Commentary

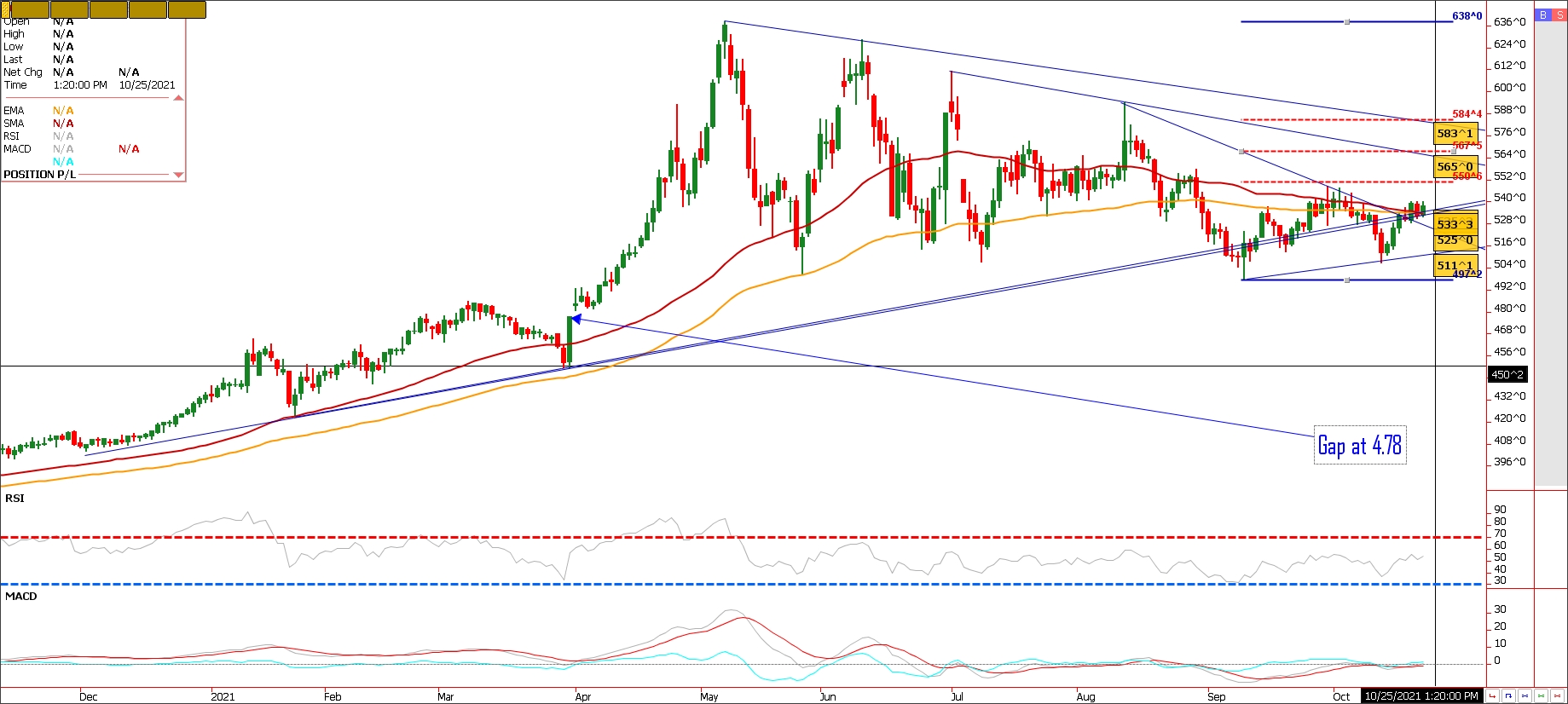

In my view, December Corn futures rebound the past week again illustrated the resilience of the market’s low-$5.00’s unofficial floor and bolstered ideas harvest lows have been posted. The market could potentially see sideways-to-slightly-higher price action leading up to USDA’s Nov. 9 Crop Production Report. But late-year rallies have historically been modest in my opinion and given the current inflationary undertone in commodities, one can discard any seasonal tendencies. That said, a rally the $5.62-$5.80 range, should we get there, may be viewed as a hedging opportunity for Producers. Outside factors, such as crude oil prices and Brazil weather, could have increasing influence. However in my view, managed money flow will likely be the primary driver of prices. Funds have cut their net long positions, but are still heavily long. The latest CFTC report showed managed funds still long 219K contracts. Longer term, we’re still stuck with the limited global supply of fertilizer, and the resulting high prices. That in turn could impact 2022 global crop production, possibly stretching into 2023 as well.

That fact in my view has contributed to the corn market trying to carve out a harvest low while supporting stronger than normal cash basis in the country. I don’t think the managed money sector has yet to comprehend the implications of high input costs on farmer production decisions. In fact, I don’t think the implications are understood by many. Its that uncertainty that has buoyed price for now. A rising wheat market that had December Minneapolis futures settling above $10.00 today has certainly aided corn to the upside as well. No trade recommendations on this report. A fifty percent retracement of the December Spring high to the September Spring low, comes in at 5.67. that could be a near term target should the market extend higher in my opinion.

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar every Thursday at 3pm Central. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604