Commentary

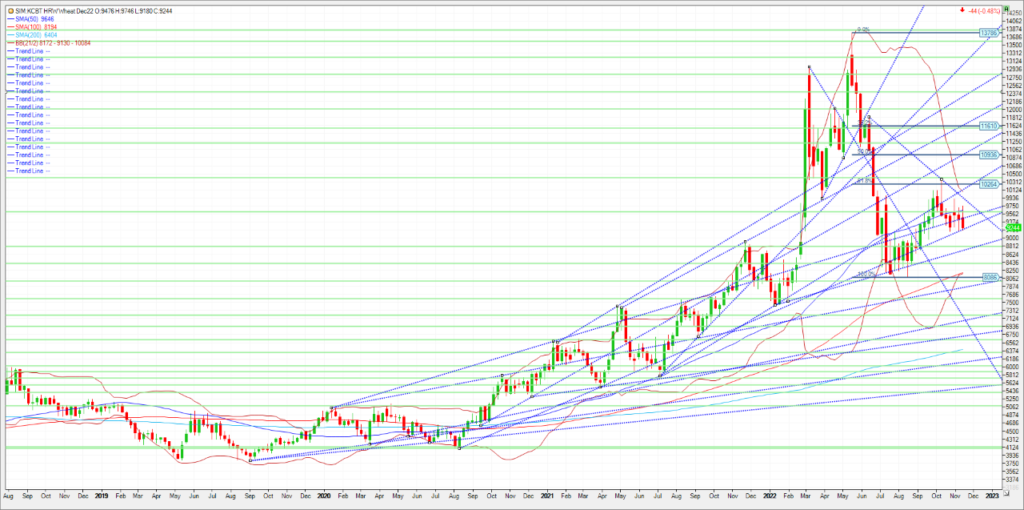

The major news this week and what the Trade was watching in my view was the deal allowing Ukrainian grain exports from Black Sea ports was extended for 120 days from Nov. 19 without any changes. United Nations officials told Russia they were “fully committed to removing remaining obstacles to exporting food and fertilizers” from the country, though there is no deal yet to export of Russian ammonia via a pipeline to the Black Sea. This came after a rogue missile hit Poland, a NATO member, in what was thought to have originated from Russia, perhaps putting the extension at risk. For me it was a buy the rumor sell the fact event as the missile originated from Ukraine, which soothed tensions and eventually selling opportunity in wheat. USDA rated 32% of the winter wheat crop “good” to “excellent,” up two points from the previous week. The portion of crop rated “poor” to “very poor” declined two points to 32%. As of Nov. 15, dryness/drought covered 83% of Colorado, 90% of Montana, 89% of Texas and all of Kansas, Oklahoma, Nebraska and South Dakota. In my view the big reason for the poor conditions. That said, its early, but the fear should it remain too dry over winter, will be very cold temps in these areas that are without snow cover/ moisture. Technical’ s for March 23 KC wheat come in as follows. Support for Kc wheat is at 9.25. A close under and its 8.91, then 8.81. If we get a run over 9.25, resistance is up at 9.51 and then 9.64. A close over 9.64, and KC wheat could re-test 9.85.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604