Commentary

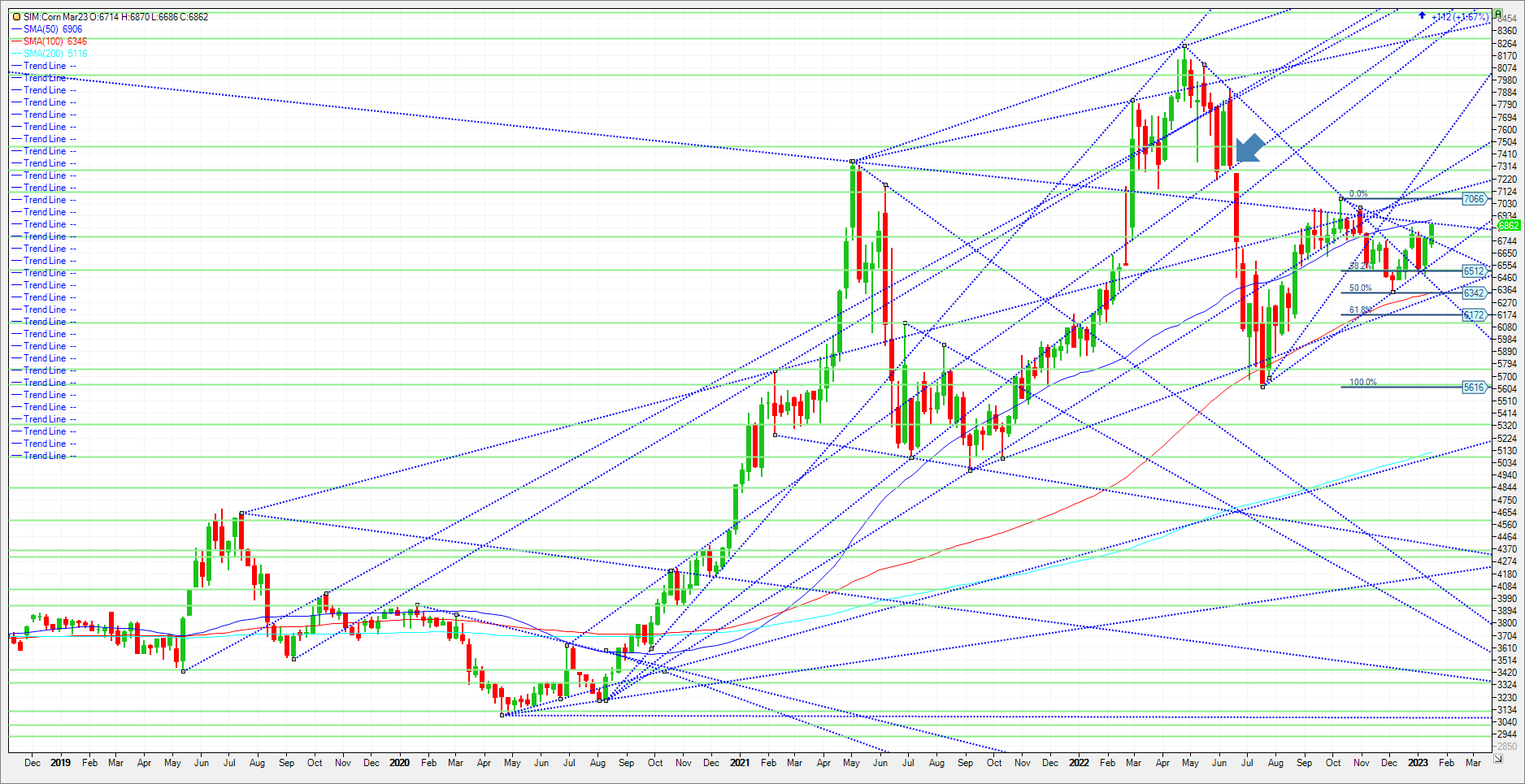

The buy the dips mentality remains in my view following the January 12th supply and demand report. The big surprise for corn came out friendly that aided the corn and beans higher. They lowered the corn acres 1.5 million despite raising the yield .8 bushels per acre. Stocks to usage is at 8.9 percent, second lowest since the drought year of 2012. With Brazil’s exportable 2nd crop safrinha corn still yet to be planted as it waits for beans to be harvested, the market focuses on Argentina, and dwindling supplies from the Ukraine. Due to a continued LA Nina drought, Argentina’s corn crop of what’s in the ground is abysmal. With 83 percent planted as of last week, the Buenos Aires Grain Exchange lowered projected plantings 200K acres. Albeit early, the condition reports show the good to excellent condition at just 13 percent vs 41 last year. There is trouble and worry for this crop, but weather can flip flop through the growing season bringing a cooler and wetter pattern that would remove any weather premium built in in my opinion. I included a weekly corn chart. We are at major resistance at 6.88/89 for March 23 corn. A close over in my view could potentially move the market to the 5% threshold higher for the year at 7.12. A close above that level and the market could challenge the gap at 7.28. Support is 6.75. A close under and the next downside targets are 6.57 and then 6.42.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604