Good Day AG Community and Speculators,

This is going to be a chart drop of quite a few markets. The idea is, you like the levels when they are the high or low? Then consider using this system that is designed many ways but one thing I think I have shown uncertain,

These are the conditions where the mkt respects levels to trade from. Coffee did vertical up one day 500 off 123.20 cited for a while. this is like slow motion but when they conditions strike, they can offer nice opportunity like hogs 1st time 6464 then down 250 immediately, then back up, st-udder step, now violating which means shorts must RUN FOR COVER!.

This is where I try to help traders and Producers use these futures where funds back this around. See CFTC Ethanol commitments today! You tell me, or call me.

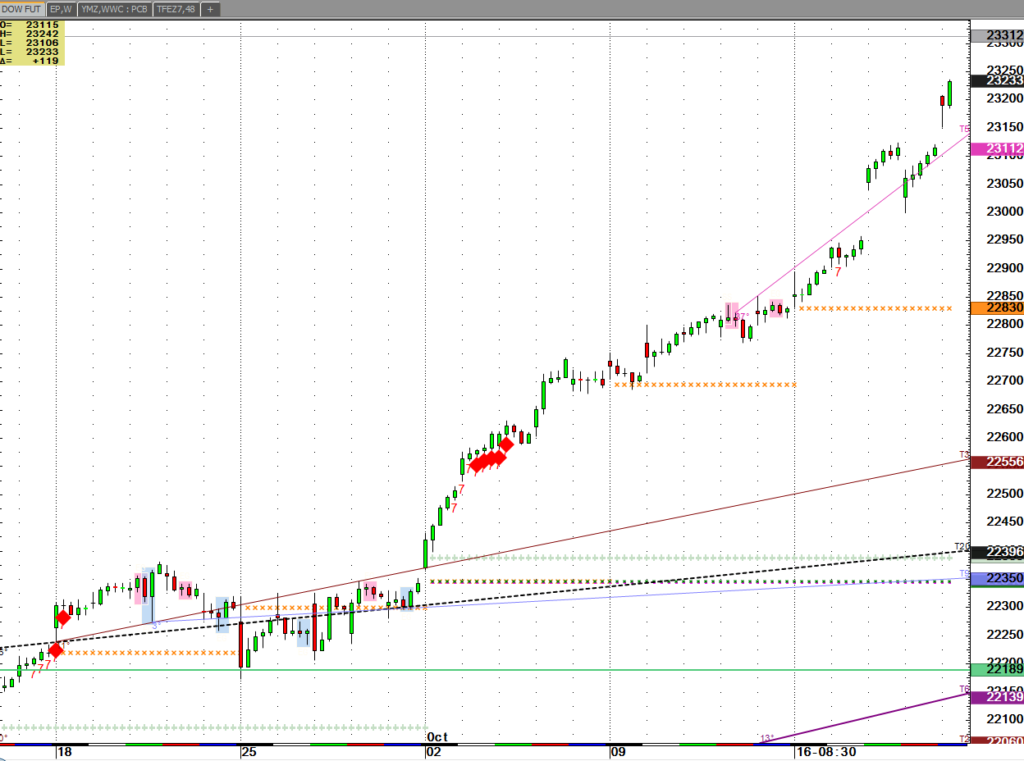

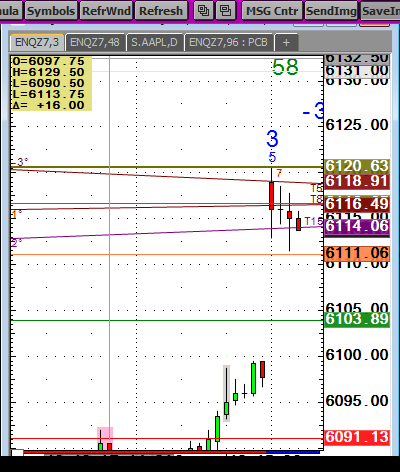

i IF YOU TRADE DOW JONES THEN CHECK WHAT YOU ARE FIGHTING. THIS HAS NEVER HAPPENED.

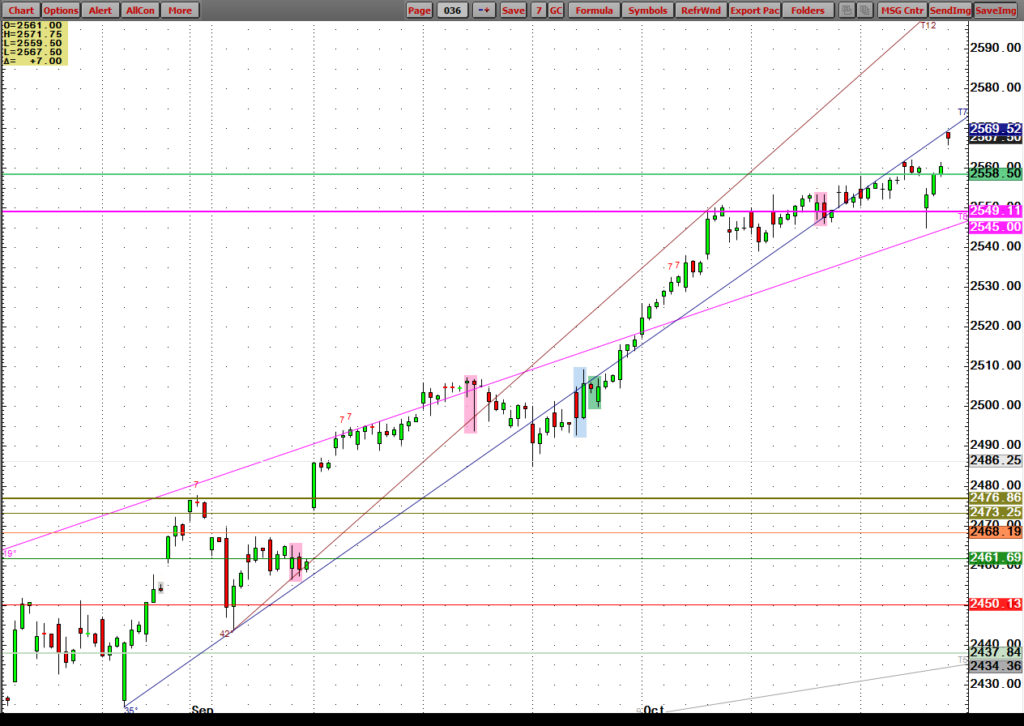

HOGS ON RIGHT

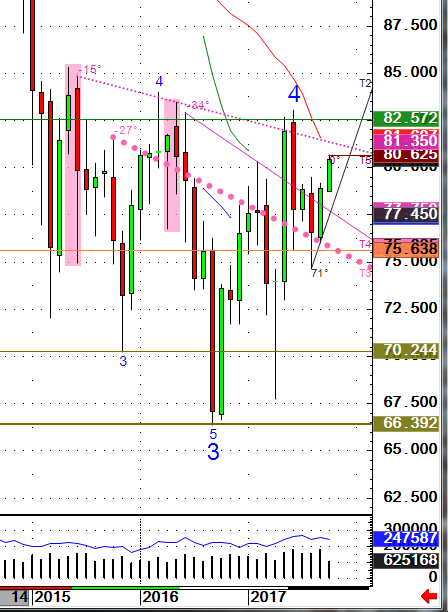

Copper has rallied 50% in a year and I have some resistance olive sell levels in the chart below if looking technically to sell this market that has run up fast.

Inflation signs are everywhere as lumber is also up even more, nearly 200% in a slightly larger duration. We all know the obvious reasons due to weather events this year but this is an area to not get too long. The funds appear this way. This can move higher over the 329.40 level in my opinion but this also could be a pretty major top if the market is ready. I light tight stops.

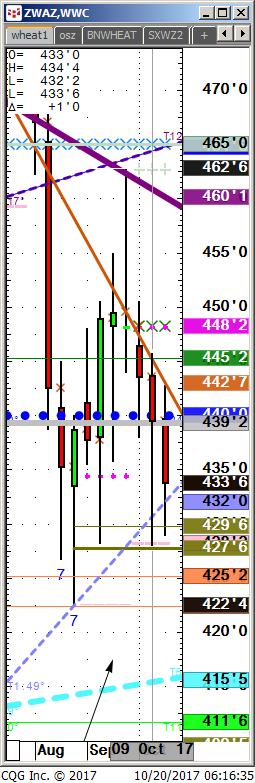

Cotton had bales underwater in the newspaper when a similar 75.75 olive sell level did provide timely sell and now 67.40 has or may be caving in. We may be approaching a final event type situation.

Surprise seems to be to the downside but why you always need risk stops and then not look at the trading screen price action for fear of brainwashing that I call

Water-Board-of-Trading.

Feel free to give me a call and let’s see if some of this market color from a real floor trader that turned into a data science project. I only try to calculate risk where $150-250 per 1 lot risk can turn into one day or more stampedes like coffee and hogs this week. I can’t say where we are going but I can say where we bet and where the stop goes. You need to learn to always use a stop and cut the stress out of looking at the fake-news quote screens.