Commentary

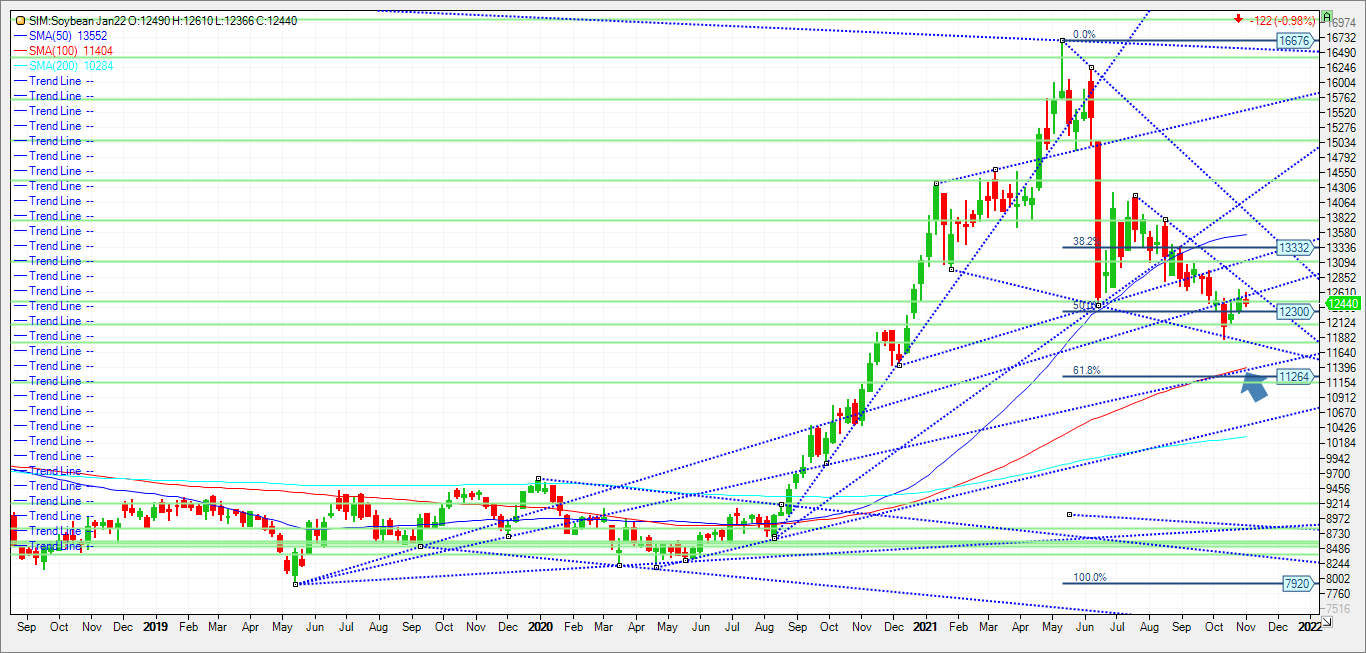

It is my belief funds hit the sell button across the Board today with many sectors finishing in the red. Perhaps it was profit taking or simply liquidation ahead of the Federal Reserve’s two day meeting and policy announcement released this afternoon. In my view soybeans and soy oil followed the grain and crude oil markets lower, with Crude futures sinking down over $4.00 as of this post that pushed crude to three-week lows. Additionally, timely rains in South America, particularly Argentina, may have improved prospects for recently planted crops. It is my belief that the unwinding of crush spread positions probably powered strength in soymeal futures. Also possibly pressuring is the fact that the soybean harvest is over 70 percent finished, the market may still be facing pressure from new supplies. Limited soybean purchases recently from China isn’t helping the bullish cause either, as totals are light. Keep in mind that next weeks WASDE report from USDA has private estimates raising yield and production. The average trade guess for beans is coming in at 362 million for ending stocks. That’s 42 million above last month and almost 200 million above the September report. The range of guesses is from 310 to 449. A number above 400 million would illicit a bearish reaction in my view. One of the reasons for the continued rise in the carry-out number is the increase in yield. Two months ago yield was just above 50 bushels per acre. The average trade guess for this Tuesdays report is 51.9, with a range of guesses from 51.5 to 52.5. If it comes in at 52 bushels per acre or above, we may see pressure to the downside. I wouldn’t be surprised for prices to get pressured in ahead of the report on Tuesday, We had a weak close today in my opinion. In my view it paints 1180/12.00 as a near term target, potentially ahead of the report. With this in mind, I posit the following trade. See chart below

Trade Ideas

Futures-N/A

Options-Buy the Dec Soybean 12.00 put for 6 cents or Better.

Risk/Reward

Futures-N/A

Options-the risk here is the price paid at 6 cents, which is $300 plus commissions and fees. If filled at 6 cents, work an offer at 30 cents to exit on a good to cancel basis. I would exit this trade on report day if we get a report day settle above 1245 in the underlying January 22 futures.

Please join me for a free grain and livestock webinar every Thursday at 3 pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604