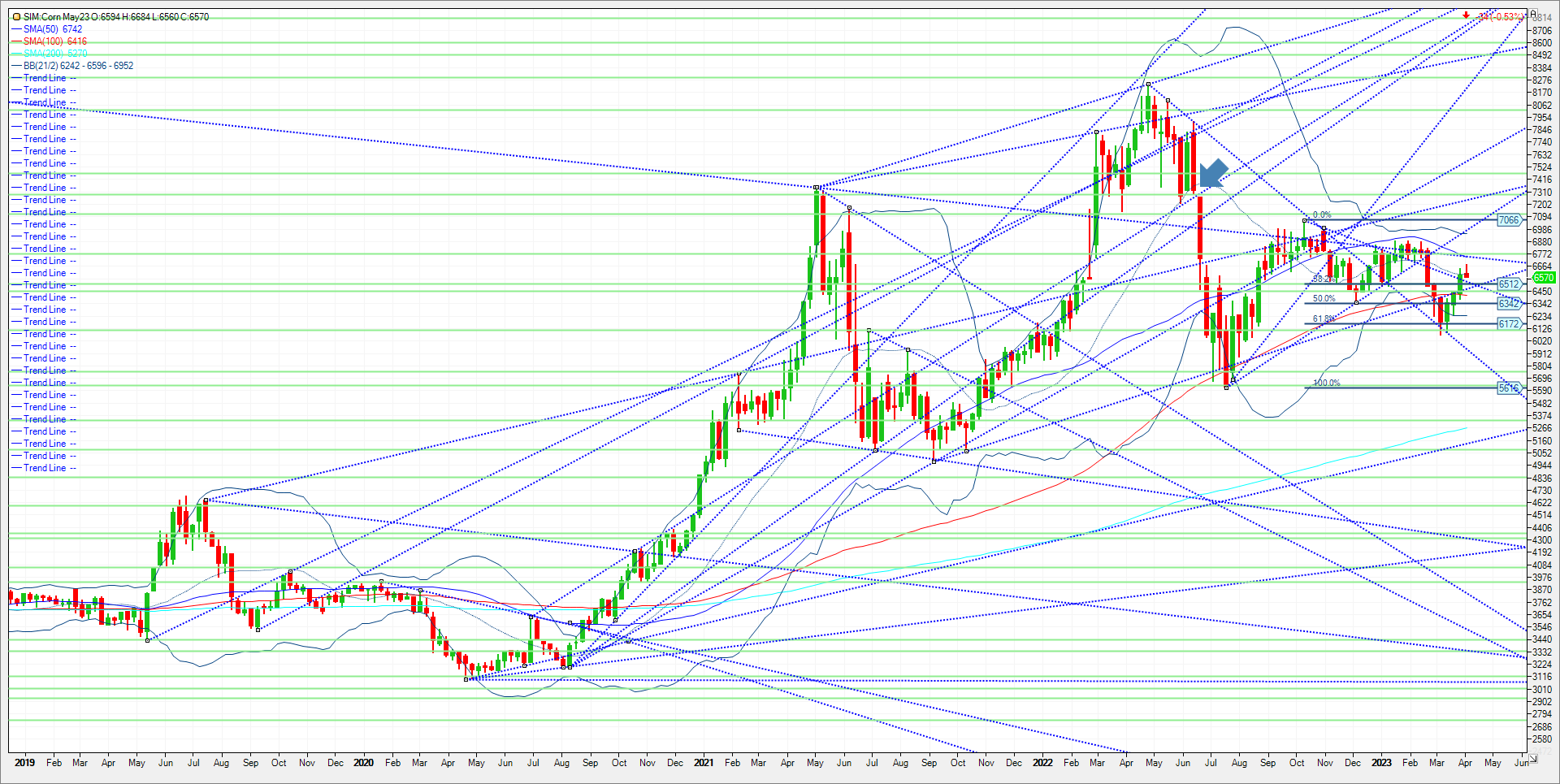

Friday’s USDA report revealed that US producers intend to raise corn acreage by about a million acres from their Feb Outlook Forum, that left soybeans roughly steady. Corn acreage fell from March to Final in three of the last four years, save for the dry/fast 2021 planting season. Friday afternoon’s Disaggregated CFTC Report showed managed money funds adding back 32.5k net corn contracts on the week ending last Tuesday (3/28), much more than expected by daily trade estimates in my opinion. Per last Tuesday, the net managed position by funds in corn was approximately 7500 shorts. Given the rally last week, I would anticipate a neutral or small net long in my opinion. Whatever the acres end up being, its not what you plant but what you grow. Corn planting so far is 2 percent planted per USDA in the season’s first crop progress report released today. This week’s technical levels for May corn come in as follows. Support is at 653.4 and then 6.47. A close under 6.47 could push the market to the 100-week moving average at 6.42. A close under here and its Katy bar the door to 6.23 and then 6.11. If the market can hold trendline support at 6.53, the path of least resistance is higher in my view. A close under this level and all bets are off. Next major resistance is the 6.76/6.78 area. A close over this resistance and its 6.98 this week.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604