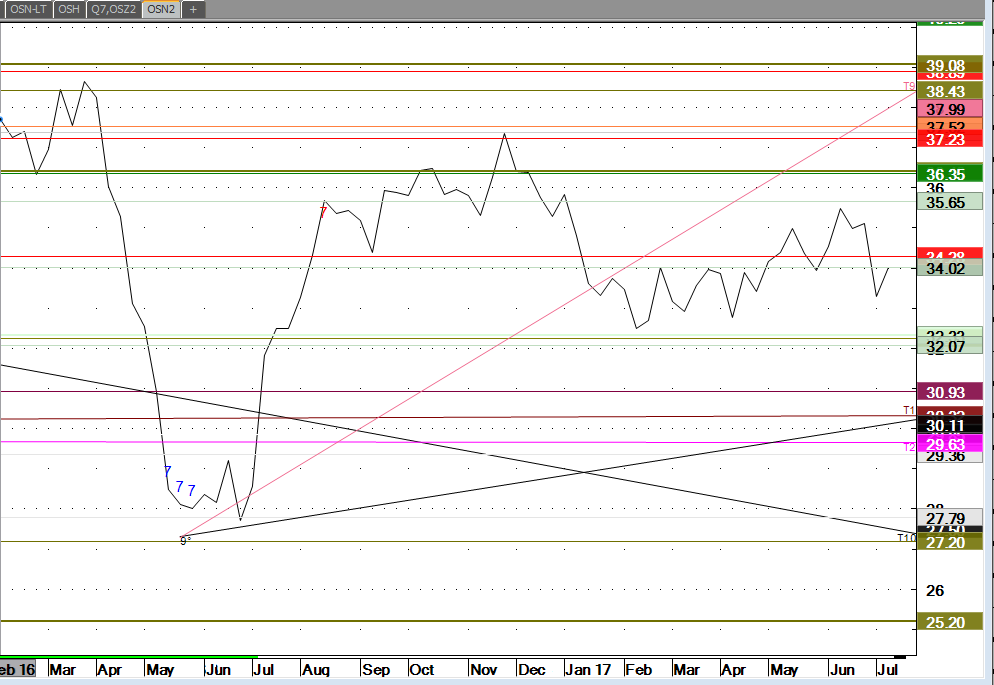

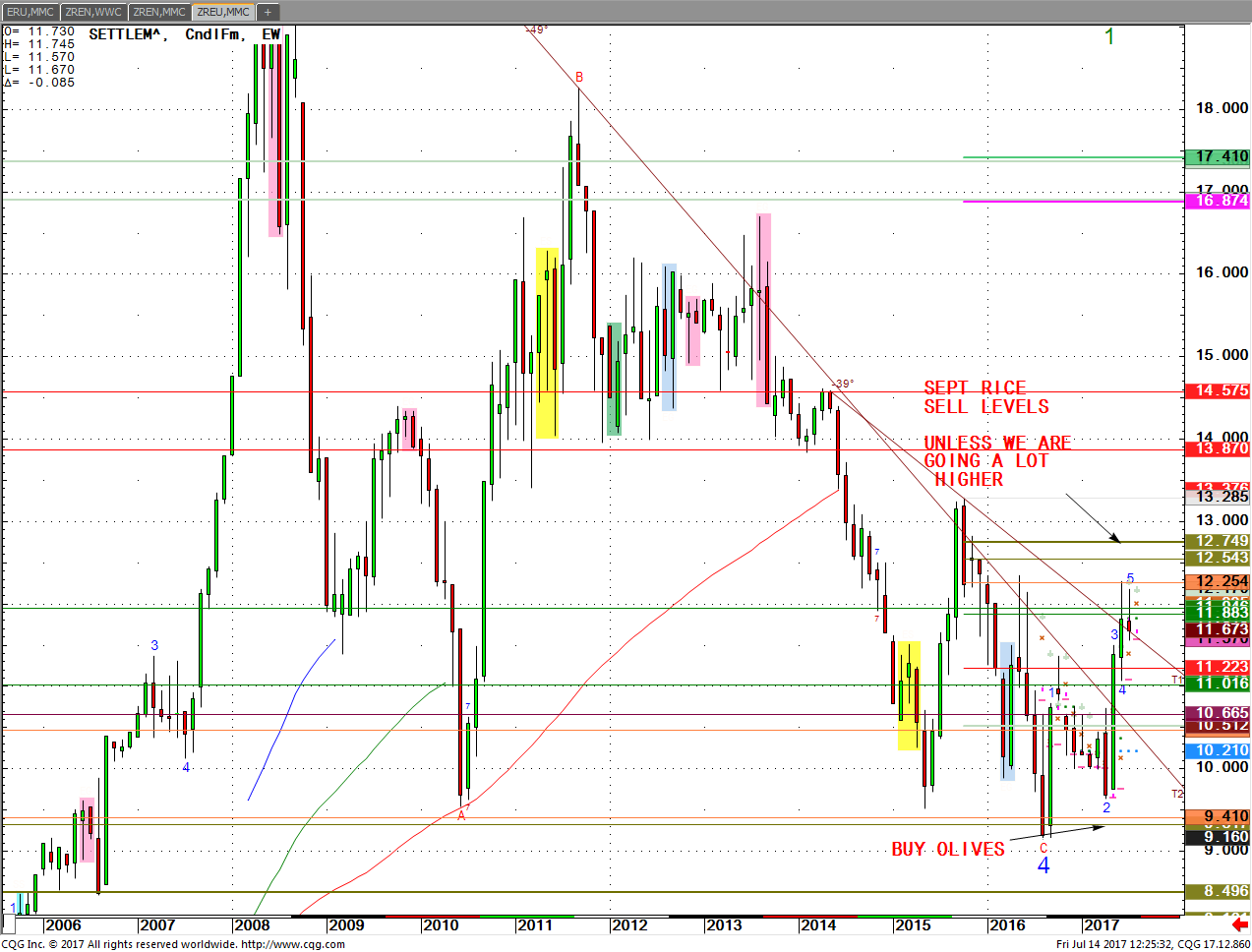

Markets are heating up everywhere, across the board so here are a few chart spots that have hit olive conditions. This olive is at the genesis of trading throughout the time spectrum that offers value and keeps you out of the way as it approaches.

The value of quality research means you wait for trade conditions to materialize. Right? So if I

ARP Wheat Pit, by Ann Ponce

was to have a buy level that is substantially lower than where you would first start buying then is that value? Yes for more reasons than you might imagine.

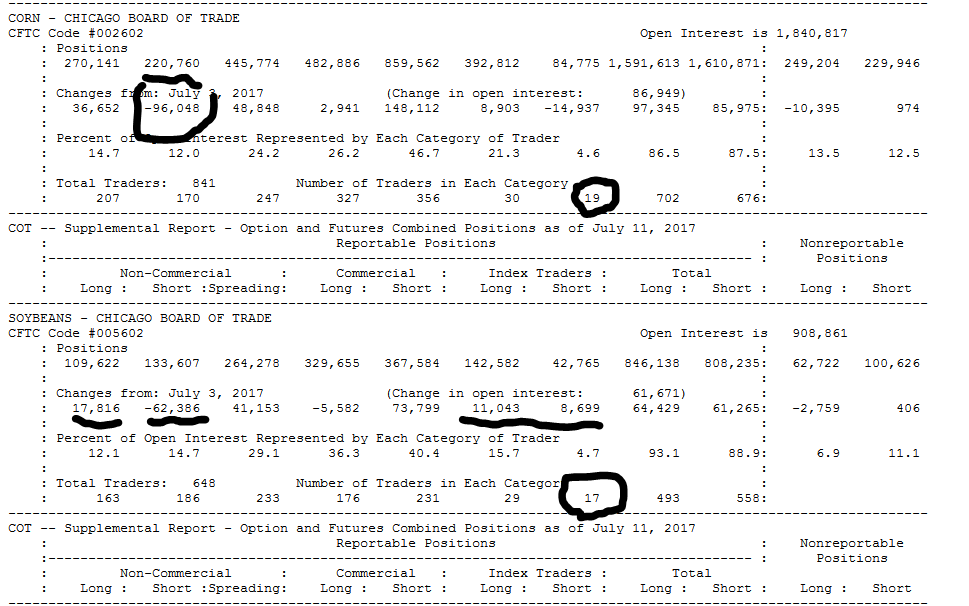

Stay fresh until there is blood in the streets, or an olive usually surfaces to encapsulate where people are selling beans last month in mass. Is that worth the value to you ? Allows to trade bigger with smaller stops because method is exact or within ticks, or out. Cut your slippage a lot over here since you only want to trade around these levels.

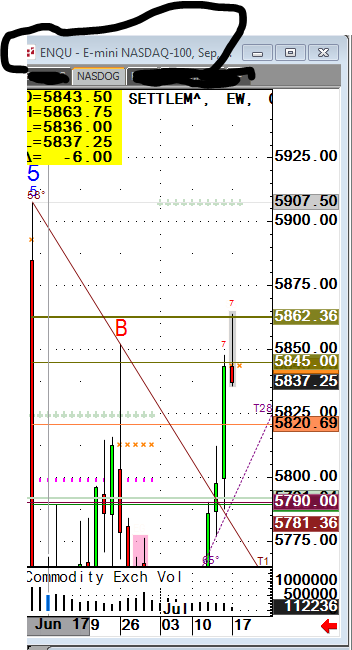

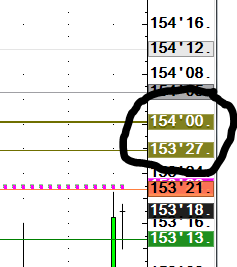

Tues as of print the NASD hit 5866.91 also the same olive line as 5862, WHY? Look how it runs up fast to our seller

Call me so we can take advantage of precise levels and other opportunities to take advantage.

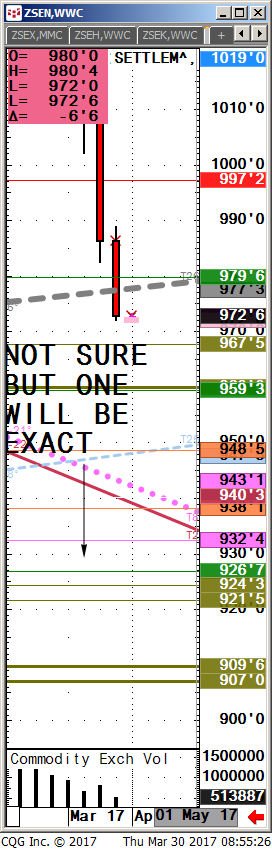

Check the thick OLBs. See if we hit 909.75 hit and filled and up 30cents before killing last of longs when we printed 9.06, then 1.20 rally.

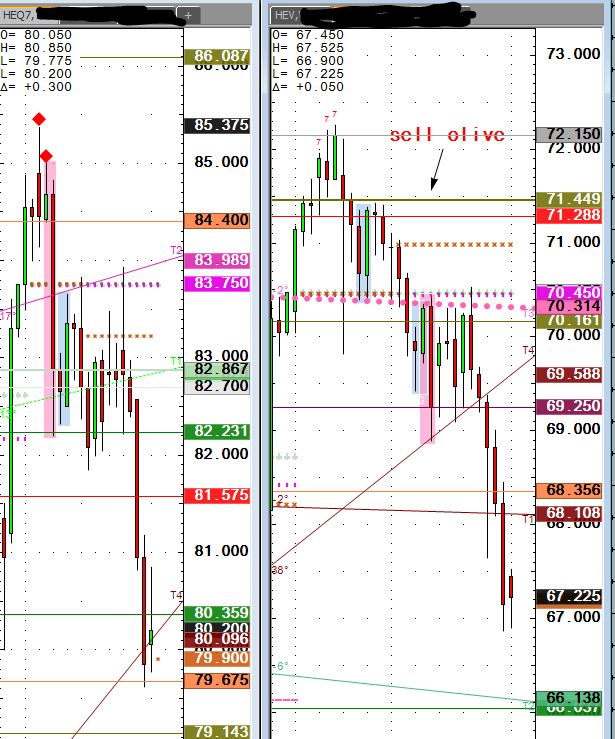

Targets in feeders,

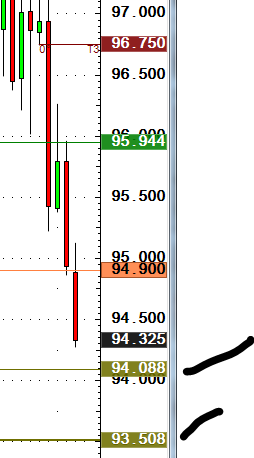

NASD speaks for itself. Not only did it hit the 1st sell level but not we retest to the 5866, different timeframe proves how complicated trading has become. Let’s keep it simple. Buy beans at $9.06, hang on to winner and it turns into $6,500 so fast you will drop your broker. Does he give you plays like that? Cocoa up 100. Coffee exploded off olive support back months very clean. Front was dicey but my long term clients buy back months like $29 crude. Sure fronts went to $26 for a nanosecond.

The olive colored lines provide so much value because it keeps you out of the way. Do you see it? The diamonds run over the crowd. Don’t be a sheep.

this is a 1000 point rally or $30,000 move on a long 5 short 3 meal spread off that 2720 olive buy which did hit down there. Small bets big rewards is only way I think we shoot for.

this is a 1000 point rally or $30,000 move on a long 5 short 3 meal spread off that 2720 olive buy which did hit down there. Small bets big rewards is only way I think we shoot for.