Commentary

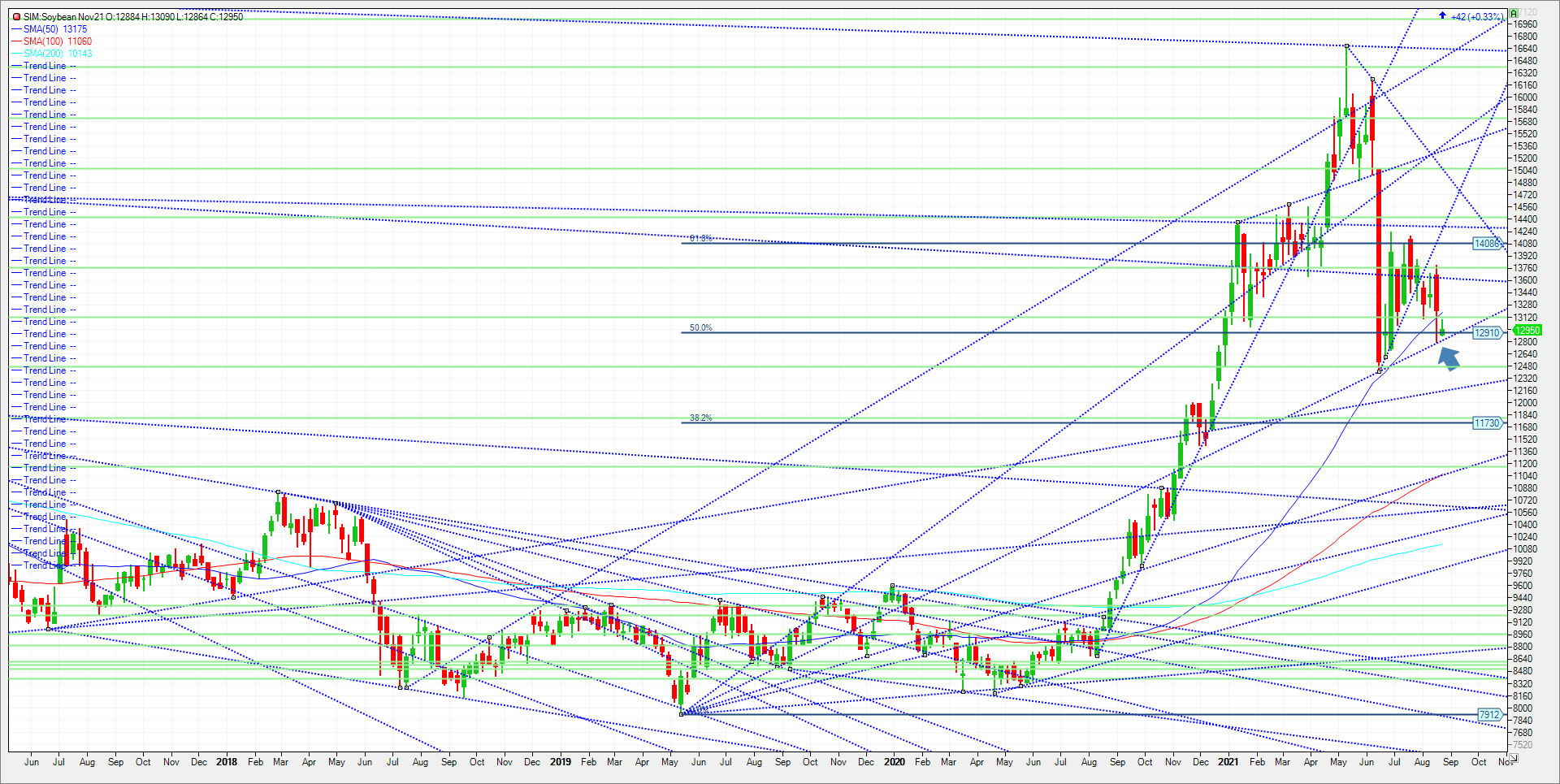

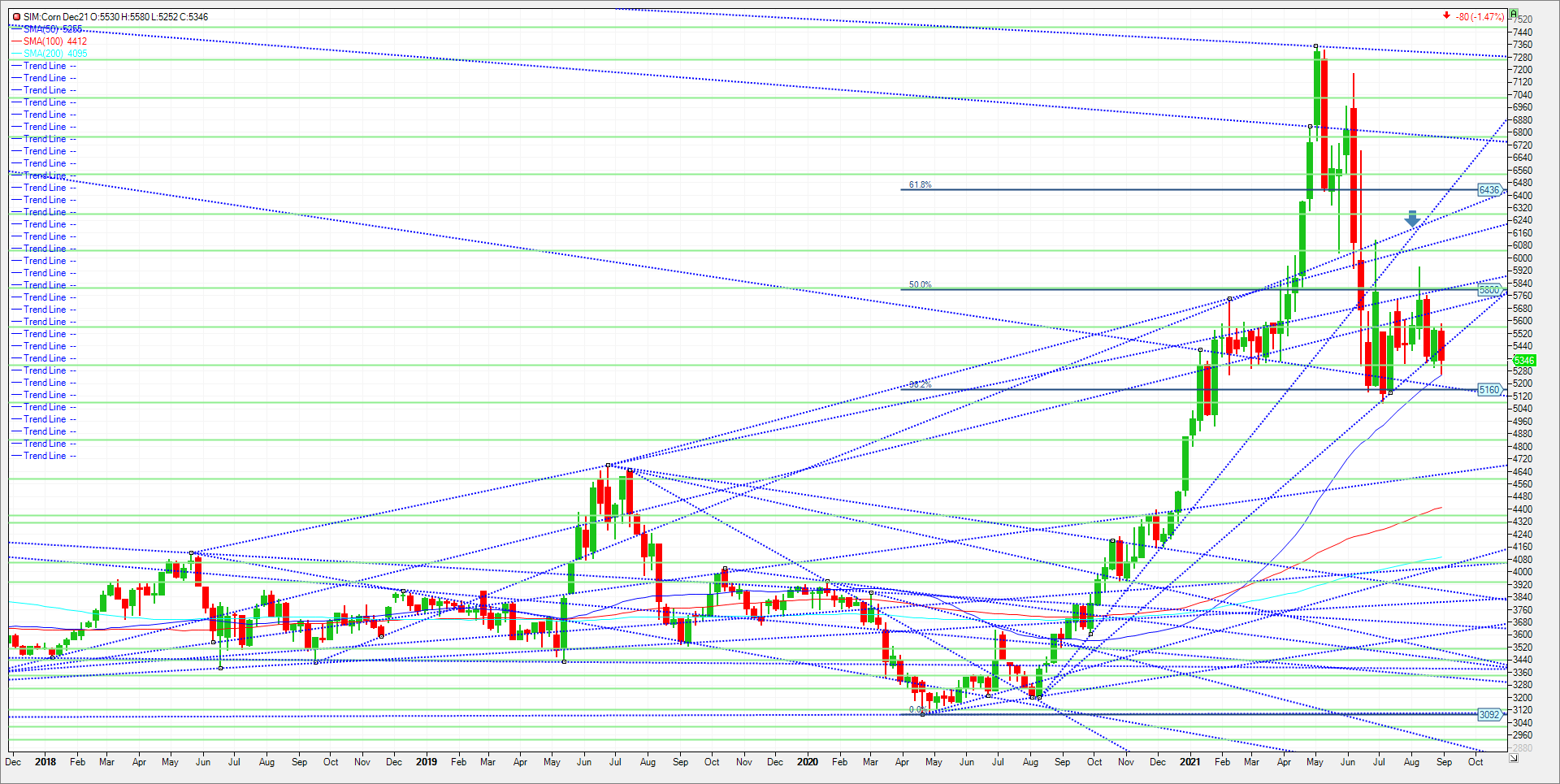

The corn and bean markets tested key support levels at 12.85 and 5.30 respectively during Tuesdays session but short covering near the close was featured as support held. Today’s settlement put corn down 24 cents from the Sunday night open high while Nov 21 soybeans are sitting approximately 44 cents from the Sunday night open high. Crop conditions this week were unchanged on the week at 60 percent to 56 percent good to excellent for corn and beans. Today marked the last day of August and ends a choppy month. Better August growing season weather and bearish seasonals were offset by better demand and lower yields according to USDA. For August, December corn lost approximately 12 cents while November beans lost approximately 57 cents. Harvest is fast approaching as is the Friday September 10th crop report. Will harvest pressure win the day here with lower prices to follow? That is the question facing the market in my view. Selling rallies in prior crop years when ending stocks were over 2 billion for corn and over 300 million for beans seemed an easy choice especially for producers. However we don’t have those excess bushels per the balance sheet right now, and with supplies of wheat getting downgraded month by month, grain supplies are seen as tight. However like I mentioned previously, the USDA has an opportunity to answer some questions on yield and production in next Fridays report. I included a December corn and November bean chart below. Watch key support at 12.85 in November beans and 5.30/32 this week in Dec 21 corn. Funds per the last CFTC report on Friday were long over 270 K contracts while just long 83 K in beans. They have defended their position for sometime in corn as the Managed long tells us. Will it continue into harvest?

Trade Ideas

Futures-N/A

Options-N/A

Risk/Reward

Futures-N/A

Options-N/A

Please join me for a free grain and livestock webinar at 3 pm central Time every Thursday. We discuss supply, demand, weather, and the charts. Sign Up Now

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall not be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Sean Lusk

Vice President Commercial Hedging Division

Walsh Trading

312 957 8103

888 391 7894 toll free

312 256 0109 fax

Walsh Trading

53 W Jackson Suite 750

Chicago, Il 60604