Commentary

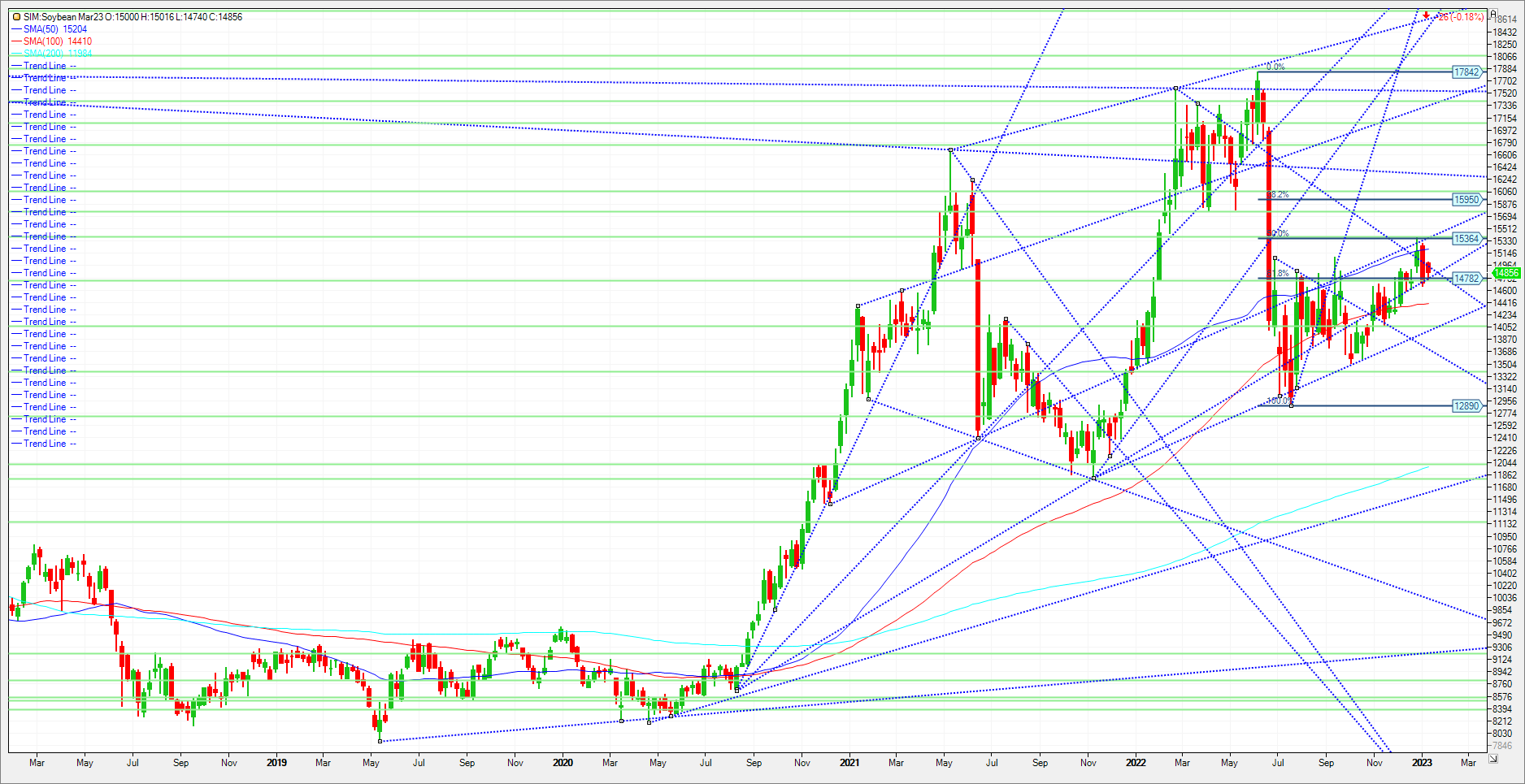

It is my opinion that Argentina is the Soybean bulls ace in the hole. They continue to be dry with some estimates down to 42 million metric tons of production from pre growing season estimated above 50 million metric tons. However, Brazil may have the largest bean crop they have ever planted. They along with Paraguay and Uruguay could easily in our view make up for the shortfall. We need to see what type of yields they produce. Yesterday’s inspection numbers showed exporters shipped 40.9 million bushels of U.S. soybeans to China in the week ending January 5th. Shipments are trending lower as the availability of new-crop Brazilian supplies begins as harvest ramps up in number one producer Mato Grosso. It is our opinion that top World soybean buyer China has already switched its purchases to new-crop Brazilian supplies, which will most likely become the dominant source of shipments as those supplies increase at Brazilian ports in the weeks ahead. Chinese buyers bought 21 cargoes of soybeans in the past week, as they extended coverage ahead of the Chinese Lunar New Year holiday that goes from January 21 to 27. U.S. domestic soybean demand remains solid, but export demand is seasonally declining. Without demand will a potential Argentinean major production short fall be enough to hold the funds interest and keep the market bull spread. Soymeal spreads so far have said yes, as has the July23/Nov23 soybean spread at $1.00/July 23 over for example. However, should we see a retreat in price, I look for the market to test a 5 percent threshold lower for the year for 2023. We closed last year at 15.24. Five percent down for year sits at 14.48. With this in mind, I suggest the following diagonal option strategy.

Trade Ideas

Futures-N/A

Options- Buy the April 1450 put and at the same time sell the August 1340 put. Suggested cost to entry is to offer the spread at 1 cent. ZSQ23P1340:J23P1450[DG]

Risk/Reward-

Futures-N/A

Options-IF filled at 1 cent over here, one is collecting $50.00 minus commissions and fees. One is using two different months with unlimited risk on the short August option. Therefore, as we enter into this position as a spread one exit as a spread. Look to cover this spread at 15 cents under, should May futures test 1450. However, I would be out of this spread if May soybean futures closed over 15.20 as the long April puts will lose more value faster than the short August. This has in theory unlimited risk if one doesn’t exit as a spread. Given your acct size one can place a GTC stop loss, at 6 cents over, risking approximately 5 cents plus trade costs and fees from entry.

Please join me each and every Thursday at 3pm Central for a grain and livestock webinar. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.