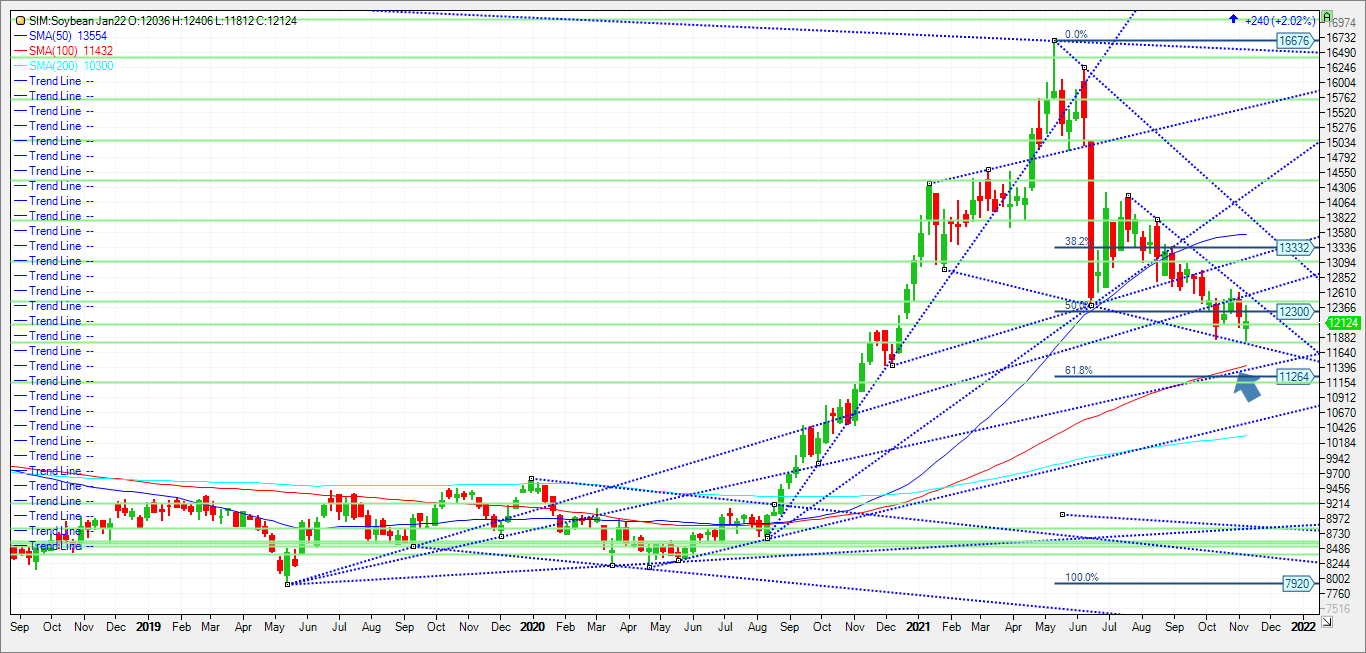

The USDA posted a surprise soybean yield decline in this morning’s November supply and demand report, down 0.3 bushels per acre to 51.2 bushels per acre. The trade was looking for a similarly-sized yield gain this month. Overall soybean carryout still rose by 20 million bushels month-over-month, to 340 million bushels with the USDA citing decreased exports. Today’s soybean trade had almost a 60 cent range today. We closed above minor support at 1210. In my view, traders feared a much more bearish yield increase. But in the end, the pod count wasn’t there to create the big yield, which was confirmed by today’s report. For me it simply raised more questions than answers that prodded short covering amid a yield that was lowered slightly and not raised. It could be enough in the near term to push beans back to trend line resistances at 1250/1260 in the days ahead. Where to from there? With a big bean crop potentially coming from Brazil in February on top of the current carry-out for US soybeans at 340 million, will traders use any potential rally as a selling opportunity? Keep in mind that while U.S. soybean supplies may not be as abundant as previously thought, 2021-22 stockpiles are still expected to be up 33% from last year, while exports are on track to decline nearly 10%, based on today’s USDA reports. That means beans may need help from outside markets within the grain complex or from the energy sector which posted big gains today. I would imagine that most producers may move their crop into storage rather than sell off the combine like most did last year. That possibility combined with a strong La Nina entering into South America maybe needed to keep this market bid in the weeks ahead.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar at 3 pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750