Juice- Freshly Squeezed Longs?

Cat Caterpillar pays 4% income tax! Front page WSJ but fear still, they pay it to Switzerland! No money to US coffers for mundane things like Amtrak Bridges or schools. These GCI’s are the ones that say 39% Corporate is so high in US. Are US citizens being hurt by tax evasion? Jury out. This is something if trading bonds, budget, interest rates, inflation.

Hogs- Some resist areas up here. I know weights are up big so here might be the place fundamentals meet my technical, new high stop is a must in my book. Stay fresh because they have bigger fish to fry. Investment money flowing into commodities in general is my feel.

Live Cattle- no comment, now in LCG three levels over and holding. This is what I mean when I say if you need a number, these are only ones to use day in day out. See charts on Walshtrading.com.

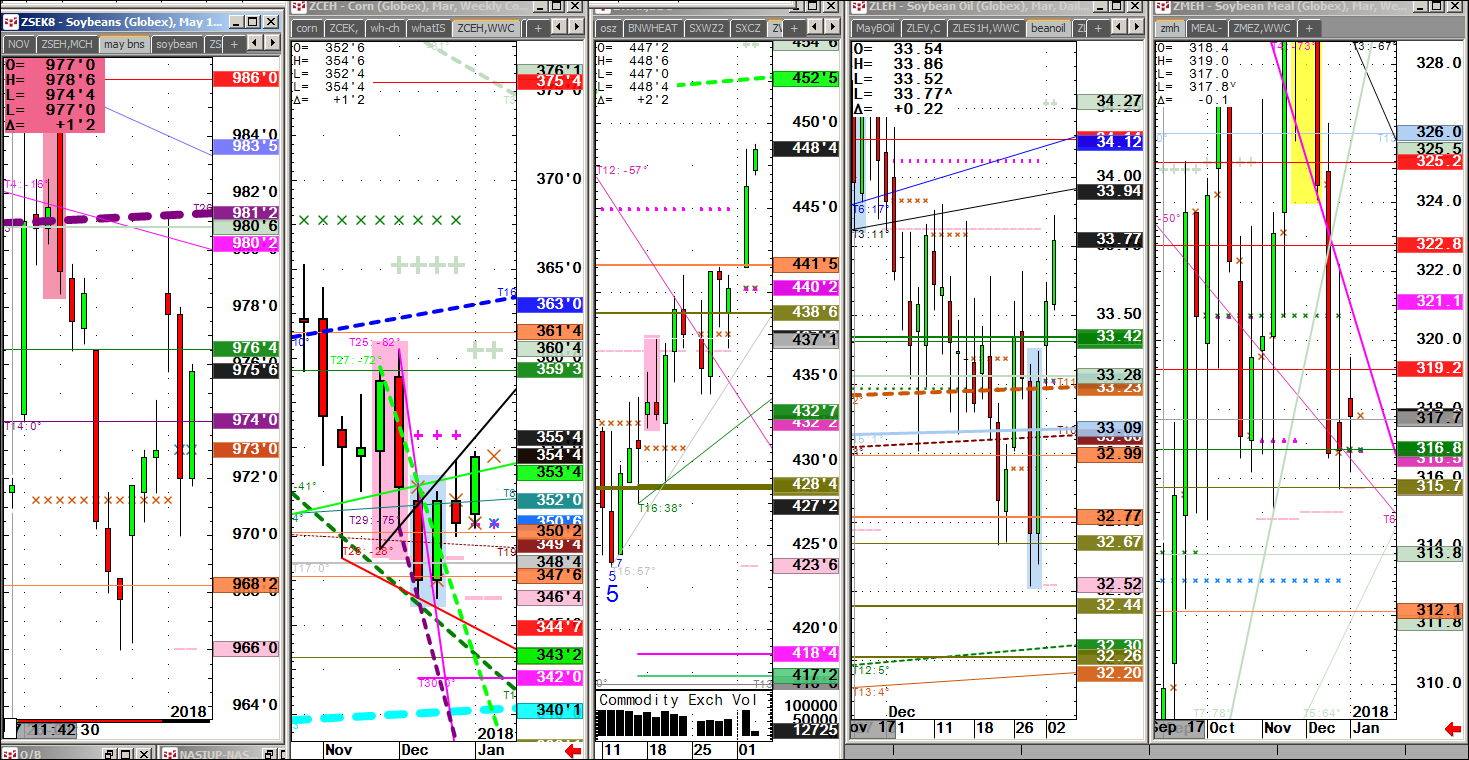

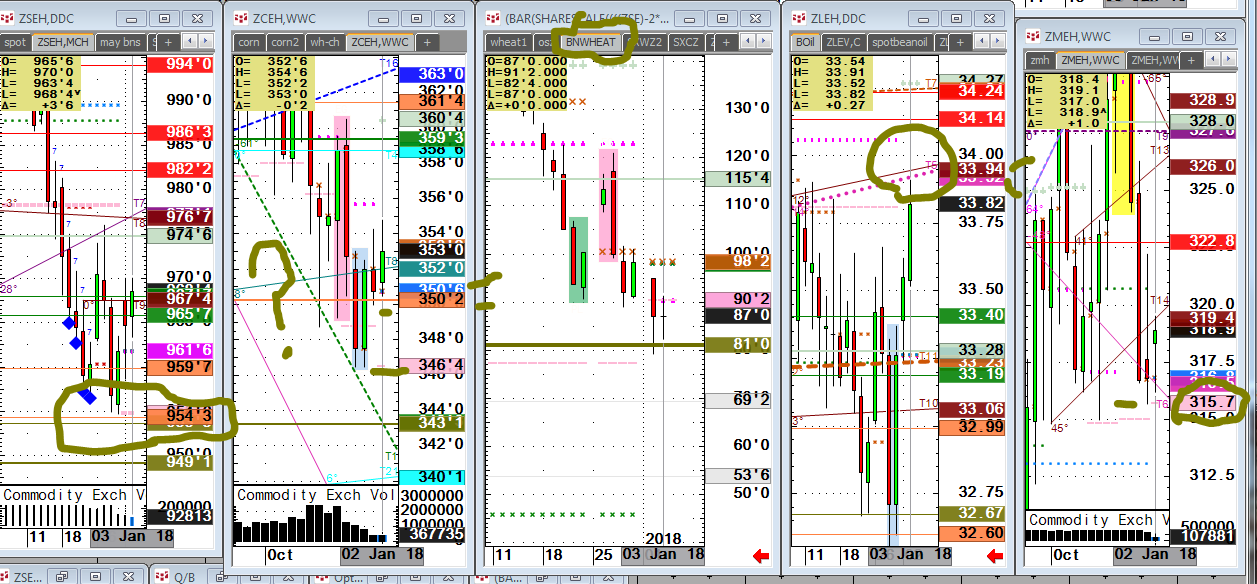

Bean oil- I favor buying boh on sharp breaks especially around OLBs. We rally 100, 3 days, break new lows in 2 days, split olives, now up 140 ticks, 4% ish move up into macro T line resist 1st time anyway. Swings are quantifiably larger as has been suggested. I think this will continue. Metals- We hit Sell levels in a few, Sold, how many do you want to buy? Gold Silver hit, Plat exploded over all today. Fed minutes-? Seriously who cares what the FRB Ivory Tower’s say about what happened before the latest budget pillage that just occurred? Game on fast markets, do we post record GDP now?

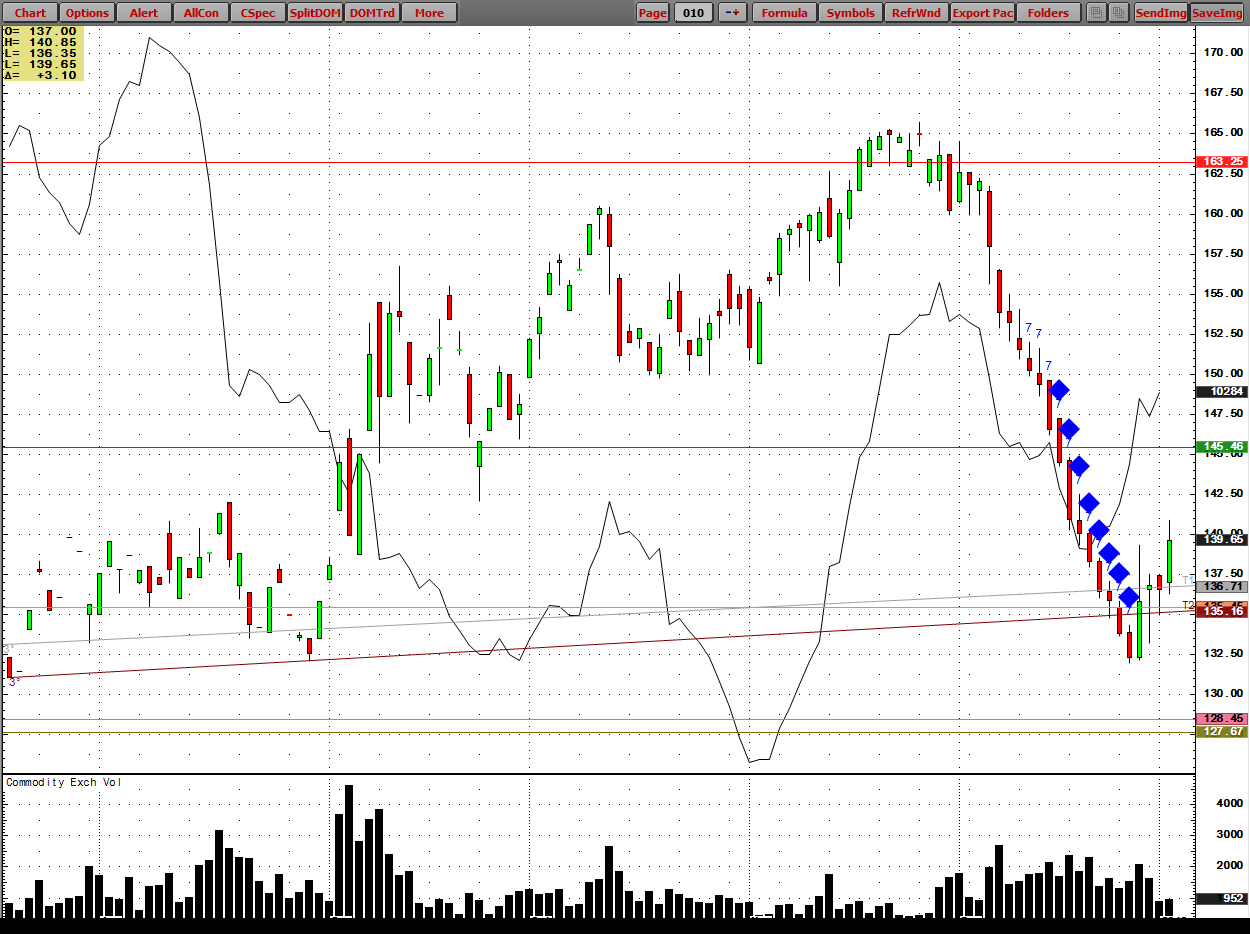

Coffee- hit some tiny OLS last 24 hours then breaks to 126.20 for those that had open buy orders working, hit/filled back long coffee in this 2% nanosecond nosedive. OJ Juice broke pattern of about 18 red dia condition straight down into anyone that wanted to buy early into a possible frost scenario? I say the market puts these vertical swandives and value plays right into low risk areas. I think I can get you close but the algo’s do this live in a more floor trader method of picking a bottom let’s say. Vertical moves of 9% in Silver happen down and just as fast up in month of December. If that doesn’t get you off the fence that things are heating up then I beg to differ. See bean oil chart as to how markets warm up before liftoff. Cocoa again folks in softs. Let bears have the last 100, or buck. Bloom hypeish kind of said we would runout someday. No shorts.

Speaking of shorting stocks- Stop the madness. You need Stock Index Sellers Anonymous . copy paste to google it

MUTE THE NEWS TRADERS. Is CNBC really talking Nazi Germany? This is how they bargain in today’s politics World. Mute it! Bannon Trump alleged feud seems to be going live at WH, stay tuned.

I think you play extreme moves at specific olive levels or patterns that decipher when a market gets deep into herd mentality High frequency pile on (to fundamental guys) if you will that blow others out but provide you nice locations that pay at least double but mostly triple times money risked. When you catch a macro big move in 6 weeks you cash in and take a vacation. I know I know, I was a city boy, my chores were my charts. Vaca.s also kept you fresh as a professional trader.

There are seriously too many situations going on in other markets. Meats have slowed, hogs are live if short but you must use a stop in case China takes phase 2 of US meat purchases. Do meats have an Asian Invasion? New buyers? I know we had one in programmed trading the last decade.

https://portal.straitsfinancial.com/user/register.aspx?brokerid=268

If you need a level or need a broker that can provide you a level when you need one, feel free to give me a call and lets chat your market. Things are heating up already as has been suggested here.

Now is the time to trade with tight stops strategically located. When you hit you hit big like silver, now a sale maybe depending on you or algos. Markets will wait for nobody.