Cattle-panic chaos day? Lumber 3rd limit down?

I do these in every market for Pro’s of all types. If it is not here and you want to see why this is what you need to use, call. 312 957 8248 biz hr.s, or email direct. 10% moves fast everywhere, too many to list. Stock up 1,000% in 2 years! Bit coin up MORE THAN ENTIRE BEAN CROP FOLKS?

HANG ON. and always use tight stops at my levels and you can’t touch the winner until I say so. 5% immediate winners can be taken, new rule.

Good Morning Farmers, Speculators, Producers. Is live cattle where hogs were when www.walshtrading.com issued a special report last week?

Get on my short list today at ARP@WalshTrading.com if you are interested in price action pattern recognition. You can mute the fundamentals. I did in the 80s as a young trader and am fine with all of it. Trade price.

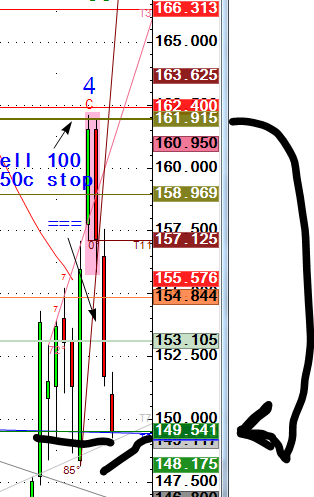

Watch Dec live today on 2nd day after report finally seems to be paying the bears. Pattern is deep, vertical down is what I service clients in finding or preventing becoming someones (Wall st.) Hood ornament, an Alan-ism from pit days a lifetime ago before this ‘tax-subsidiary bestowed high frequency trading wreaked human behavior obsolete. One human mistake, flinch, and youre playing ‘their game.’

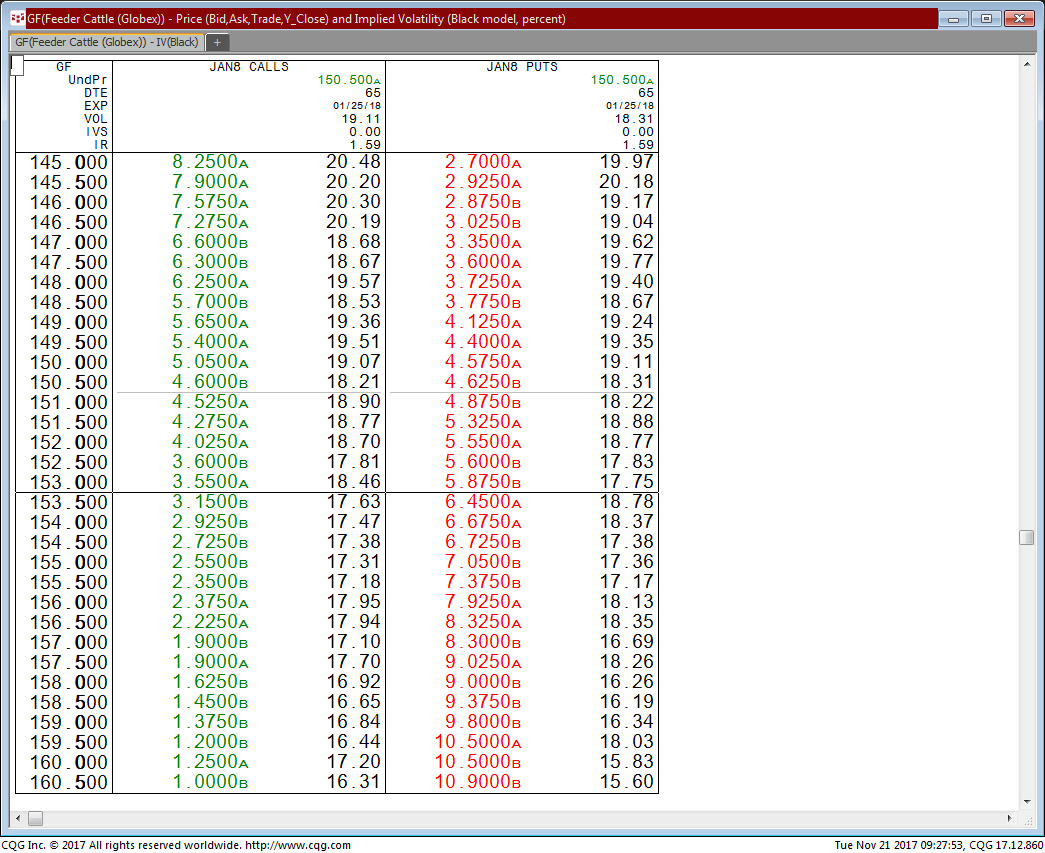

Cattle- when mkts go vertical you need an olive. Call me for a minute, before this panic algo kicks in. Too late? Knife catchers looking for a turn? Look at last weeks hog pattern. Hint: diamonds are real selling.

Lumber- when I start to cover a market it usually means we are approaching, or there.

Step up from the teasers and get it from a source thats seen it all, because he traded it all,

as an individual independent local (own money like you) with pit market sense and a outlandish story (disclaimer) like into cattle highs when Im asking did China buy a huge chunk? Did you or your broker suggest a top on that WSJ article? Does he read at all or chirp? I do chirp quite a bit but thats the situation at the time. I say it. You take it or take a pass.

Most of the time its low risk but if you wanted to sell lumber, 1 lot to get blood flowing but also because of a reason, condition etc. This isnt blind bs, it’s math of some sort. I just had to define risk a monster task for you but not this mostly un-opinionated broker trader. Feeders live today at low and yes it looks like hogs last week.

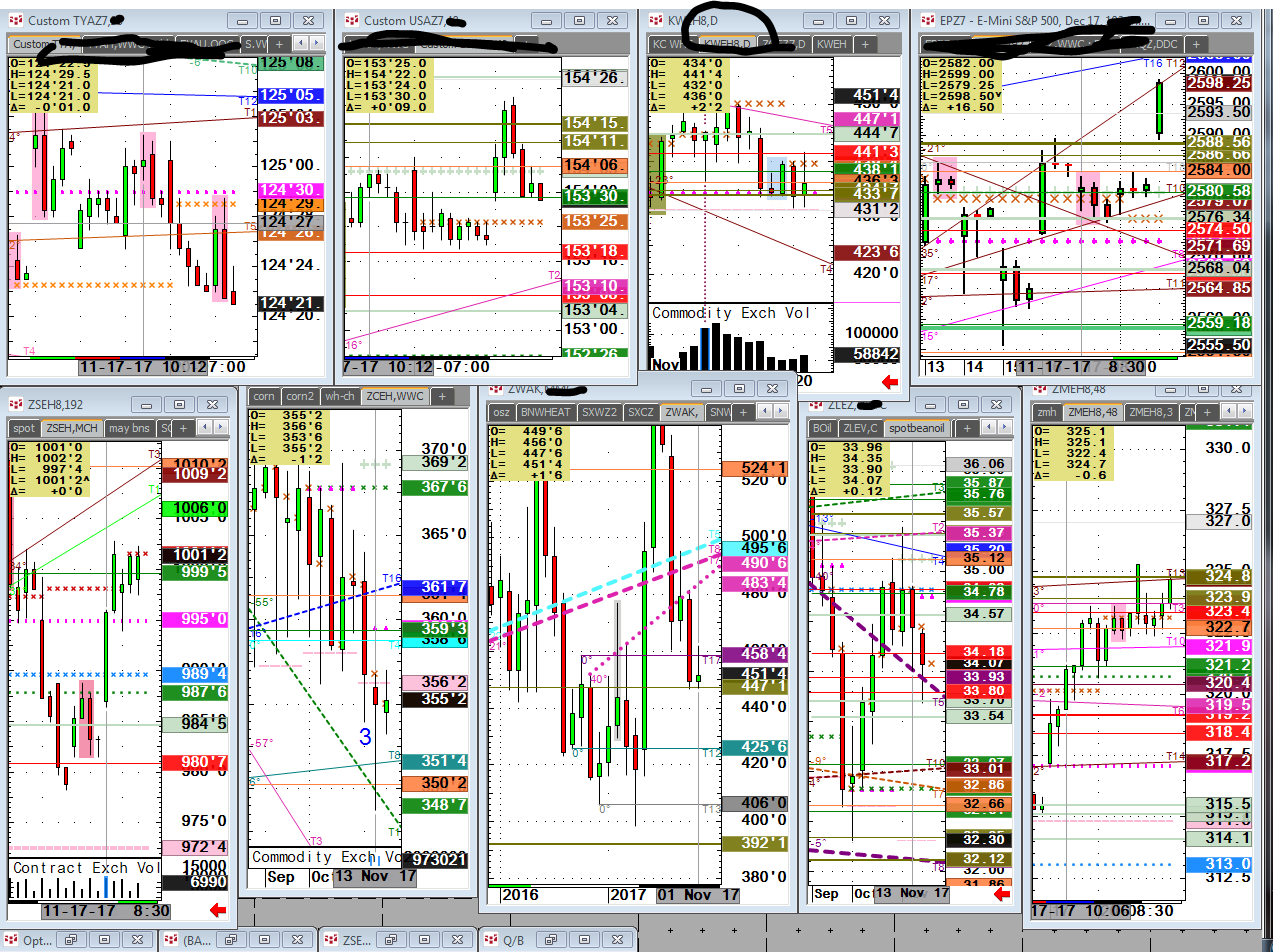

Many other markets, bonds, notes weaker, wheat, corn all live, spreads, patterns, Olives.

I am curtailing some time consuming chart posting so get on my short list. I do not put out most charts due to trade secrets and the education part of this is brokerage for clients.

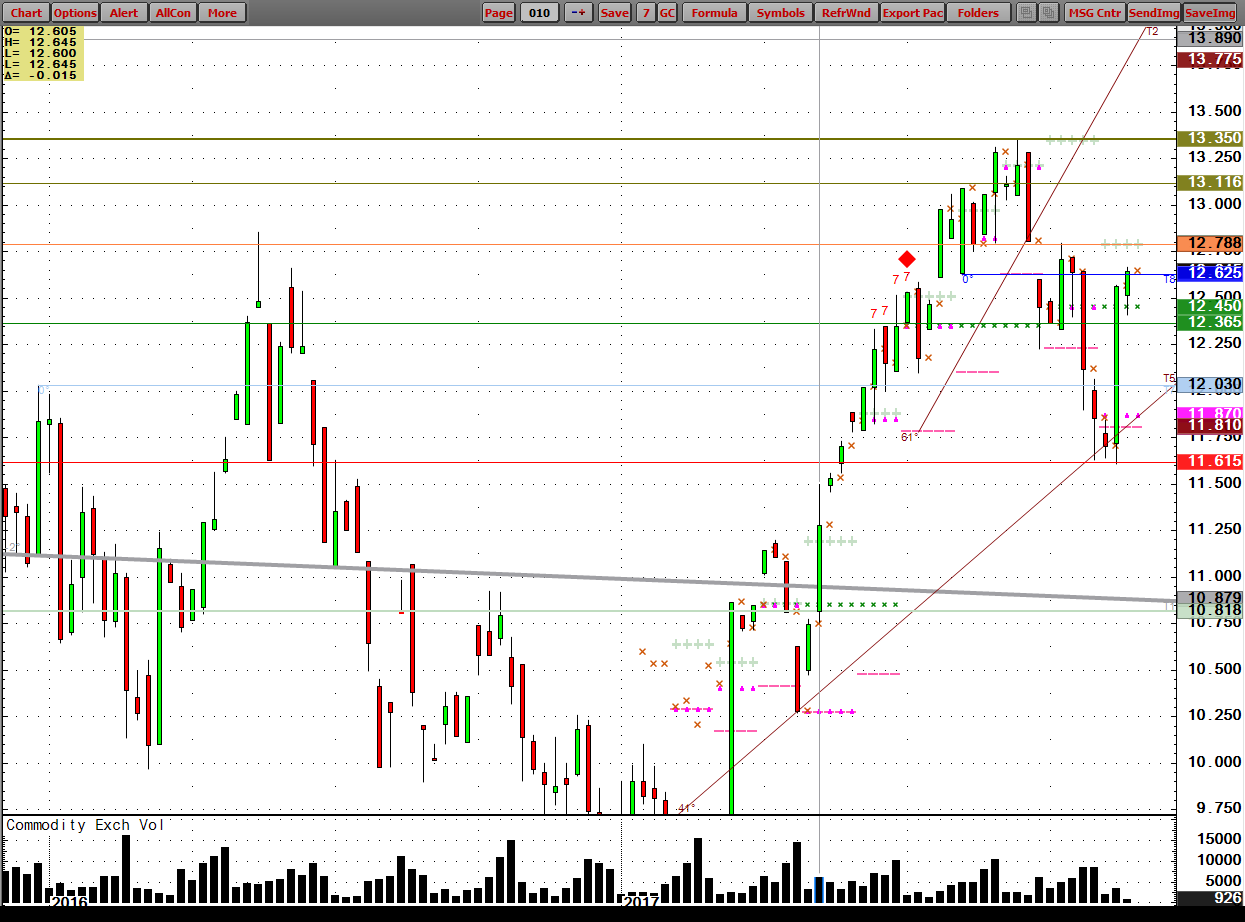

I do pound the table bullish like in a few grains last 6 months but that is my specialty coming from pits. Some spreads hit OLB’s last few months in the products. Corn is a mess but managers aint waiting to get short. They fade seasonals so if you follow those I tell clients the skinny on why not to use. Fade em early- who is that player? If you need to buy 3,000 contracts do you wait for seasonals to turn?

Wheat selling again holds lows. Is this low for year (s)?

Corn ditto? $350.25 CH my 1st buy level. More behind that! Lumber feels like toast, enjoy this vertical ride. Did your guy see that 100% olive sell on the Trump Canada tariff followed up last week?

Bonds- Traded over OLS so 3 ticks stops stopped, 11 tick max is my rule but thats max risk. Flatteners all the rage last few weeks, 2-10 67-ish.

New year a coming and it isn’t waiting for anybody.

Whatever market you trade, I give my word like honoring trades,

These patterns can be detected on my system.

Even a LC/FC ratio spread I posted weeks back.

Hang for the teaser or lets get down to brass tax. I love accounting frauds also.

Traders must be skeptical.

Too high you want to sell.

Too low you want to buy.

Beware of the middle but as you can see on my site those play but you need a stop, or better yet flip stop under like 119 LCZ chirped last week, 3 levels within 50c.

ARP

https://portal.straitsfinancial.com/user/register.aspx?brokerid=268

Good morning,

I spell these levels out ahead of time. It’s of no use to me or potential clients to say these patterns work after but you should know by now I had buy levels down here. Link is below so you can get ready for the new year. Meats might even present value if China may want more. TOL thinking out loud.

Today was the day in live cattle and feeders Jan.

Notice how Jan FC hits ols at top, I did not have Jan updated due to no client, or little interest due to time constraints but also why You may want to heed these special situations.

I say feeder bottom is in, new low stop. You may get one more chance. Call for directions, lol.

Hogs now day 4 after the OLS and pulling back to green.

Does your broker give market color, coverage like this?

This is also why I like to stress the importance of working open orders in ahead of time. Sure one time it will get killed but the record so far is pretty convincing to me. Nobody can trade all these but I can put these in front of you.

Lows could be in in both. Risk is slightly higher.

https://portal.straitsfinancial.com/user/register.aspx?brokerid=268