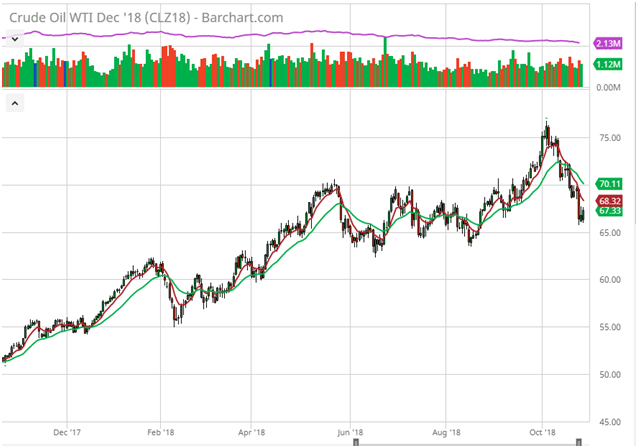

Crude Oil fundamentals are pointing lower in my opinion, the Hurricane season is close to ending. Gulf platforms are back online, shale production remains strong, and data from the EIA per yesterday’s gov’t data is showing strong builds of crude oil. Also providing stability to the oil outlook in my view is both OPEC and non OPEC areas possibly promising to keep Oil flowing. Also of note China’s oil output is still increasing despite this recent drop in equities, and in my view this has slowed global demand for Oil. In my opinion I look for Oil to go lower towards $63.00 basis January 19 futures. With this in mind consider the following trades:

The January option settles December 14th 1:30pm 50 days to expiration tic value $10.00 per 0.01

Looking at lower futures pricing….buy the 65.00 put pay 1.54 = $1540.00, buy the 64.00 put pay 1.29 = $1290.00, buy

the 63.00 put pay 1.06 = $1060.00, to enter the trade. The risk is the price of premium paid plus commission and associated cost.

A higher risk short option strategy is buy the 63.50 p 1.19 = $1190.00 and sell the 71.50 call 1.02 = 1020.00 so pay .17 for the strategy =$170.00. What you are paying in premium is what you are willing to risk for the above trade plus fees and associated costs per transaction. Also to help protect this trade is to add a stop at 71.50 in Crude Oil futures.

A contrarian view or an Oil shock geopolitical event, buy the 69.00 call pay 1.91 = $1910.00, buy the 70.00 call pay 1.46 = $1460.00 or the 71.00 call pay 1.19 +1190.00 to enter. What you are paying in premium is what you are willing to risk for the above trade plus fees and associated costs per transaction.

Peter Ori.

Toll Free: 1 888 391 7894

Direct: 1 312 957 8108

Fax: 1 312 256 0109

peterori@walshtrading.com

WALSH TRADING INC.

53 West Jackson Boulevard, Suite 750

Chicago, Illinois 60604

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices.PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.